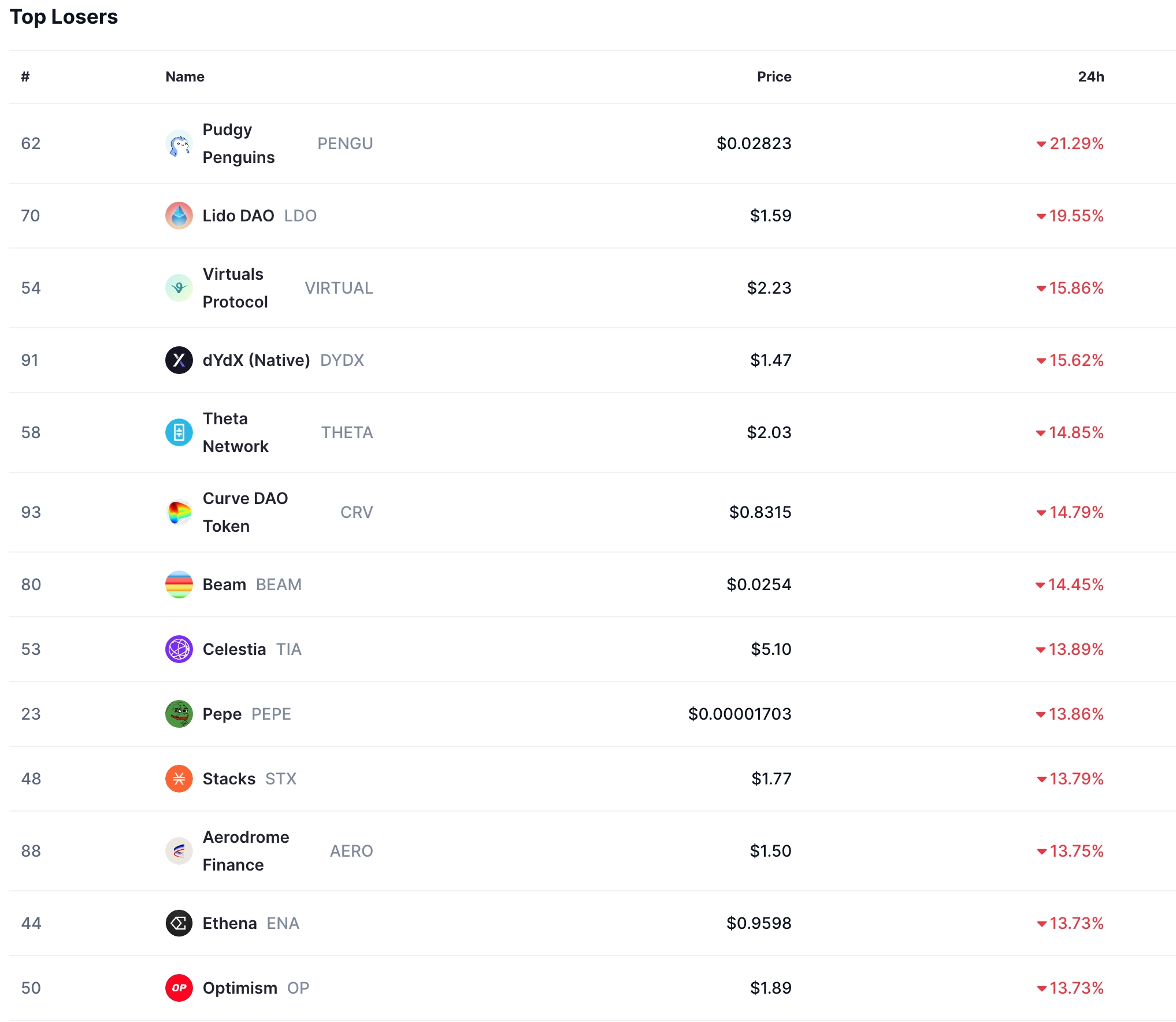

Cryptocurrency prices crashed on Thursday, a few days after Bitcoin (BTC) surged to a record high of over $108,000. Bitcoin has now retreated below $97,000, while the crypto fear and greed have moved from an extreme greed level to almost neutral.

Also, the market cap of all cryptocurrencies has crashed to $3.45 trillion. So, why did crypto crash, and is it time to buy the dip?

Why did crypto crash?

There are three main reasons why the crypto crash happened. First, the sell-off accelerated after the Federal Reserve delivered a highly hawkish decision on Wednesday. While the bank slashed interest rates by 0.25%, it hinted that it would deliver just two cuts in 2025.

The implication is that the US dollar index surged to a two-year high while American bond yields rose. The ten-year rose to 4.57%, while the 30-year and 5-year jumped to 4.74% and 4.43%, respectively.

Higher bond yields could lead to a rotation from risky assets like cryptocurrencies to money market funds. Before the meeting, analysts were expecting the Fed to cut rates four times in 2025, which will benefit risky assets.

Second, cryptocurrencies plunged as a sense of panic came into the market. The crypto fear and greed index dropped from the extreme greed zone of 90 a few weeks ago to 69. While it is not in the fear zone yet, it will probably move to that level in the coming days.

Third, technically, the sell-off is mostly because of mean reversion and distribution. Mean reversion is a situation where an asset in an uptrend falls and moves back to the mean price. Distribution is a concept in the Wyckoff Method that explains why assets plunge after a strong rally. This sell-off happens when people who have accumulated an asset and rode the uptrend sell.

Is it safe to buy the cryptocurrency dip?

The ongoing crypto sell-off may attract some investors to buy the dip. Besides, American stocks rebounded after crashing shortly after the Federal Reserve decision.

The risk of buying the dip now is known as a dead cat bounce. This is a situation where an asset in a freefall bounces back briefly and then resumes the downtrend. These dead cat bounces will likely happen in the next few days.

Fortunately, historical data shows that the year’s first quarter is the second-best for cryptocurrencies. The average Q1 return for Bitcoin in the last twelve years is 56%, while Ethereum has returned an average of 97%. Ethereum has risen in six of the last eight first quarters.

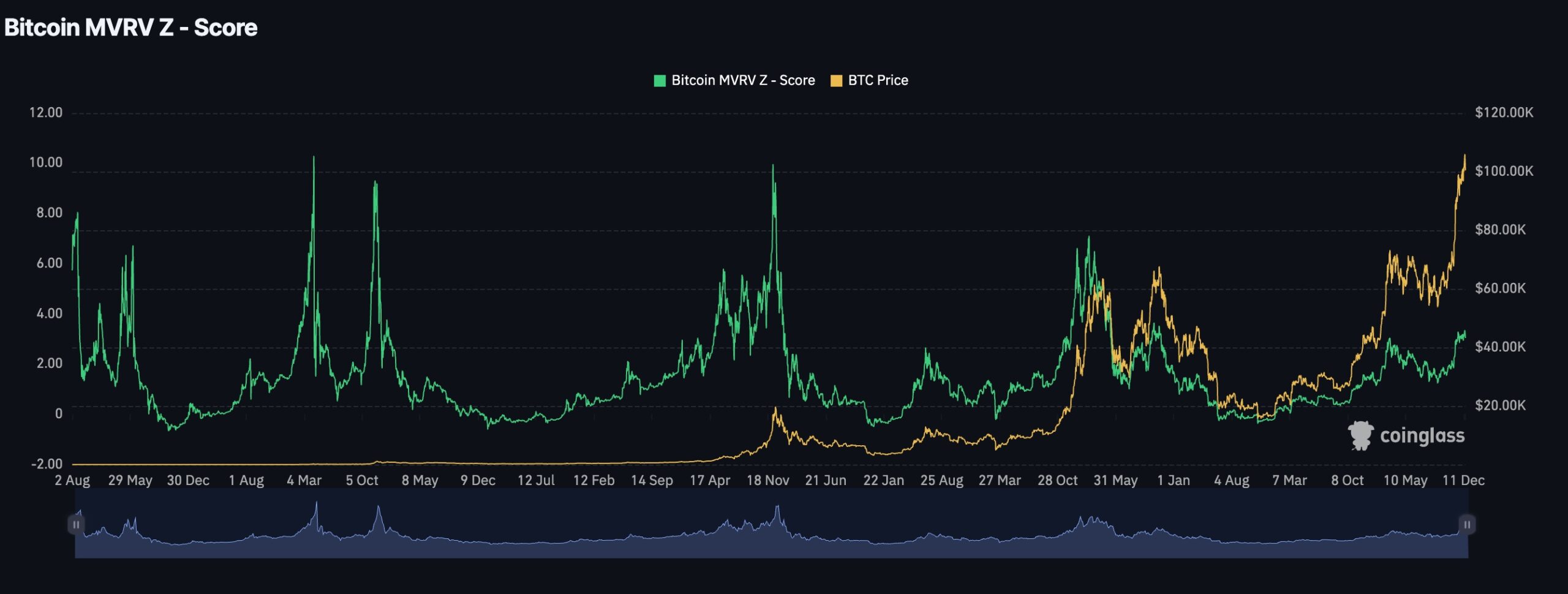

Therefore, there is a likelihood that Bitcoin and most altcoins will bounce back in the next few months. Besides, as shown below, the MVRV score for Bitcoin stands at 3.16%, which is much lower than in the previous tops. The MVRV score looks at the coin’s market value minus the realized value for a coin.

So, is it safe to buy the crypto dip? In my view, we are still in the crypto bull run, but it is too early to buy the dip just yet.

Read more: SUI Falls 11% Below Recent ATH As $5 Rally Hopes Dwindle