Bitcoin price continued its slow recovery on Monday as investors bought the dip and as the crypto fear and greed index exited the fear zone. It crossed the important resistance point at $64,000 and was nearing this month’s high of over $65,000.

Odds of a breakout are rising

Bitcoin’s rally happened as crypto analysts predicted that the coin has more upside. In an X post, Crypto Rover, an analyst with over 844k followers, predicted that the coin was about to make a “massive breakout” after going sideways for eight months.

In another X post, Michael van de Poppe, a popular crypto analyst with over 744k followers, predicted that the coin was about to hit its all-time high.

A few potential catalysts could push Bitcoin to a record high. First, there are signs that companies are accumulating Bitcoin. MetaPlanet, a Japanese company, has now accumulated hundreds of coins worth over $33 million. Some of these acquisitions happened on Monday when it bought coins worth over $6.7 million.

Other companies, especially hedge funds, have accumulated Bitcoins in the form of ETFs. Some of the biggest hedge funds like Susquehanna, Millennium, and Citadel Securities, have all bought Bitcoin ETFs this year.

Blackrock, the biggest asset manager with over $10.7 trillion in assets, has also added Bitcoin in its balance sheet. In a note last month, three of its analysts made the case for BTC, which they named as a ‘unique diversifier’ since it outperforms the market in times of geopolitical risks.

The other potential catalyst for Bitcoin is a report by a bipartisan committee that predicted that Trump’s plans would add over $7.5 trillion in deficits. In comparison, Kamala Harris’s policies would add $3.5 trillion in deficits.

In the Blakckrock’s report, the analysts noted that many investors were moving to Bitcoin because of the ballooning public debt and the fear of a black swan event.

Meanwhile, Polymarket data shows that crypto investors are bullish on Bitcoin. For example, a poll with over $459k in assets predicts that Bitcoin will hit a new all-time high this year. In another poll with $348k in assets, there is a 62% chance that the coin will rise to $67,500 this month.

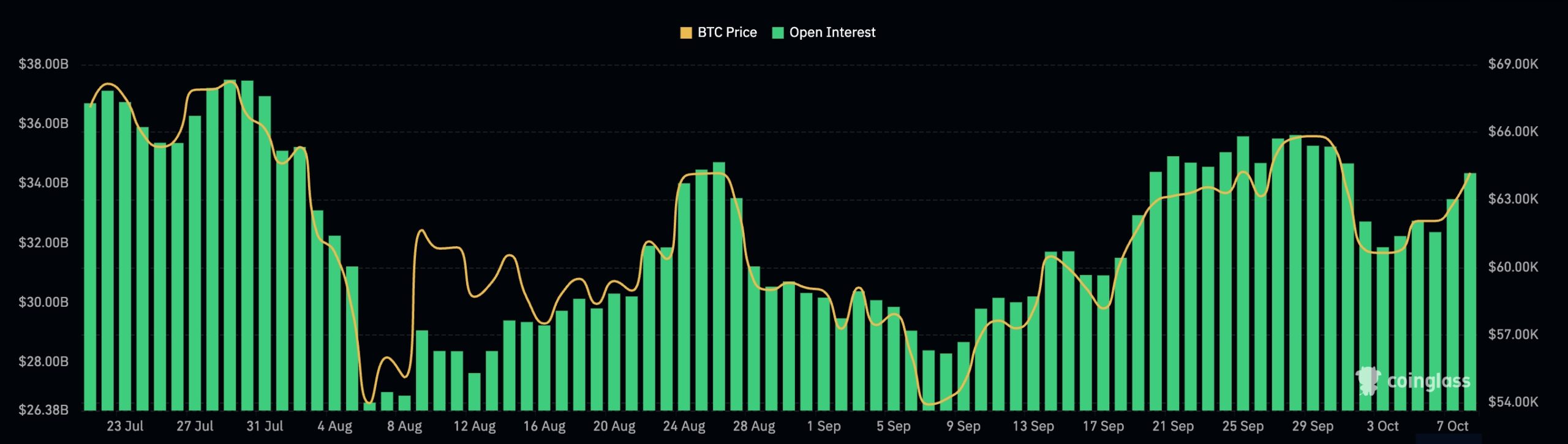

According to CoinGlass, Bitcoin’s open interest in the futures market has continued rising, hitting $34.6 billion, its highest level since October 1.

Bitcoin has strong technicals

Bitcoin has also formed three positive technicals that could push it higher soon. It has formed an inverse head-and-shoulders pattern, a popular bullish sign. Also, Bitcoin has moved above the 200-day and 50-day moving averages a few days after it avoided forming a death cross pattern.

It has been forming a falling broadening wedge pattern since March. In most cases, this pattern results in a strong bullish breakout. In this case, it needs to rise above last month’s high of $66,600, followed by the July high of $70,000, and the year-to-date high of $73,800.