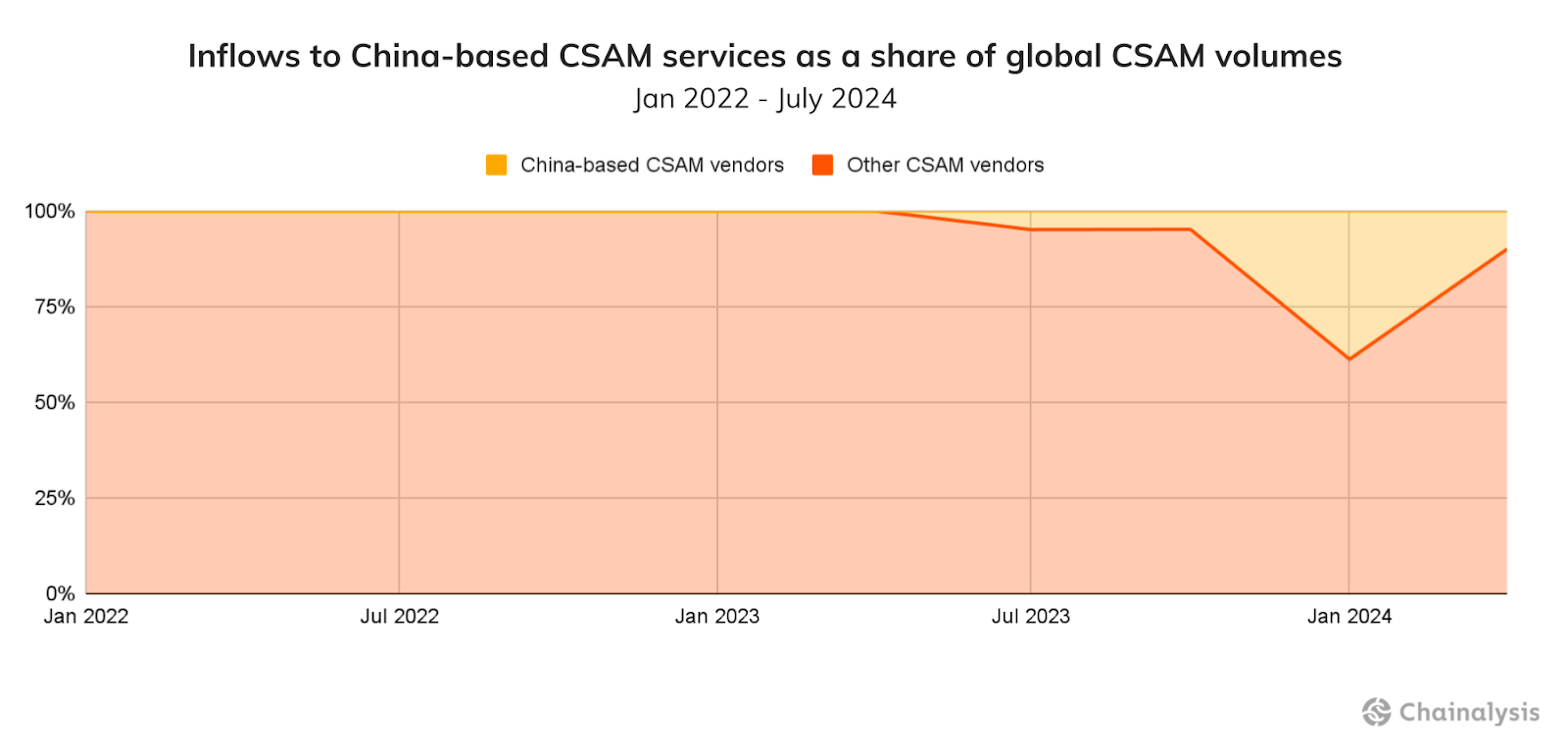

Crypto payments for illicit activities have been a major concern for regulatory authorities globally. A mid-year crypto crime report published by Chainalysis, a US-based blockchain analysis firm on Aug. 29, reveals shocking data about the increase in active Child Sexual Activity Material (CSAM) vendors based out of China. Chainalysis data shows that a significant 38% of the global CSAM vendors, that were paid in crypto during Q1 2024, were operating from China.

In addition to highlighting how the on-chain activity related to payments made to these CSAM vendors have increased in 2024, the report also reveals the nature of wallet holders’ activities, claiming they are using crypto to purchase permanent membership across these illicit sites.

“A majority of wallet holders are purchasing a month’s access or more. As for CSAM vendors, they’re taking advantage of instant exchangers when cashing out,” the report claims.

Tracking the Global CSAM inflows in contrast with the China-based vendors, the Chainalysis report also asserts that the increasing number of wallets engaging with such sites represents a “true trend.”

Source: Chainalysis

CSAM Vendors Have Become More Resilient

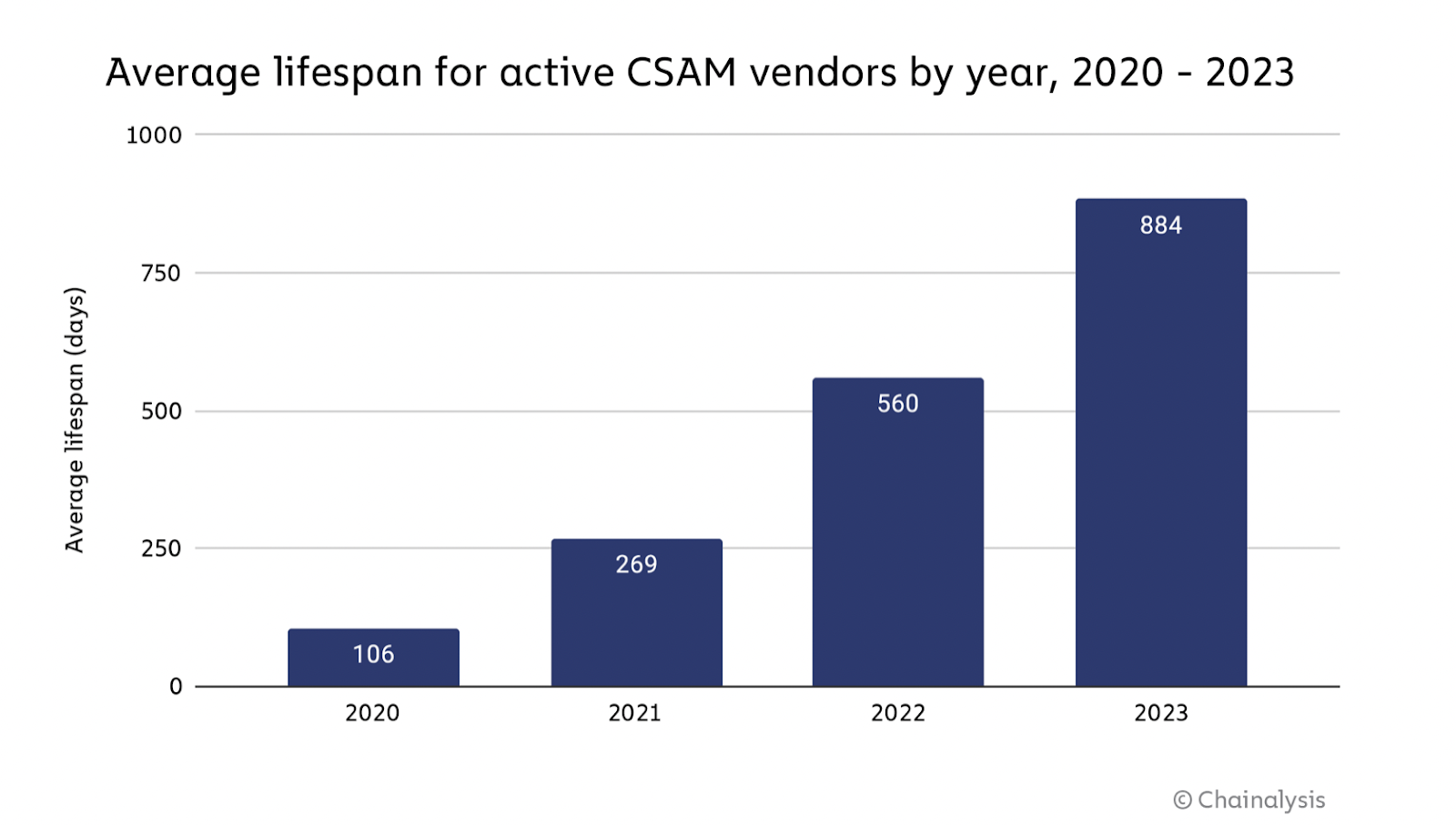

While the mid-year update of the Chainalysis crypto crime report focuses on a concerning trend about China-based CSAM vendors, the annual report for 2024 published earlier in January, shows how over the past three years CSAM vendors have become increasingly resilient.

Source: Chainalysis

Raising concerns, Chainalysis reported: “In 2023, the lifespan of the average active CSAM vendor is 884 days, up from 560 days in 2022. However, relatively few new CSAM vendors have cropped up in 2023 — just 43, compared to 112 in 2022. Still, how is it that so many CSAM vendors are able to persist for so long, and why is resilience going up?”

CSAM vendors are increasingly using Monero, a privacy coin. Interestingly, many of them are explicitly asking their customers to pay in Monero, which they can then exchange on “Monero-friendly” instant exchanges.

Instant private exchanges that don’t require a KYC are a part of this ecosystem too. They allow for instant and anonymous exchange of privacy coins. Not surprisingly, the Chainalysis data confirms the rise in “CSAM vendors’ usage of instant exchangers that allow for Monero conversion.”

Last year, Dubai had banned the use of such privacy coins including Monero citing concerns about traceability.

US Senators Have Demanded a Scrutiny

While regulatory bodies have been on their heels trying to curb the use of crypto wallets for such illicit activities, US senators voiced their concerns about the use of crypto for CSAM. In April 2024, Elizabeth Warren and Bill Cassidy had written to the Department of Justice (DOJ), to make serious efforts to investigate and curb the role of crypto in dissemination of CSAM.

So far, the senators have not claimed to have received a clear response from the concerned authorities about the measures which they have taken to address the increasing use of crypto for CSAM purchases.