UXLINK has unveiled ambitious plans to revolutionize Web3 accessibility. Currently trading around $1.68 with a market cap above $270 million, UXLINK has captured the market’s attention with its innovative “One Account” launch. The solution aims to address a fundamental challenge – the complexity of managing multiple blockchain identities and wallets.

The development aligns perfectly with the growing demand for more accessible Web3 solutions as institutional demand continues to rise. Against this backdrop, UXLINK’s ambitious goal to expand its ecosystem raises questions about the potential impact on its token value.

Revolutionizing Web3 Access: Game-Changing Features of UXLINK’s One Account

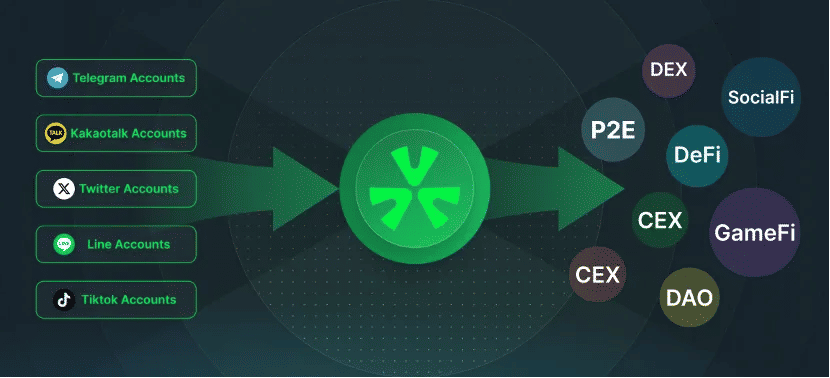

UXLINK’s One Account stands out as a groundbreaking account abstraction protocol that merges social and blockchain identities into a unified gateway. The protocol consolidates various social media accounts like Telegram, X, Line, and WhatsApp with blockchain wallets across networks such as Ethereum, Arbitrum, Mantle, and TON. This integration eliminates the complexity of managing multiple digital identities, making Web3 more accessible to mainstream users.

The recent launch of the Social Growth Layer testnet introduces enhanced functionality through the combination of “One Account” and “One Gas” features. This innovative approach allows users to pay transaction fees exclusively with UXLINK tokens, removing the need to hold native tokens for different blockchains. The platform has also unveiled plans for PayFi integration and UXLINK credit cards, further bridging the gap between social interactions and financial services.

These developments arrive as UXLINK experiences significant ecosystem growth, with the platform currently maintaining a market cap of around $273 million. The strategic timing of these features aligns with UXLINK’s ambitious vision to expand its user base to 100 million.

Technical Analysis: UXLINK’s Market Momentum

The price action shows a period of consolidation after experiencing significant volatility in late December 2024, where it reached peaks above $3.00. The MACD indicator reveals a subtle bullish signal, with the blue line (0.0109) crossing above the signal line (-0.0087), suggesting potential upward momentum building. However, the histogram bars remain relatively small, indicating modest momentum strength.

The RSI currently sits at 44.40, positioning the token in neutral territory – neither overbought nor oversold. This moderate RSI reading, coupled with the recent price stability around the $1.53 support level, suggests a balanced market sentiment.

Monthly UXLINK Trading Chart. TradingView.

Looking at the price structure on a broader note, UXLINK has established a local support zone around $1.53. The next support level is $1.36. This level has been held since the start of 2025. However, the current price action shows signs of a potential accumulation phase, with decreasing volatility and steady trading volume.

The overall technical setup suggests UXLINK could be preparing for its next significant move, with the key resistance level to watch at $1.78. However, maintaining the $1.53 support level remains crucial for sustaining the current market structure.

READ MORE: Backpack Exchange Acquires FTX EU, Plans 2025 Expansion Across Europe