TON price has continued to underperform most cryptocurrencies as concerns about its ecosystem continue. Toncoin has dropped from last year’s high of $8.2827 to $5.500, a 33% drop. Still, while TON’s fundamentals are a bit worrying, technicals suggest that the coin could be on the verge of an explosive surge soon.

TON Price Analysis Points to a Rebound

The daily chart shows that the Toncoin price peaked at $8.2827 in 2024 and then started a slow downward trend. This decline has seen the coin move below the 50-day moving average, a sign that bears are gaining control.

On the positive side, this retreat happened after the coin made a strong bull run, rising from a low of $1.00 in June 2023 to its ATH after exactly one year. That surge could be a flagpole of a bullish pennant pattern, a popular continuation sign.

The coin is also forming a falling wedge chart pattern, which happens when there are two converging trendlines. Therefore, this price action means that the coin will probably have a strong bullish breakout as the two lines of the wedge pattern near their confluence.

Such a rebound will see the coin rebound to last year’s highest point, which is about 50% above the current level. A break above that level will point to more gains, potentially to $8.9400, the 61.8% Fibonacci Extension level.

Toncoin Price to Enter Low-risk Phase

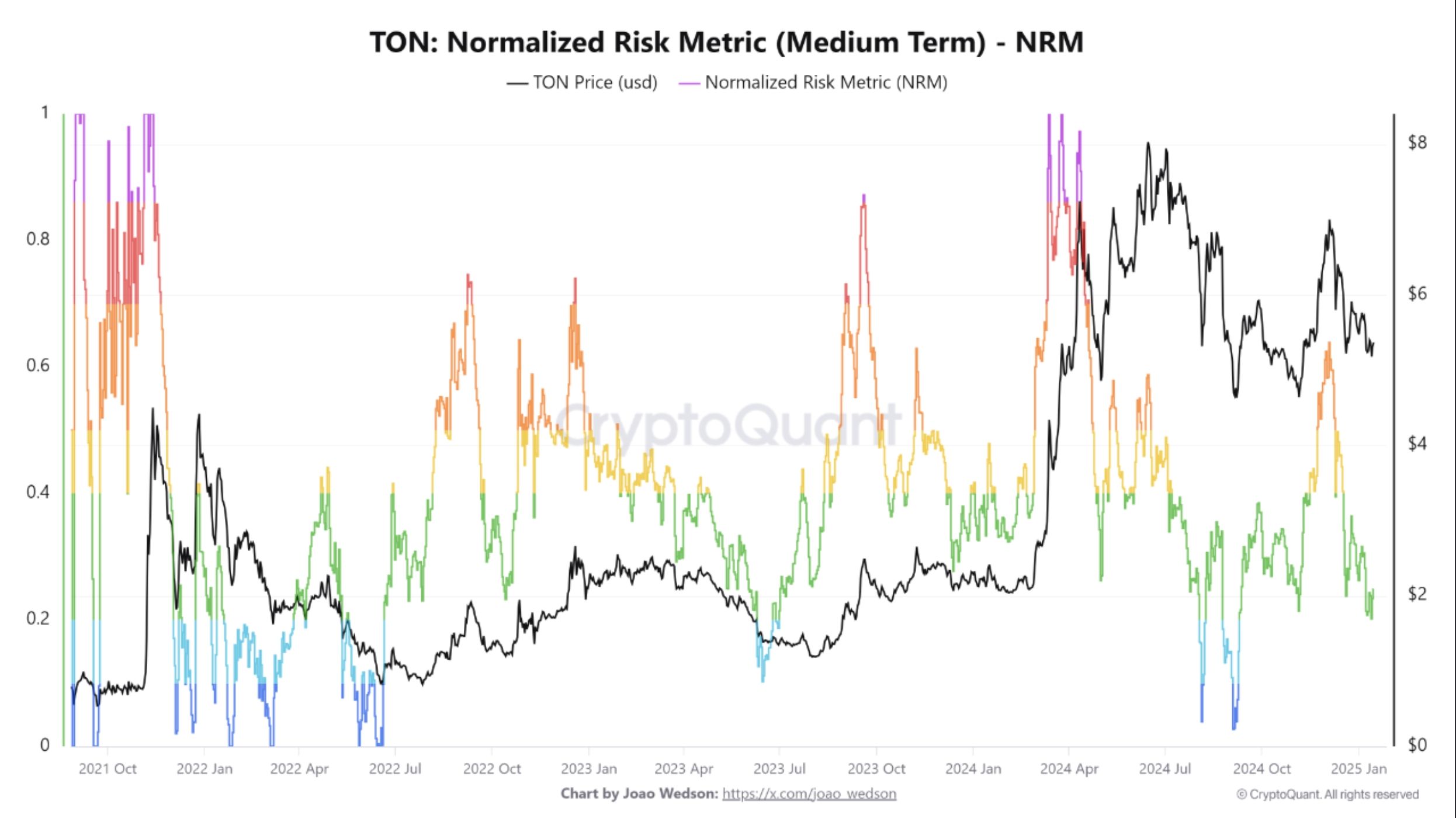

Meanwhile, more data shows that the TON price is about to enter the low-risk phase, where the reward often exceeds the risk. This is based on a popular indicator known as the Normalized Risk Metric (NRM), which looks at concepts like volatility, Sharpe ratio, and drawdowns.

As shown below, the normalized NRM indicator is about to move to the blue zone, which is often a good point to accumulate. However, unlike other indicators, the NRM always requires patience since its signal can take months to happen.

Fundamentals Needs to Improve

TON’s biggest challenge is that its fundamentals are not doing well. Popular tokens in its ecosystem, like Hamster Kombat, Notcoin, and DOGS, have plunged. Also, TapSwap, another popular tap-to-earn game, has delayed its token generation event once more.

Further, data compiled by TonStat shows that the TON supply has continued to grow and now stands at over 5.12 billion. An increase in the number of tokens while the burn rate is falling is often seen as a negative catalyst because it leads to dilution. The daily burn of Toncoin has decreased to just 6,120 from nearly 40,000 a few months ago.

In addition, the number of active wallets has continued falling, reaching a low of 5.03 million from 7.15 million a few months ago. If these metrics improve, there’s a possibility that the Toncoin price will rebound.

READ MORE: Coinbase Users Can Borrow up to $100K USDC Using Bitcoin Loans