River, a leading U.S. Bitcoin exchange, unveiled its latest innovation in digital asset protection: a new security layer called ForceField. Given the unprecedented surge in cryptocurrency fraud, the launch is timely, with BTM-related losses exceeding $65 million in the first half of 2024.

River’s ForceField Boasts Enhanced Protection Features

ForceField introduces multiple security barriers to protect client Bitcoin holdings. The system lets users turn off withdrawals completely or set weekly withdrawal limits on their accounts. This feature prevents unauthorized access, even if an attacker somehow gains the potential victim’s account credentials.

Another interesting point is that the platform builds upon River’s existing security infrastructure, which includes SOC 1 and SOC 2 certifications and multi-sig cold storage systems. By implementing a multi-layered approach to security, ForceField makes it virtually impossible for an attacker to empty a client’s Bitcoin account.

River Steps up With Strategic Response to Evolving Threats

The launch comes amid growing sophistication in crypto-related crimes, as seen in the cases of Litecoin’s X hack. In recent months, there has been an increase in phishing attempts, with around 300 victims falling prey to such scams in the past year. River’s ForceField directly addresses these threats through its multi-layered security approach.

In a blog post, Alex Leishman, CEO of River, stated, “Nothing is more important than your security, but it shouldn’t come at the cost of convenience. ForceField protects your Bitcoin with best-in-class security, without adding complexity.”

Future Impact and Development

The system integrates with River’s proven Bitcoin infrastructure, which already secures over $800 million in client assets. Their enterprise-grade architecture includes isolated processes and physical hardware separation, providing stronger security guarantees than cloud-based solutions.

Looking ahead, River’s security framework positions them at the forefront of institutional Bitcoin custody. The platform maintains separate hot and cold wallet systems, with limited amounts in hot wallets for enhanced security. This structured approach allows them to balance client accessibility with robust protection measures.

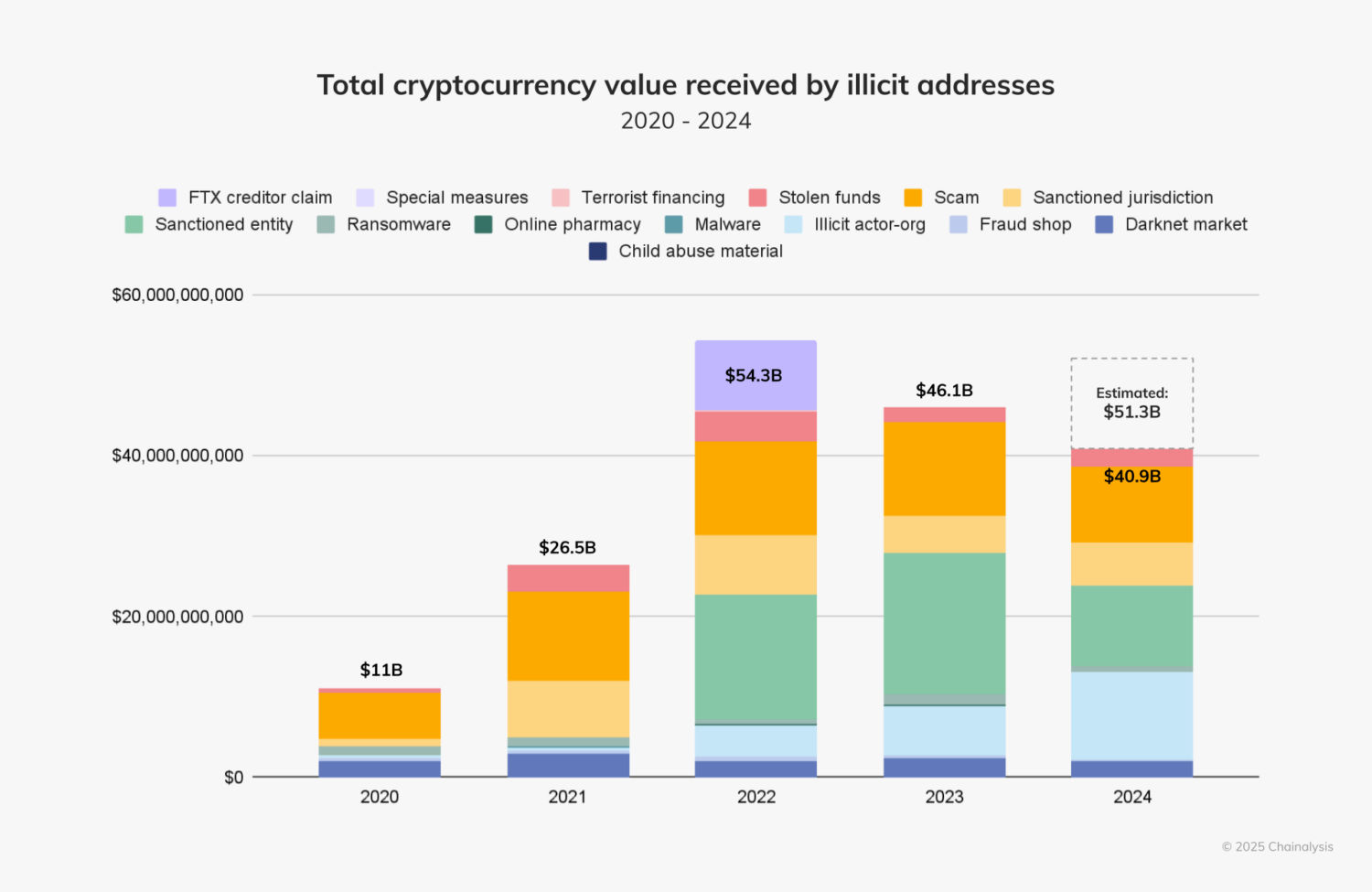

The development comes at a critical time, as crypto-related crimes reached new heights in 2024, with total illicit revenue estimated at $51 billion. River’s approach includes mandatory multi-factor authentication and real-time monitoring systems, ensuring transparency and quick response to potential threats.

With stolen funds increasing by 21% year-over-year to $2.2 billion in 2024, River’s enhanced security measures address a crucial need in the market. Their focus on Bitcoin-specific security and full-reserve custody sets new standards for asset protection.

READ MORE: Chainalysis Report Shows Stablecoin’s Dominance in Illegal Cryptocurrency Transactions