The RENDER Network is stepping into 2025 with the intention of implementing major changes to its ecosystem. Fresh off a successful 2024, where it tripled its usage, the network just got community approval for three game-changing proposals. These updates will bring a new tier system for node operators, better governance, and tweaks to how the tokenomics of the RENDER coin works.

With over 40 million frames already rendered and a growing community of more than 200,000 followers, RENDER shows it can handle heavy workloads while paying attention to community expansion.

RENDER Network advances with key improvements despite market volatility

The RENDER Network started 2025 with three major community-approved proposals that could boost its market position. RNP-016 introduces a new tier system for node operators, which should make the network more reliable for heavy rendering tasks.

RNP-017 streamlines the voting process, while RNP-018 brings updates to token economics. However, RENDER still fell victim to market volatility as it sits at 39th in global crypto rankings, falling from the 32nd spot it snatched just yesterday.

In other news, RENDER’s recent shift to Solana has already paid off, with most tokens successfully migrated from Ethereum. This move has made the network more efficient and cut down on fees. With new support for AI services and popular tools like Cinema 4D and Redshift, RENDER is handling more workload than it used to.

These improvements come during a period when RENDER’s market performance is not clearly optimistic or bearish. For one, the network’s market cap falls just short of the $4 billion mark, decreasing by 3% in the last 24 hours.

On the other hand, the token’s daily trading volume is around $450 million at press time, with a 23% increase in the same timeframe. While the price has succumbed to some volatility, the network’s improvements suggest stronger performance for the token this year.

RENDER price outlook

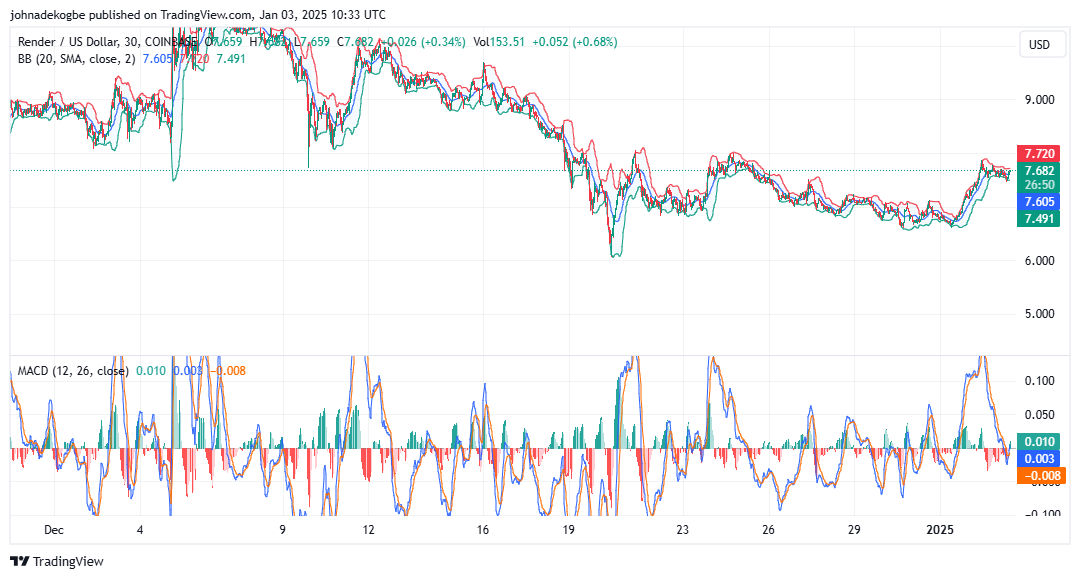

Data from RENDER’s 30-minute chart attached below spell mixed signals for the token’s price action. To start with, the token has been trading in a range between $7.40 and $7.77 since the start of the new year. At press time, it costs around $7.68 per token, showing signs of short-term resistance.

The Bollinger Bands show that volatility has been tightening lately. The price is hugging the upper band, which often signals a pause in the upward movement. The SMA line acts as decent support, around $7.49, and prices have been bouncing off this level consistently.

Moreover, the MACD indicator is giving mixed signals. While it’s still in positive territory at 0.010, the histogram bars are getting smaller. This suggests the recent upward momentum might be losing steam. The signal line crossing below the MACD line hints at possible short-term weakness.

For traders watching RENDER, key levels to watch are $7.77 as resistance and $7.49 as support. A break above $7.77 could open the door to more gains while dropping below $7.49 might trigger further selling. Trading volume has been steady but not remarkable, showing the market is still making up its mind about direction.

RENDER/USD Trading Chart Dec 2024 – Jan 2025. TradingView

Given RENDER’s recent network updates and current technical setup, there might be some consolidation before the next big move. The market seems to be digesting both the positive development news and the token’s recent ranking drop. For now, the technical indicators suggest caution, with a wait-and-see approach making sense until a clearer direction emerges.

Read more: LUNC Price Analysis as Binance Burns 1.7b Terra Classic Tokens