Cardano price has retreated in the past four weeks, falling by over 34% from its highest point in November. While ADA has some weak fundamentals, technicals suggest that it may stage an epic surge, potentially to the year-to-date high of $1.326.

Cardano price forecast: a rebound can’t be ruled out

The four-hour chart shows that the ADA price has been in a slow downtrend in the past few weeks, mirroring the performance of other altcoins. It has fallen from this month’s high of $1.326 to the current $0.86.

Cardano has slipped below the 50 and 100-period Volume Weighted Moving Average (VWMA), a sign that bears have prevailed. It also hovers slightly above the 50% Fibonacci Retracement level at $0.826.

On the positive side, Cardano has formed a falling wedge chart pattern, which is shown in red below. The upper side of this pattern connects the highest swings since December 3. The lower side links the lowest points – barring a false breakdown on December 20 – since November 24.

These two lines are nearing their confluence, meaning that a bullish breakout could happen soon. If this happens, the ADA price will likely rise to the year-to-date high of $1.326, up by 51% from the current level.

Conversely, a drop below the 50% retracement level at $0.825 will invalidate the bullish view and signal more downside in the near term.

Cardano whales are not selling

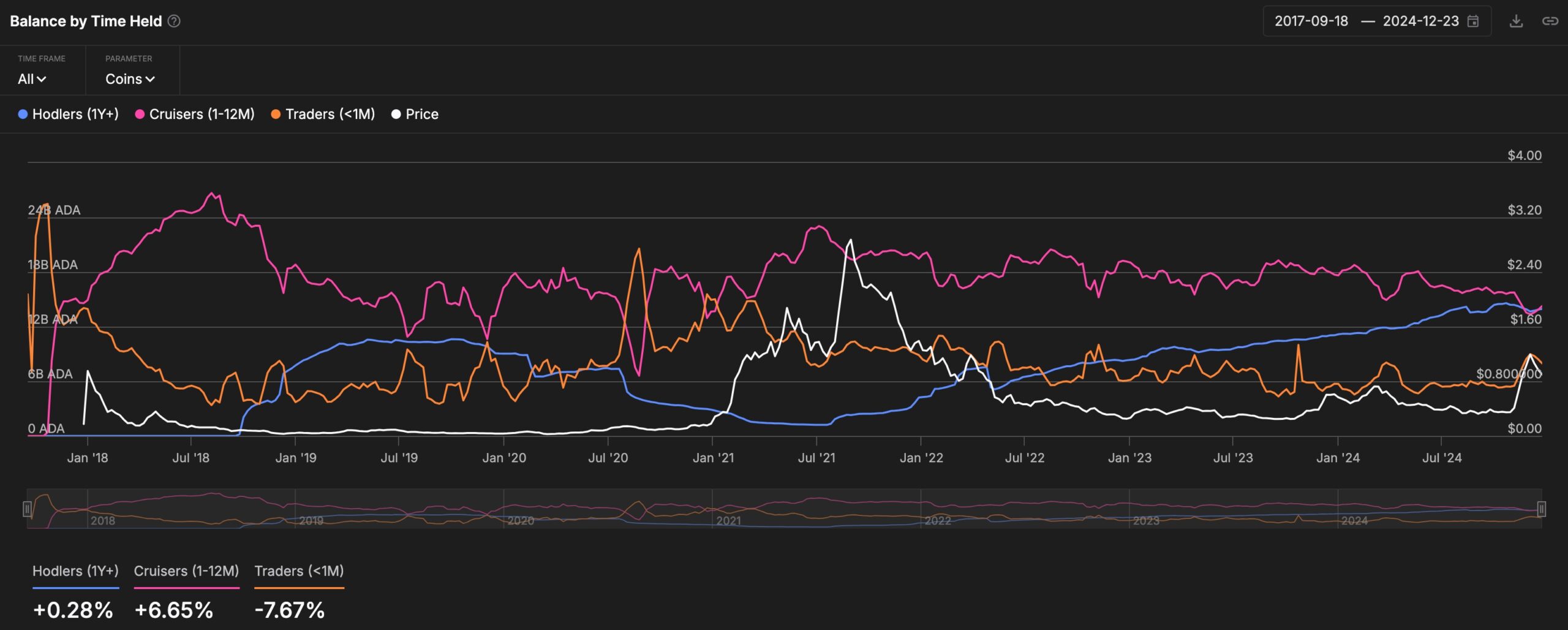

A notable catalyst for ADA price is that holders are not selling their coins even after the coin surged recently. According to IntoTheBlock, Cardano holders who have had their ADA tokens for over a year have remained invested. Their total holdings have risen to 13.6 billion ADA from 1.2 billion in June.

At the same time, as shown below, cruisers – holders of between 1 month and 12 months – have reduced their holdings gradually. Traders have also hiked their positions in the past few days. Therefore, the whale’s positioning indicates that they expect the coin to rise again.

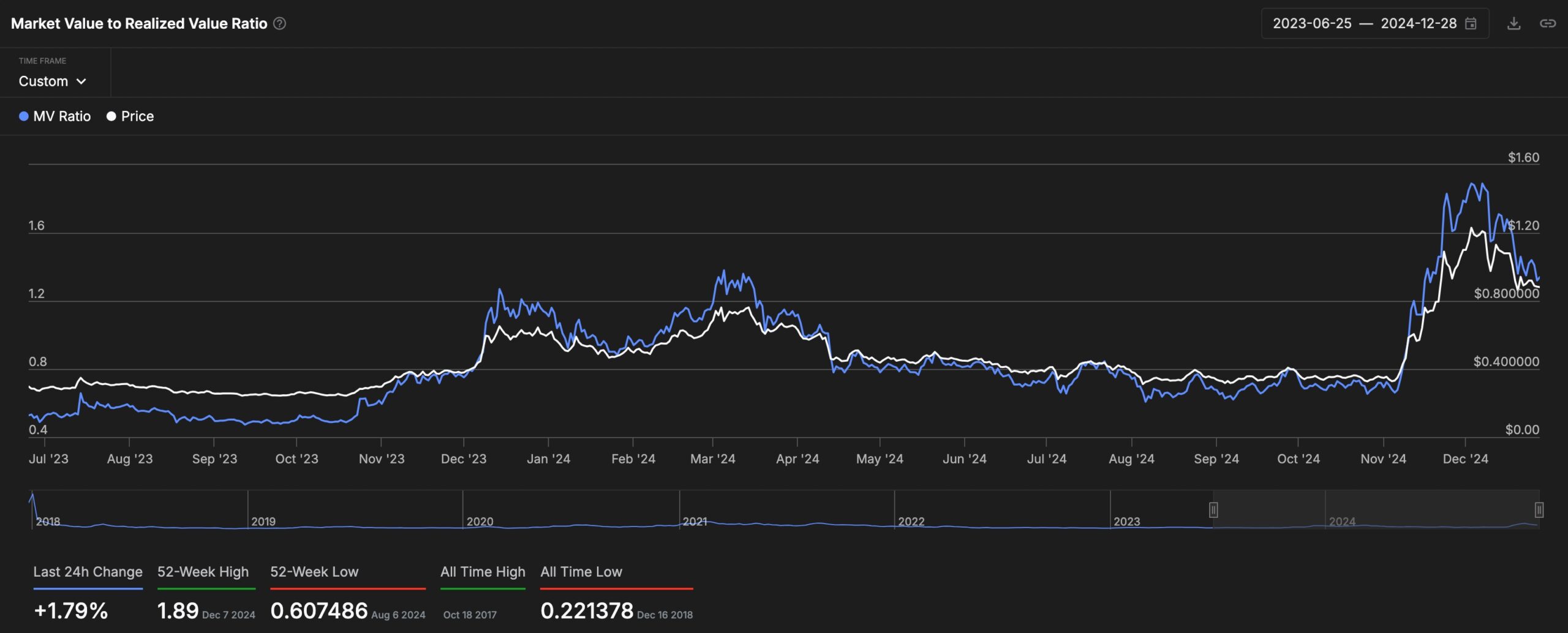

Additionally, Cardano still has a low Market Value to Relative Value (MVRV) figure. Its MVRV indicator stands at 1.26, meaning that it is highly undervalued since an asset is said to be overvalued when the MVRV indicator moves to over 3.8.

The main challenge for Cardano is that the network has struggled to attract developers in the last few years. According to CoinGecko, the biggest cryptocurrencies in the Cardano ecosystem are Snek, SingularityNET, Iagon, Minswao, Indigo Protocol, and NuNet.

Read more: Cardano Transaction Fees Are Tanking: What Next For ADA Price Crash?

Cardano’s DeFi network has just $436 million in total value locked (TVL). While this is a lot of money, it is significantly lower than newer networks like Base Blockchain, Sui, Aptos, and Blast.