Bitcoin (BTC) price saw a sharp decline recently, dropping 11% from its all-time high of over $108,000 earlier this month. The downturn follows the Federal Reserve’s latest FOMC meeting, where Jerome Powell’s remarks triggered significant market reactions. The crypto market entered a bearish phase, with leading altcoins also recording losses. This sudden shift in sentiment has raised concerns about a potential extended downtrend for Bitcoin and other cryptocurrencies, creating uncertainty among investors and traders during December’s market fluctuations.

Bitcoin Price Falls 11% from ATH; Bearish Momentum Ahead?

Bitcoin’s price has fallen 11.79% from its all-time high of $108,268.45, recorded on December 17, 2024. This correction follows a strong November rally that propelled the cryptocurrency to historic levels.

However, the recent downturn has raised concerns about the possibility of prolonged bearish momentum as traders reassess market conditions. Bitcoin’s current decline marks a shift from the bullish sentiment seen earlier, with investors now focusing on whether this correction could deepen further.

The correction has also reignited discussions around Bitcoin’s market dominance, which surged during the rally but left altcoins struggling to gain traction. Despite its record-breaking performance, Bitcoin’s pullback has sparked uncertainty, putting pressure on other cryptocurrencies.

At the time of writing, Bitcoin is trading at $95,874.40, reflecting a 2.56% decrease in the past 24 hours. The cryptocurrency market displays bearish momentum, with Other notable altcoins, such as Solana (SOL), XRP, and Dogecoin (DOGE), continuing to maintain steady gains.

Bitcoin Faces Potential Pullback Ahead

Crypto analysts has flagged a potential pullback in Bitcoin’s price, highlighting a possible Head & Shoulders pattern on its chart. The noted breakout from a broadening wedge pattern recently pushed Bitcoin past $95,000, indicating a robust bullish momentum.

However, analyst warns that a short-term retracement could occur if the right shoulder of the pattern forms.

Bitcoin Exchange Reserves Surge, Market Reacts

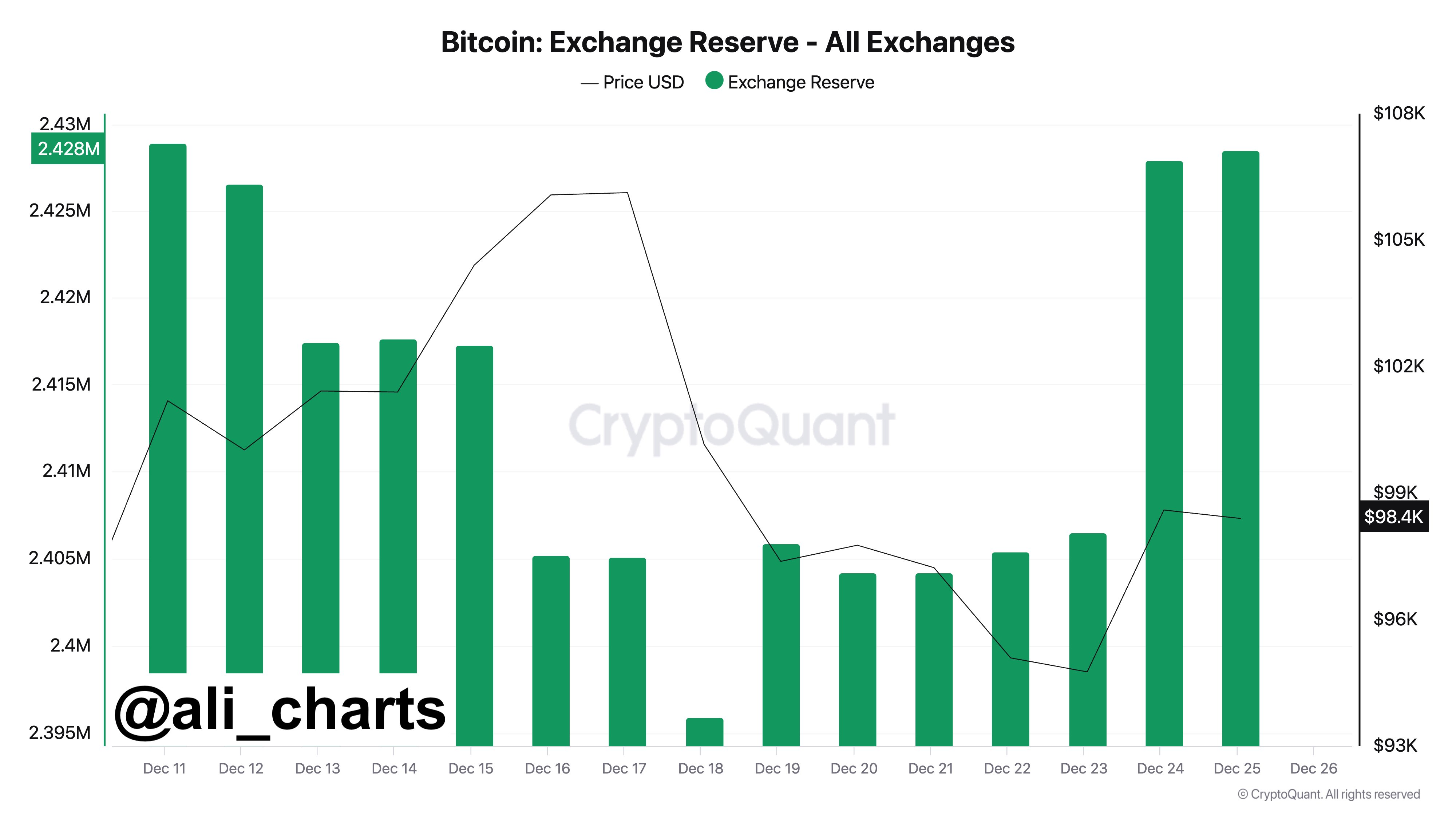

The Bitcoin market witnessed significant activity this week, as over 33,000 BTC were transferred to exchanges. These transactions are valued at an estimated $3.23 billion. This influx has raised questions about potential market trends.

The data, sourced from CryptoQuant, highlights a notable increase in exchange reserves. This trend is often associated with rising market uncertainty. When traders move Bitcoin to exchanges, it typically signals selling pressure or preparations for trading activity.

Chart analysis shows that Bitcoin’s exchange reserve reached approximately 2.428 million BTC, a sharp rise compared to prior weeks. During this period, Bitcoin’s price hovered around the $98,000 mark.

Will BTC Price Hit Back To 90K?

If the bearish trend continues, the BTC price could break the support level of $95K. However, $90K might be the next stop for the leading cryptocurrency if sellers gain further momentum. Despite temporary relief near $95,555, Bitcoin struggles to recover amid weakening buying pressure. If a bullish trend makes a comeback, the leading crypto could hit back to $100k, and if pressure increases, BTC could hit back the ATH.

The Relative Strength Index (RSI) at 42 suggests bearish control as it moves further away from neutral territory. A decline below the oversold threshold could accelerate selling pressure.

Additionally, the Moving Average Convergence Divergence (MACD) highlights weakening bullish momentum. The signal line diverges from the MACD line, creating a bearish crossover that could reinforce a downward trend. Sellers remain dominant, as reflected in the diminishing histogram values.

Bitcoin’s recent drop from its ATH raises market uncertainty, with bearish momentum prevailing. Traders closely monitor key levels, while indicators suggest potential further declines or a recovery scenario.