Ethereum, the second-biggest cryptocurrency, retreated for four consecutive days as the crypto fear and greed index retreated. After rising to a multi-week high of $2,725 last week, the coin has fallen by over 7.38% to $2,500.

Crash triggers liquidations

Data by CoinGlass shows that the ongoing Ethereum price crash triggered a substantial increase in liquidations.

Over $44.4 million of bullish trades were liquidated, the biggest increase since August 27. Most of these liquidations happened in Binance followed by OKX, HTX, and Bybit.

More data shows that all crypto liquidations in the last 24 hours jumped to over $350 million, the highest figure in more than a week.

A liquidation happens when an exchange closes a leveraged trade because of insufficient liquidity. Traders are mostly requested to add more money into their accounts to prevent that liquidation from happening.

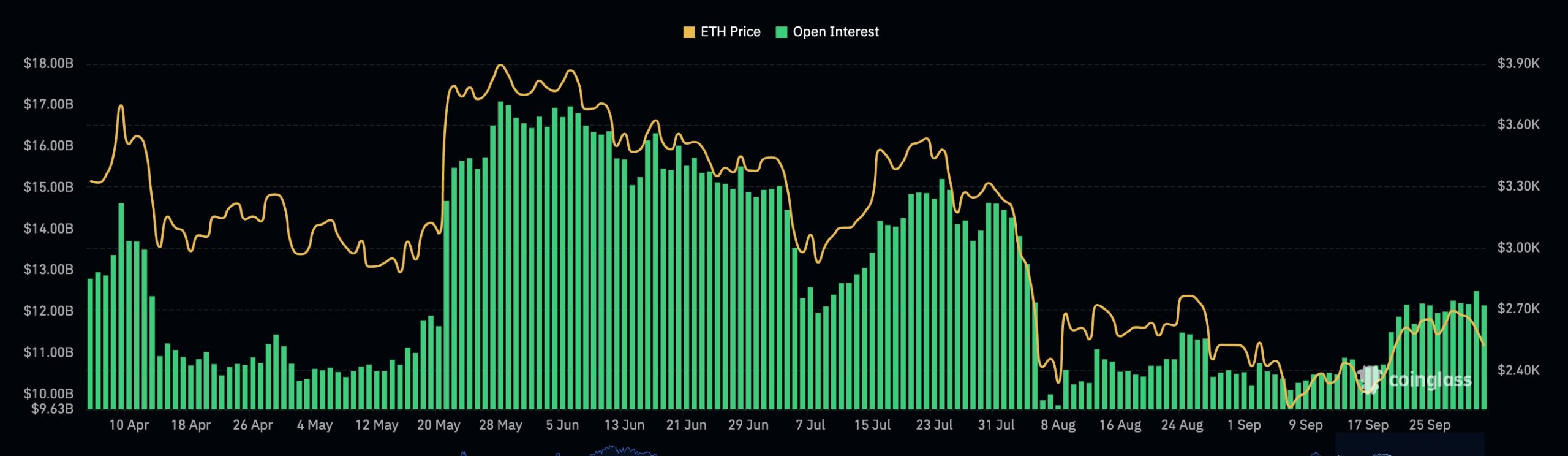

Another data shows that last week’s increase in Ethereum’s open interest in the futures market has faded. The token had an open interest of over $12 billion on Tuesday, down from this week’s high of $12.50 billion.

Stalling futures open interest is usually a sign of waning demand among investors in the futures market.

Ethereum has worsening fundamentals

The ongoing Ethereum price action is happening at a time when the coin is having weak fundamentals.

Data by Sosovalue shows that Ethereum ETFs are seeing waning demand as more institutional investors focus on Bitcoin. All Ether ETFs had outflows of $822k on Monday after adding $58 million on Friday. The cumulative outflow has reached $558 million.

At the same time, there are signs that Ethereum whales, including the Ethereum Foundation and Vitalik Buterin have started to sell their holdings. One whale sold 22,480 coins worth $59 million on Tuesday while Ethereum Foundation sold 100 coins on Sep.30

Ethereum is also seeing substantial competition in the DEX industry. Data by DeFi Llama shows that the volume handled by Ethereum DEX networks fell by 4% in the last seven days to $8.23 billion, while Solana handled $8.17 billion in the same period.

Ethereum price formed a death cross

Ethereum’s technicals have also been a bit weak. It formed a death cross pattern in August as the 50-day and 200-day Exponential Moving Averages (EMA) crossed each other. This is one of the most bearish patterns in the market.

Ether has also moved to the 61.3% Fibonacci Retracement point and has formed a triple-top chart pattern. Therefore, the coin’s outlook is bearish, with the next point to watch being at $2,152, its lowest swing on September 6.

The bottom line

Ethereum has faced some weak fundamentals and technicals, which explains why it has dropped by 38% from its highest level this year. It is having substantial competition, whale distribution, and weak inflows in the futures market, pointing to more sell-off.