The Thena token price has gone parabolic over the past 24 hours following its listing on the leading Binance cryptocurrency exchange on November 27.

Thena token spikes after listing on Binance and Bybit

Binance revealed the listing of Thena (THE) to its Simple Earn, “Buy Crypto,” Binance Convert, Binance Margin, Binance Auto-Invest, and Binance Futures platforms, along with the distribution of a Thena airdrop to qualified users.

THE historic moment is here: @binance spot market LIVE, with $60M in volume in just 30 minutes!

This milestone belongs to all of YOU. Community is everything. And this is just the beginning.

Never stop building 💜🏛️ pic.twitter.com/BB9Juz8dD5

— THENA (@ThenaFi_) November 27, 2024

Another major crypto exchange, Bybit, also introduced the THE/USDT Perpetual Contract with leverage of up to 25x on the same day, leading to a rise in trading activities and the token’s price over the previous day.

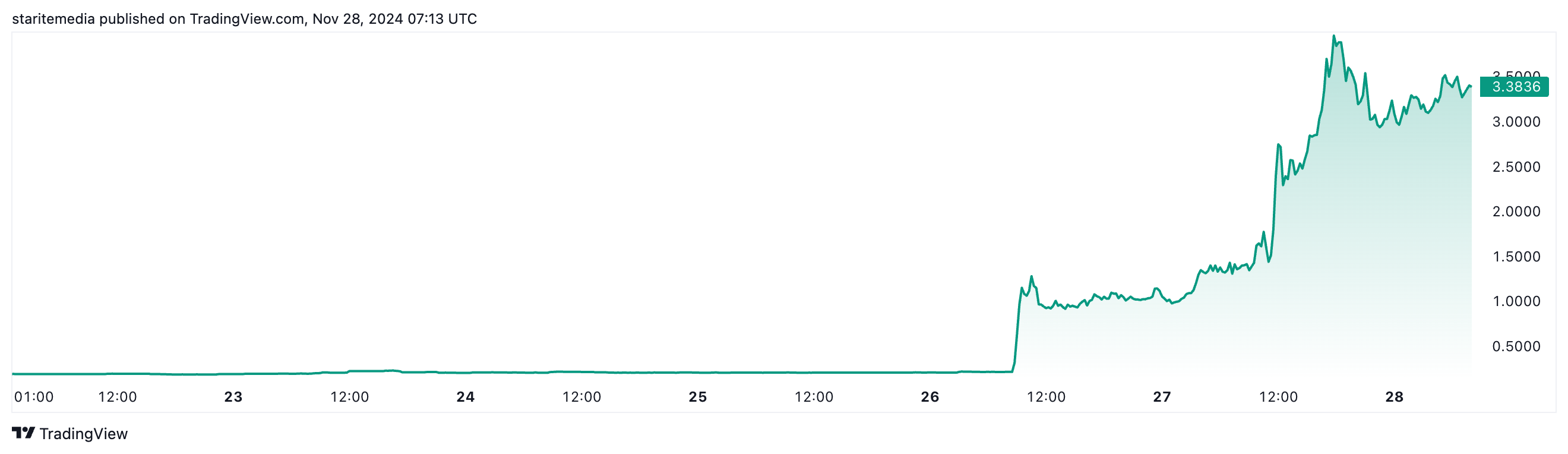

Following the dual exchange listings, the price of the THE token increased from around $1.27 to a peak of $4.10. This represents an increase of about 300% over 24 hours, adding to the staggering 1714.69% gain it has seen in the past week. At present, it has decreased by 14.9% from its all-time high to $3.38, with a market capitalization of $259.95 million.

THE/USDT weekly price performance | TradingView

Interestingly, the trading volume of Thena coin also went extreme after the Binance listing. At the time of writing this line, the Thena token shows a 24-hour trading volume of $2,292,489,176.75, a massive surge of 3793.97% over the last 24 hours alone.

THE is the native token of THENA, a top decentralized exchange and liquidity layer operating on the BNB Chain. The platform provides spot and perpetual trading for various digital assets.

Why THE price might drop in the short term

While the Thena price has shown strong bullish momentum recently, technical indicators reveal potential risks for a short-term pullback.

One of the main reasons THE could drop is that it appears to be overbought. According to TradingView data, the Relative Strength Index (RSI) is currently at 98.6, much higher than the typical overbought threshold of 70.

This suggests that the token may be due for a correction, as traders might take profits.

Additionally, the Commodity Channel Index (CCI) is at 345.03, another sign of an overbought condition. When the CCI is this high, the market is often ripe for a reversal or pullback.

If the price drops, traders should keep an eye on two key support levels. The first level of support is around $2.12, which is the Ichimoku Base Line. If the price moves down, this could be the first level where buying interest might pick up.

If the sell-off continues, the next support could be $1.28, where the EMA 10 (Exponential Moving Average) is positioned. This level is important because it reflects short-term price movements.

Read more: Ripple News: Crypto Analyst Sees XRP Price Soaring to $16