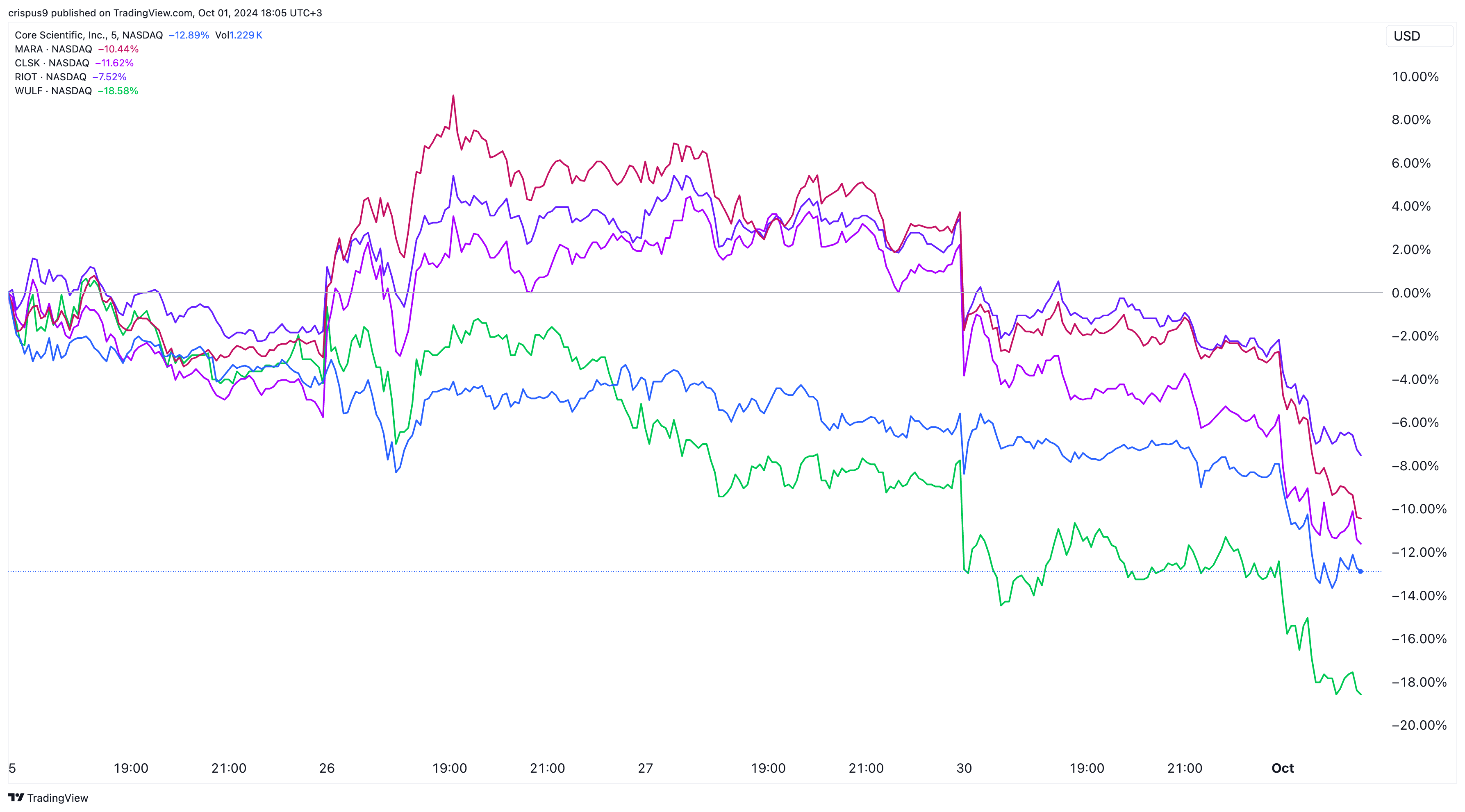

Bitcoin mining stocks dropped sharply on Tuesday as cryptocurrencies suffered a harsh reversal. Marathon Digital (MARA), the biggest mining company by market cap, led the losses, falling by over 6%. It has dropped by over 55% from its highest point this year.

Core Scientific (CORZ), one of the best-performing miners in 2024, dropped to $11.25, its lowest level since September 17.

The other notable mining companies like CleanSpark (CLSK), Riot Blockchain (RIOT), and TeraWulf fell by over 3%. All the 24 mining companies tracked by Companies By Market Cap have a market cap of over $23 billion.

Risk-off sentiment resumes

Bitcoin mining companies dropped for two main reasons. First, there are signs that crypto and stock traders have embraced a risk-off sentiment after the relatively hawkish statement by the Federal Reserve chair, Jerome Powell.

On Monday, he warned that the Fed would cut interest rates gradually going forward, a statement that was viewed negatively by market participants.

Second, the risk-off sentiment happened as geopolitical risks rose after Israel attacked Lebanon, meaning that the war could escalate. As a result, bond yields jumped while American indices like the Nasdaq 100 index fell by over 1%.

Some of the most popular stocks led the sell-off. Nvidia stock dropped by over 3.65%, while Microsoft, Amazon, and Alphabet fell by over 2%.

Bitcoin price retreats

Bitcoin mining stocks also plunged after Bitcoin prices retreated to $62,000, down by 6.7% from its highest level in September.

These companies often have a close correlation with Bitcoin for two reasons. First, higher Bitcoin prices lead to more margins when they sell their coins. Second, these companies have substantial Bitcoins in their balance sheets, which are affected by its prices.

Data by BitcoinTreasuries show that Marathon is the second-biggest Bitcoin holding company after MicroStrategy with 26,200 coins. It is followed by Riot Platforms, which has 10,019 and CleanSpark and Hut 8, which have 7,558 and 9,105, respectively.

Still, there are three possible reasons why Bitcoin will bounce back in the coming weeks. It remains above the 50-day and 200-day moving averages. It has also formed an inverse head and shoulders pattern, pointing to a potential comeback.

Also, Bitcoin often rises in October. Data by CoinGlass shows that the average Bitcoin return in October is usually 20%, making it the second-best month of the year after November.

On top of this, mining companies have retreated because of April’s halving event, which reduced the block reward size. Since then, most of them have reported weak monthly mining data.

For example, CleanSpark produced 478 coins in August, down from over 800 before the halving event. Marathon also mined 673 coins, down from 692 in July and over 900 in March.

The bottom line

Bitcoin mining stocks plunged because of the overall sell-off in the stock market, the ongoing risk-off sentiment, and the sharp Bitcoin plunge from $65,000 to $62,000. These stocks will only bounce back if Bitcoin recovers.