Bitcoin price continues to hover near its all-time high after soaring by over 525% from its lowest level in 2022. BTC was trading at $98,000 on Monday, giving it a market cap of over $1.8 trillion, and making it one of the biggest assets globally.

Still, many popular indicators show that Bitcoin is still cheap and has more room to go in the near term.

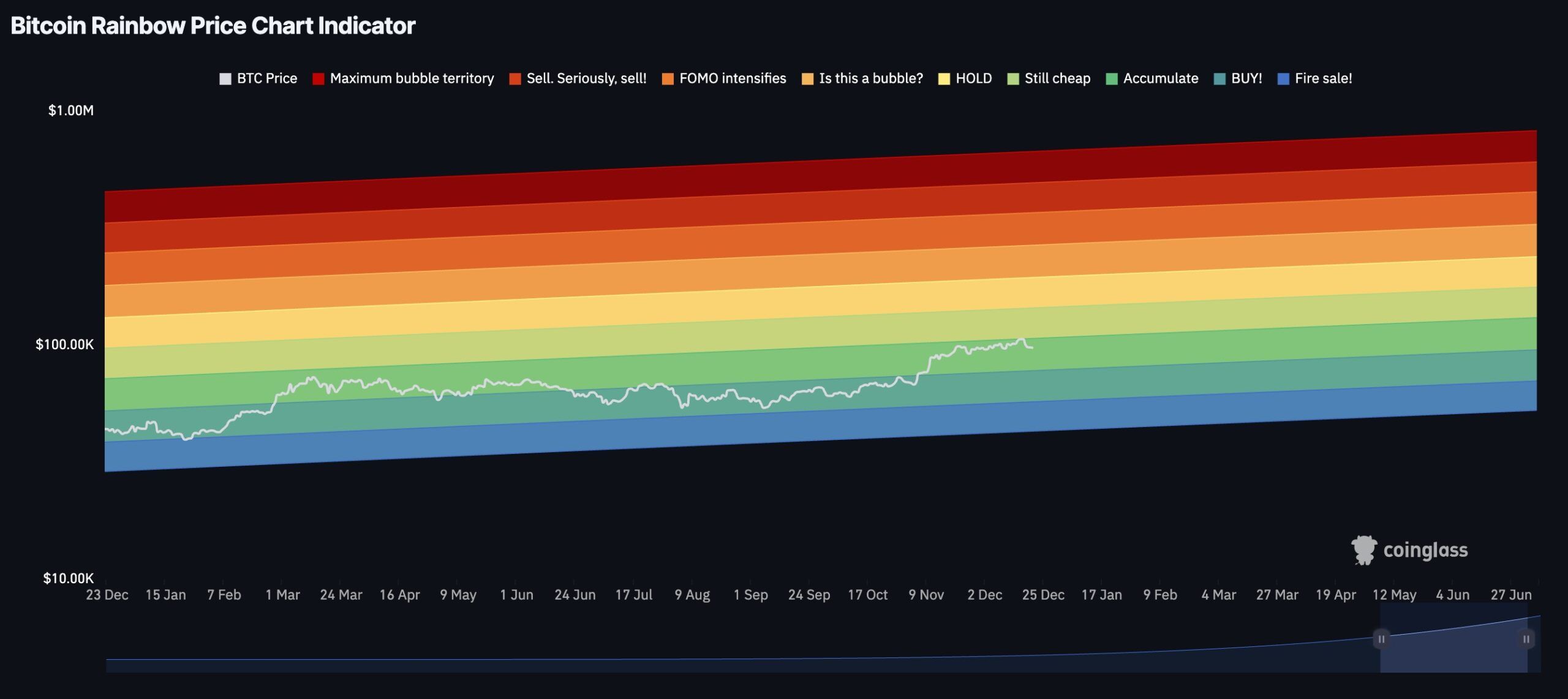

Bitcoin rainbow price indicator

The Bitcoin rainbow price indicator, which uses the logarithmic growth curve shows that the coin is a bargain. The logarithmic growth curve is a complex mathematical calculation that represents a growth that starts quickly and then slows as it moves near the maximum value.

This indicator identifies key levels of Bitcoin, including extreme bubble territory, sell, FOMO, hold, accumulate, and fire sale. At $98,000, Bitcoin has moved to the green zone, meaning that it is still in the accumulation stage and has more upside. When its price reaches $267,000, Bitcoin will start entering the bubble territory.

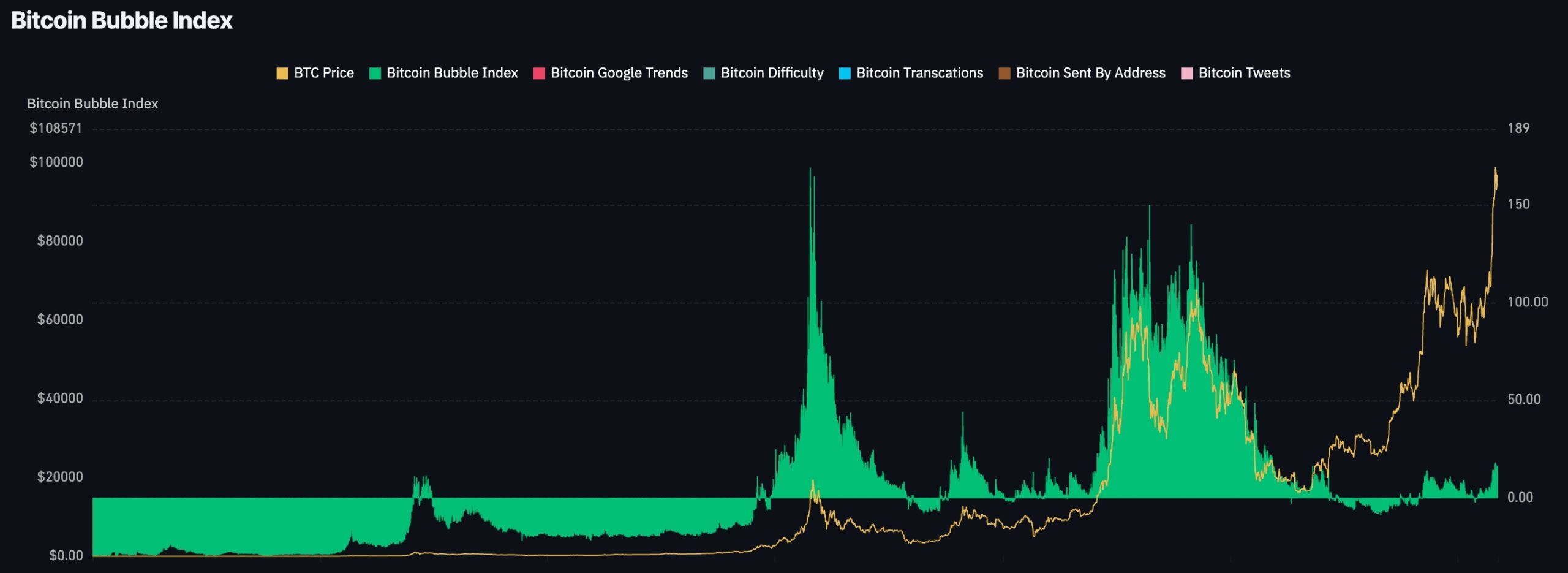

Bitcoin bubble index is still low

The Bitcoin bubble index remains significantly low in line with the rainbow indicator. According to CoinGlass, the index remains below 15, a sign that the coin is not in the bubble territory. Most of the biggest Bitcoin crashes such as between 2021 and 2022 happened when the index has moved above 100.

This bubble index looks at key indicators such as Google Trends, mining difficulty, the number of transactions, tweets, and the number of coins sent by address. It now suggests that the coin may have more upside in the near term.

Bitcoin price MVRV-Z score

The other important indicator that show that Bitcoin’s price has more upside are the market value and realized value (MVRV) and Z score. The MVRV-z score is calculated by subtracting the realized market cap, or the value of transactions on the Bitcoin chain, from the circulating market cap, and dividing with the standard deviation.

Bitcoin and other cryptocurrencies are said to be cheap when the MVRV-Z score indicator is about 3.8. The figure stands at 2.57 today, meaning that it has more upside to get to the overvalued today.

BTC has strong fundamentals

Meanwhile, Bitcoin has some strong fundamentals that will help it continue rising. The most important one is that there is demand from American investors, who have continued to add more coins to their portfolios. Spot Bitcoin ETFs have accumulated over $111 billion of assets, with the iShares Bitcoin Trust (IBIT) having the biggest market share.

Further, Bitcoin’s supply has remained under intense pressure following the halving event in April last year. This halving reduced the amount of block rewards offered to Bitcoin mining companies. Since then, the mining difficulty and hash rate have soared to a record high.

Therefore, the confluence of rising demand and falling supplies means that the Bitcoin price may continue soaring. Most importantly, Bitcoin has a long track record of doing well as its price has jumped from below $1 in 2009 to almost $100,000 today.