Ripple CEO Brad Garlinghouse announced on Tuesday that the company has received approval from the New York Department of Financial Services (NYDFS) to launch its new RLUSD stablecoin.

This just in…we have final approval from @NYDFS for $RLUSD! Exchange and partner listings will be live soon – and reminder: when RLUSD is live, you’ll hear it from @Ripple first.

— Brad Garlinghouse (@bgarlinghouse) December 10, 2024

RLUSD stablecoin prepares for exchange listings

Ripple USD, or RLUSD, is a new stablecoin designed to facilitate cross-border transactions. It targets large institutional clients and seeks to compete with Circle’s USDC in the US market.

RLUSD price will keep a 1:1 value with the US dollar. US dollar deposits, short-term US government bonds, and other cash equivalents similar to stablecoins like Tether’s USDT and USDC will also back it.

Before it gets final approval from the New York Department of Financial Services (NYDFS), the XRP RLUSD stablecoin tested on the Ethereum and XRP Ledger (XRPL) networks and is now preparing for its official launch on cryptocurrency exchanges.

The exact RLUSD launch date is still unknown, but Ripple’s CEO Brad Garlinghouse mentioned that partnerships with exchanges will be announced soon. He advised the crypto community to wait for official updates from Ripple to avoid misinformation.

Also, RLUSD will not replace XRP, as some people believe. RLUSD acts like digital cash, while XRP is used to help facilitate transactions around the world.

What does RLUSD mean for XRP price?

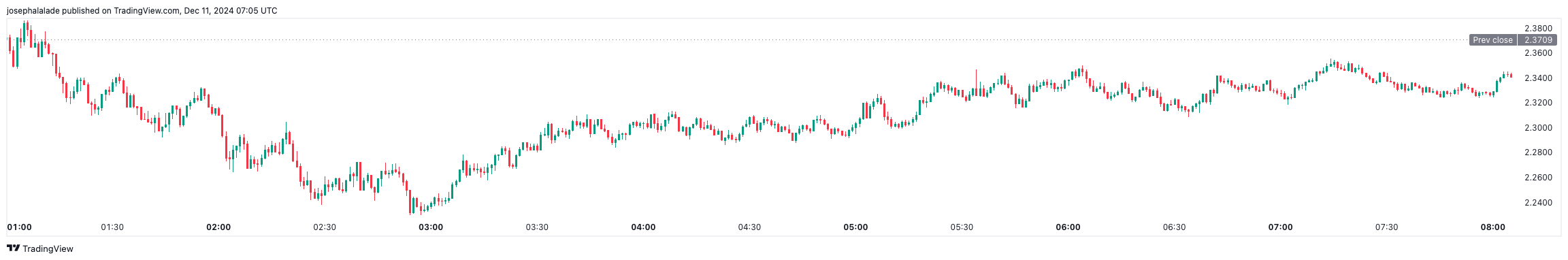

Since the announcement, the price of Ripple (XRP) has increased by about 8.01%, even as the overall cryptocurrency market has dropped.

On Tuesday at 6:15 UTC, the price of XRP fell to $1.92, but within two hours of the stablecoin announcement, it rose to $2.4. This increase is happening even before the public launch of the RLUSD.

XRP/USD price chart | TradingView

This shows that as more people use RLUSD, the use of XRP as a settlement layer also grows. For example, USDC and USDT stablecoins operate on Ethereum and have boosted Ethereum’s transaction volume and liquidity over the years. RLUSD could do the same for XRP if it becomes popular.

Some predictions say XRP may reach its 2018 high of $3.84 and possibly move up to $5 from there in the near term.

Daily technical analysis for XRP/USDT is mostly positive, with 13 indicators suggesting “Buy,” 9 being “Neutral,” and 4 signaling “Sell.” Oscillators show the RSI at 63.51, indicating neutrality, while other metrics show positive trends.

However, the MACD and Stochastic RSI suggest there may be short-term pullbacks. Moving averages support upward momentum, with 12 out of 14 signals in the “Buy” zone, including the 10-day EMA at 2.3064.

Currently, the XRP price is $2.3347. If positive momentum continues, it may retest resistance at $2.44 and rise to $2.93. Key support levels are $1.47 and $0.97, which can help prevent larger losses.