Algorand’s price has remained in a tight range in the past few years as its momentum in 2021 ended. ALGO coin was trading at $0.4013 on Monday morning, as the Elliot Wave and the Wyckoff Theory point to further gains, potentially to $1.

Algorand Price Technical Analysis

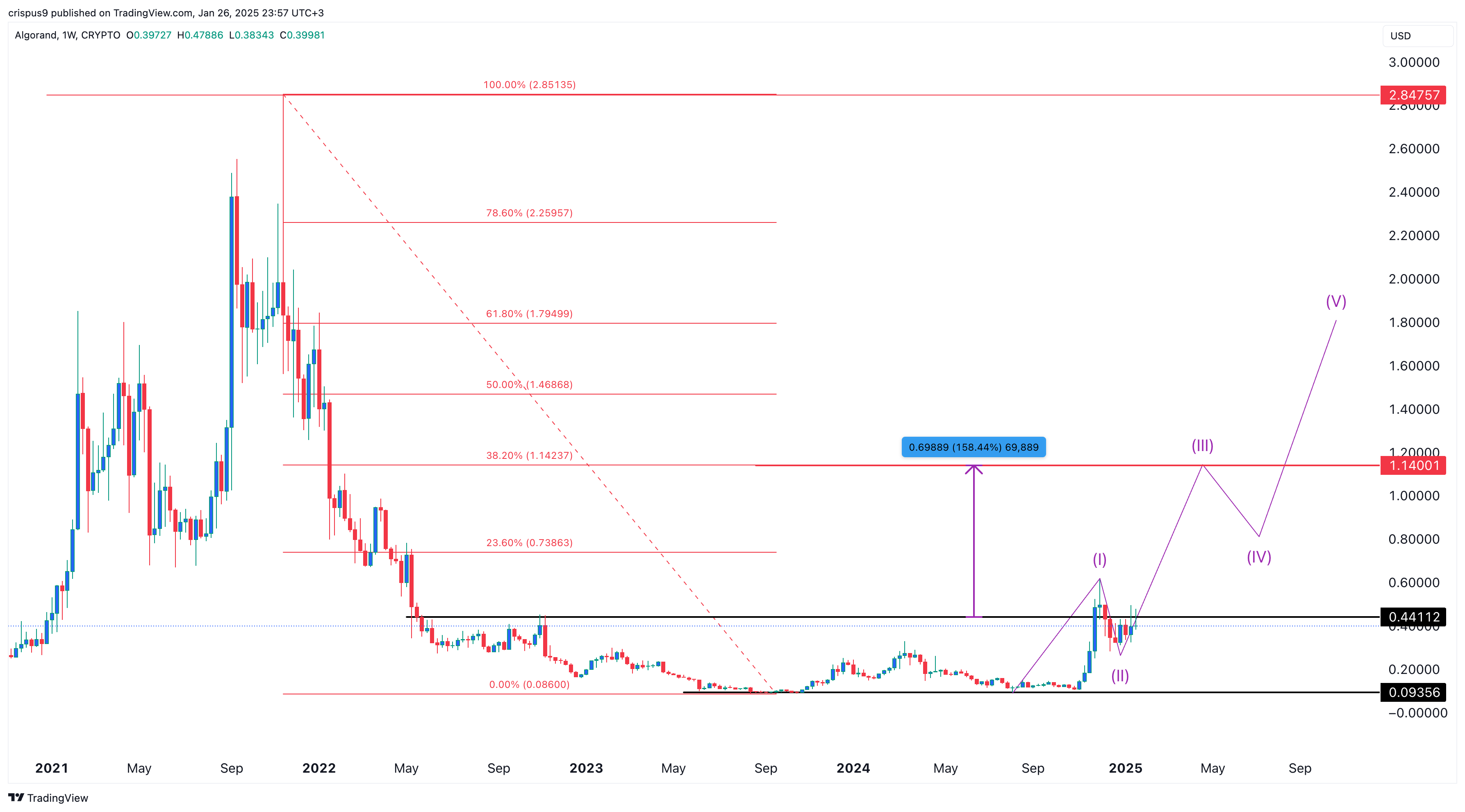

The weekly chart shows that the ALGO price surged to a record high of $2.84 in 2021 as its popularity rose. It then plunged and moved to a low of $0.0935.

The coin remained inside the support at $0.0935 and the resistance at $0.4411 since 2023. It underperformed other cryptocurrencies in 2024 as some, like Bitcoin and Solana, surged to a record high.

The Wyckoff Theory explains this consolidation to be part of the accumulation phase. Usually, this pattern is followed by the markup, where demand is usually higher than supply. In this phase, the Fear of Missing Out (FOMO) intensifies, leading to parabolic moves.

Meanwhile, there are signs that the coin has already completed the formation of the first phase of the Elliot Wave. This phase is usually bullish and short, followed by the bearish second wave.

Algorand price is now about to enter the third wave, which is highly bullish and the longest. Combining the Fibonacci Retracement, we can estimate that the ALGO price will jump to the 38.2% retracement point at $1.400. Such a move would imply a 160% surge from the current level.

Potential Catalysts for the ALGO Price

ALGO’s price has numerous catalysts that could push it higher in the long term. First, Algorand will likely continue doing well soon because of its ecosystem growth. Data shows that the total value locked (TVL) jumped to over $154 million, up from $62 million in 2024. Folks Finance, Lofty, Tinyman, and Vesta Equity are the biggest parts of the ecosystem.

Just recently, Enel, one of the biggest companies in Italy, announced that it will launch a tokenized solar energy project in Algorand.

Further, Algorand has continued to build its network. It recently made a protocol upgrade that introduced the ability for consensus participants to opt into incentives.

Meanwhile, the amount of stablecoins in the Algorand blockchain has started rising. It has risen to over $78 million, up from this year’s low of $40 million. While this figure is much lower than the all-time high of $425 million, it is a good improvement.

READ MORE: How to Buy Algorand Online in 2025