The private markets raise trillions of dollars a year – much larger than the public markets, yet almost all offline and with virtually no liquidity. The industry agrees that this market must go digital and yet the institutional digital securities landscape has been highly fragmented. With multiple private and public blockchain ledgers working in silos, there has been limited access to investor financing and a lack of scale to establish effective markets at a global level.

FinP2P changes this. By interconnecting siloed venues through one unified routing network, every financial institution can make instant and immutable transactions of digital securities across the network, regardless of which blockchain ledger, custody solution or settlement currencies they use.

FinP2P is being unveiled today at the Security Token Summit with a demonstration of the seamless interconnection of 10 leading industry solutions. As part of this launch, the FinP2P API specifications will be released as a first-of-its-kind cross-industry open-source collaboration. These APIs provide a single point of connection to multiple blockchains, enterprise DLT technologies, custody solutions and settlement currencies whilst supporting instant settlement and full regulatory compliance – taking a major step in digitizing the global economy. Using these APIs, any regulated institution to join the network and provide new financing and investment opportunities to their clients.

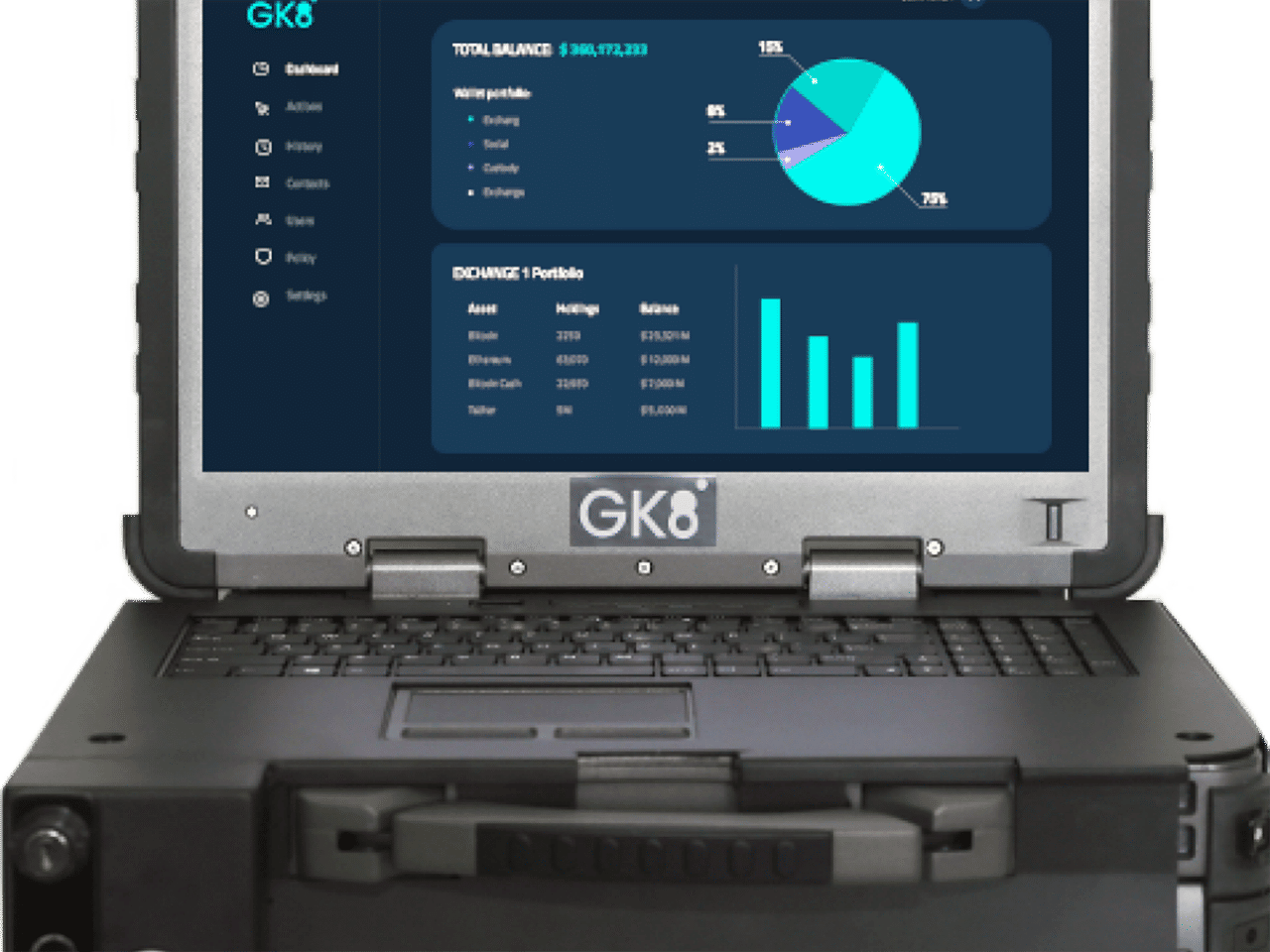

GK8, a leading custody solution provider, provides its patent-pending MPC wallet, as well as key management processes, and has integrated its service to the FinP2P protocol.

“As a banker managing security token, you don’t really care which distributed ledger was used to create it,” GK8 CRO Mark Mayerfield said. “FinP2P connects buyers and sellers in a very straightforward process, much like a traditional security. Since it’s a truly interconnected network, asset owners don’t have to worry about handling point-to-point connections across various private blockchain networks”.

FinP2P creates new channels for companies to raise capital and attract some liquidity in a way that is impossible within the current digital securities ecosystem. Institutional participation gives investors access to high-quality assets with online access to company information and choice of preferred custody provider and settlement solution. Transactions are immediate and immutable with real-time settlement against either FIAT currencies or alternative payment solutions such as stable-coins and CBDCs when these arrive.

“Interconnecting dozens of different blockchain platforms was never done at this scale, and with such diverse interoperability”, added Ami Ben-David, founder and CEO of Ownera, the company providing the FinP2P interconnectivity node to companies on the network. “The expected results of the adoption of the FinP2P network are higher liquidity and better access to capital and assets, opening up any privately-held asset to hundreds of thousands of potential investors.

“Deals on the FinP2P network are expected to be completed in just a fraction of the time they take today, utilizing simplified, automatic processes such as online due-diligence, unified and automated legal work, and shorter regulatory and compliance processes”.

Both Mr. Ben-David and Mr. Mayerfeld will be presenting FinP2P today at the Security Token Summit.