Popcat has done well this year, becoming one of the best-performing cryptocurrencies in the industry. On Monday, it soared to a record high of $1.4785, up by more than 33,295% from its lowest point this year. This surge has brought its market cap to more than $1.3 billion, making it the seventh-biggest meme coin in the industry.

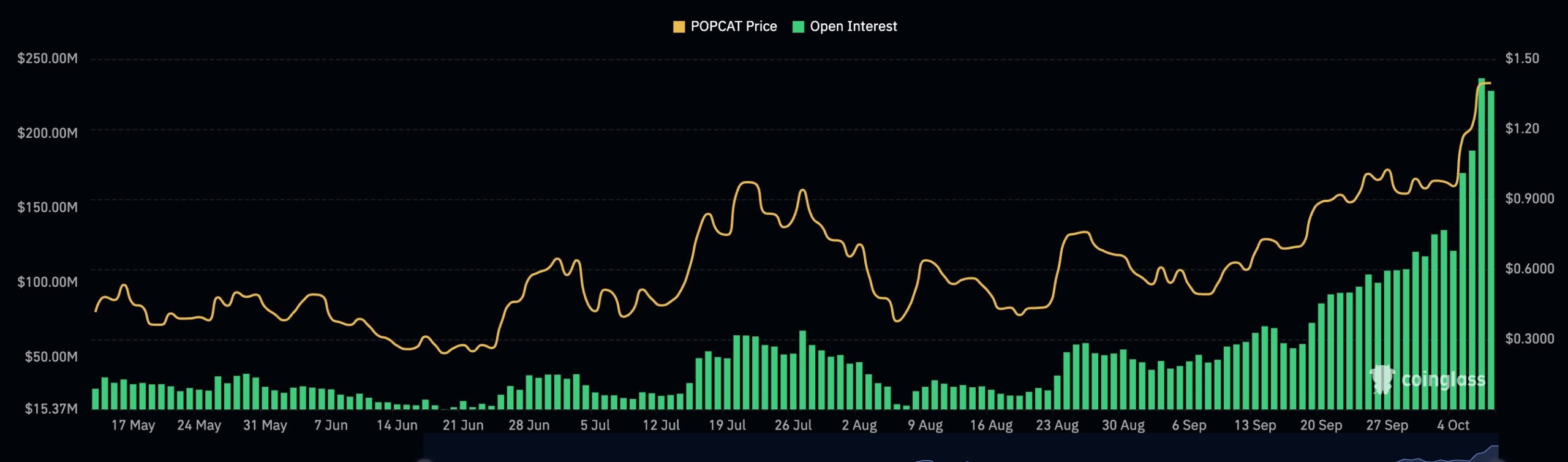

Popcat futures open interest is rising

The ongoing Popcat surge has led to a big increase in its futures open interest. According to CoinGlass, its interest jumped to an all-time high of $237 million, a significant increase from last month’s low of $46 million.

Futures open interest is an important metric that measures the number of unfilled put and call orders in the futures market. A put is a derivative that gives users a right but not the obligation to sell an asset. A call option is the opposite of that.

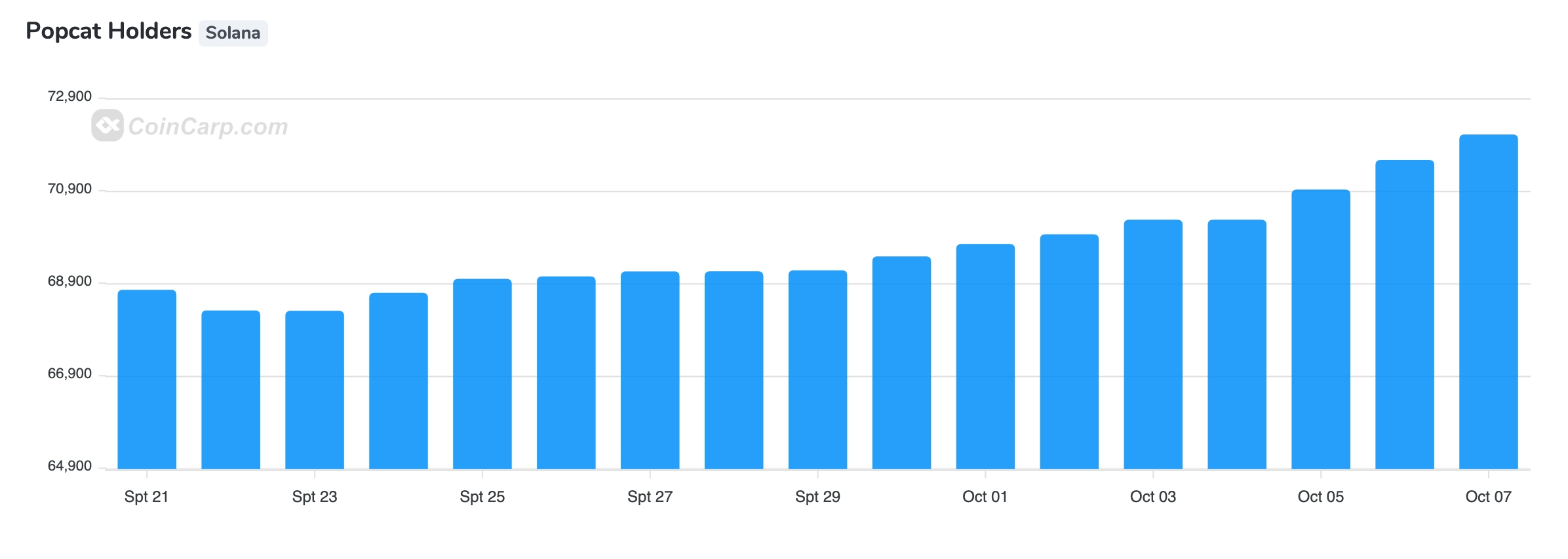

Another metric shows that the number of Popact holders has soared as the Fear of Missing Out (FOMO) trend continued. Data by Coincarp shows that Popcat has over 72,000 holders, a big increase from last month’s low of 68,000.

Popcat’s surge illustrates the popularity of Solana in the meme coin industry. Other top Solana meme coins like Dogwifhat (WIF), Bonk (BONK), and Cat in a Dogs World (MEW) have surged this year. According to CoinGecko, all Solana meme coins have a market cap of over $10 billion, while the 24-hour volume was $3.1 billion.

There was no clear catalyst for the Popcat price surge on Monday. A likely reason was because of the ongoing crypto comeback after Bitcoin rose to over $64,000 for the first time in a few days. In most cases, meme coins do well when Bitcoin is pumping.

Read more: Bitcoin Price Could Have A ‘Massive Breakout’ – Crypto Analyst

Popcat price forecast

The daily chart shows that the Popcat token has been in a strong bull run in the past few months. Most recently, it rose above the key resistance point at $1, a psychological point and its highest point in July.

Popcat has rallied above the 50-day and 25-day moving averages. It has moved above 45% above the 25-day moving average.

Also, the Relative Strength Index (RSI), Stochastic Oscillator, and the Commodity Channel Index (CCI) have all moved to the overbought level.

Therefore, while the coin may have more gains, there is a rising risk that it will retreat and retest the support at $1. This is known as a break and retest pattern, a popular continuation sign.