Bitcoin price continued powering on, hitting a record high of $94,946 on Wednesday. It has more than doubled this year, making it the best-performing major assets in Wall Street. Analysts are expecting the coin to jump to $100,000 as soon as this week. Still, there are a few reasons why a correction could happen.

Bitcoin price has formed a rising wedge pattern

First, there are signs that the BTC price has formed a rising wedge pattern on the daily chart. As shown below, the coin has formed two ascending and converging trendlines that are nearing their tipping points.

In technical analysis, this wedge pattern is one of the most popular signs of a bearish reversal. In this case, there is a risk that the coin will drop and retest the important support at $85,000, which is about 10% below the current level.

BTC and mean reversion

The other risk that the price of Bitcoin faces is known as mean reversion. In its case, the coin has jumped sharply above the 50-day and 200-day moving averages. It has moved up by 25% above the 50-day EMA and 35% above the 200 EMA.

The concept of mean reversion states that a financial asset often goes back to its average price over time. If this happens, it means that the coin could drop by as much as 20% as it seeks to retest the 50-day moving average level.

This is a possibility because Bitcoin price has become highly overbought. The Relative Strength Index (RSI) has remained at the extreme overbought level of 80, while the Stochastic is near 100.

Bitcoin’s seasonality and Trump trade

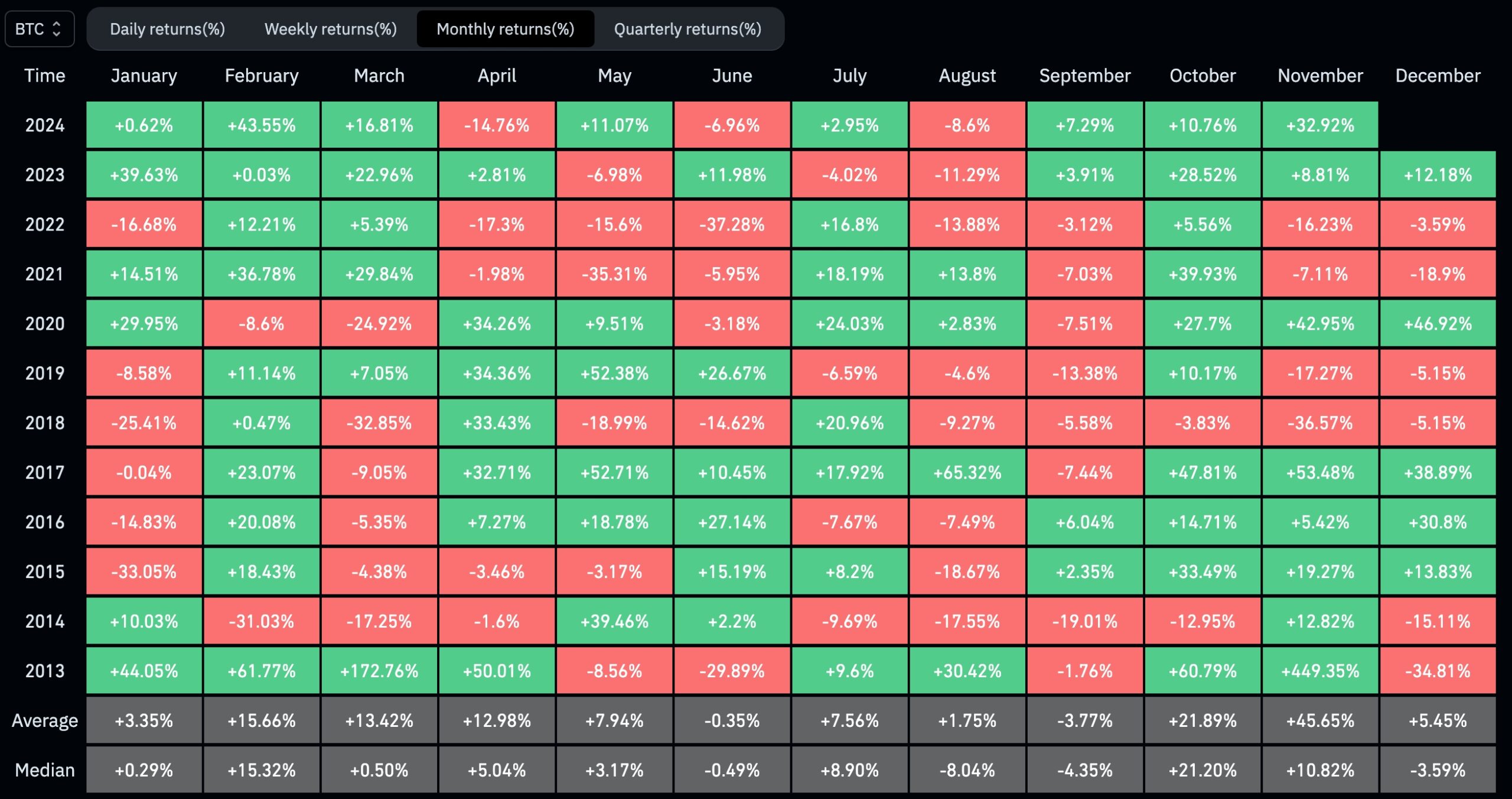

Meanwhile, it is worth noting that Bitcoin’s surge has coincided with its historical returns. In most periods, November is usually its best month. As shown above, its returns averaged about 45% in November.

They then drop to 5.45% in December, when the median return is usually minus 3.60%. Therefore, following a strong performance in November, the coin is likely to resume the downtrend in December as investors start to take profits.

At the same time, there are odds that the Trump trade will start to fade in the coming months. This is notable since the main reason for the current surge has been Trump’s election and the possibility of a more lenient Securities and Exchange Commission (SEC).

Trump is said to be considering Tereas Goody Guillen to lead the SEC. While she would be a better regulator than Gary Gensler, it is unclear how friendly she will be for the industry.