Morpho, a leading player in the decentralized finance (DeFi) industry, has done well in the past few weeks. Its token has jumped from $0.7046 in November to $2.8 today, a 2955% surge that has brought its market cap to over $426 million and its fully diluted valuation to $2.7 billion.

Morpho is a growing AAVE rival

Morpho has become one of the biggest rivals to AAVE, the crypto industry’s biggest lending and borrowing protocol.

The network allows users to deposit their tokens into third-party vaults and earn returns. This yield comes from lending these funds to borrowers.

According to its website, Morpho’s network has over $4.3 billion in deposits and $1.69 billion in borrowed funds. Most of the deposits are in the Spark DAI Vault, which has over $700 million in assets. Usual Boosted USDC follows it with $208 million in assets, and Gauntlet WETH Prime with $164 million in assets.

Morpho has also grown its ecosystem by introducing other players in the DeFi industry. Some of these platforms that help to supply liquidity in the ecosystem are Moonwell, Instadapp, Safe, Hyperdrive, and Reserve Rights Token.

Morpho is available in Ethereum and Base, the biggest layer-2 network in the industry. Its goal is to become a bigger platform than AAVE, a network that has achieved over $21 billion in assets in the past few years.

Morpho price has two other potential catalysts that will push its price higher. First, it received $50 million in venture capital money in August. These funds came from firms like Ribbit, Pantera, Brevan Howard, Coinbase, and BlockTower.

Historically, some of these funds have a history of pumping cryptocurrencies as they seek to generate returns, as we saw with Injective. The Injective token price pumped in 2023 as some of these VCs sold some of their allocated tokens.

The other potential catalyst will be a Coinbase and Binance listing. Coinbase may list it since it is one of its investors. Such listings will likely push its price higher.

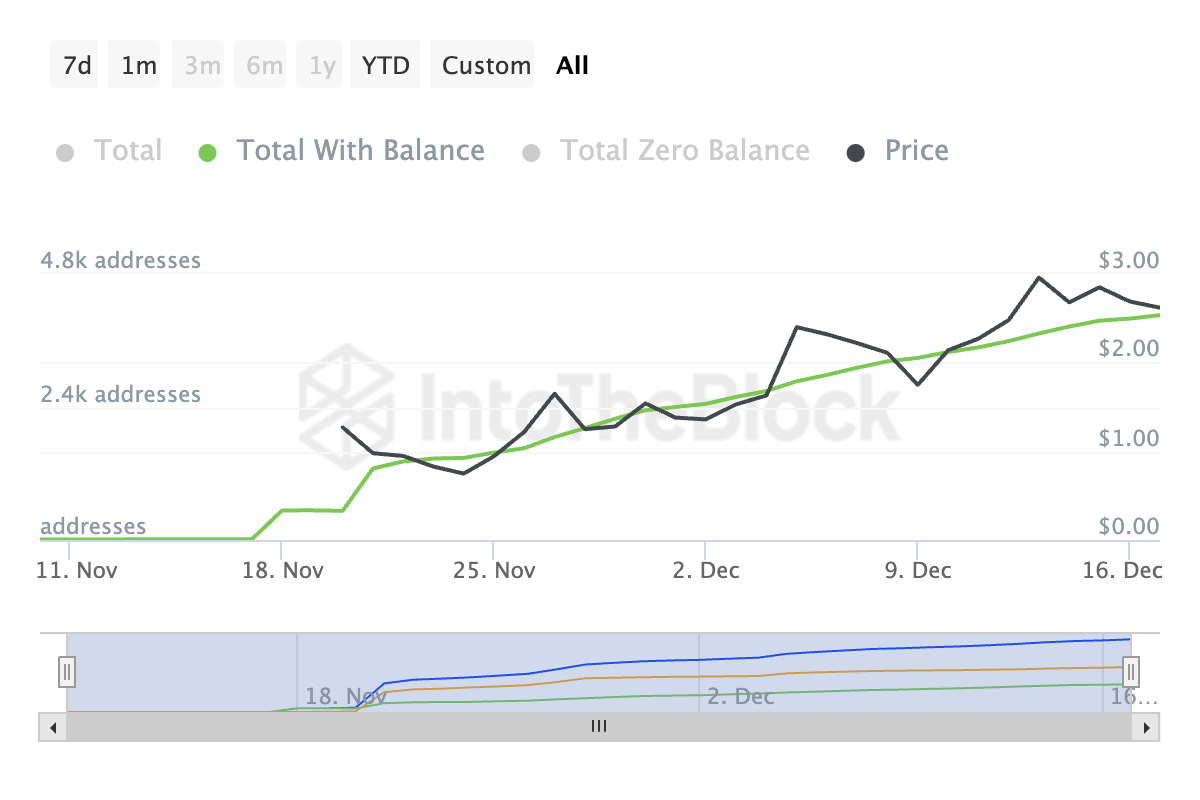

Additionally, on-chain data shows that the number of Morpho active addresses has continued rising. This is a sign that it is gaining traction among users.

Morpho price prediction

Chart by TradingView

The two-hour chart shows that the Morpho price has formed a series of higher highs and higher lows in the past few weeks. It has also completed forming the impulse wave of the Elliot Wave pattern. The recent consolidation has been part of the three-wave corrective phase.

Morpho price has remained above the 50-period moving average. Therefore, the coin needs to move above the key resistance level at $3.1880, its highest point this month, to continue its bullish trend. That move will invalidate the forming double-top pattern and raise the hopes of it soaring to $5 over time.

Read more: