The Turbo crypto token surged this week as the cryptocurrency market gained momentum. It soared to a high of $ 0.00556, its highest level since February, up by almost 300% from its lowest point this year.

Turbo’s surge happened as Bitcoin and other altcoins rebounded. Bitcoin retested the crucial resistance level at $94,000 for the first time in over a month. Other meme coins like Fartcoin, Pepe, Official Trump, and Dogecoin also soared. As a result, the market cap of all meme coins tracked by CoinGecko jumped by 16.5% to $58 billion.

Turbo price jumped as the futures open interest rose to $63 million, its highest level since December 17. It has risen from this month’s low of $13 million, indicating increased demand in the futures market.

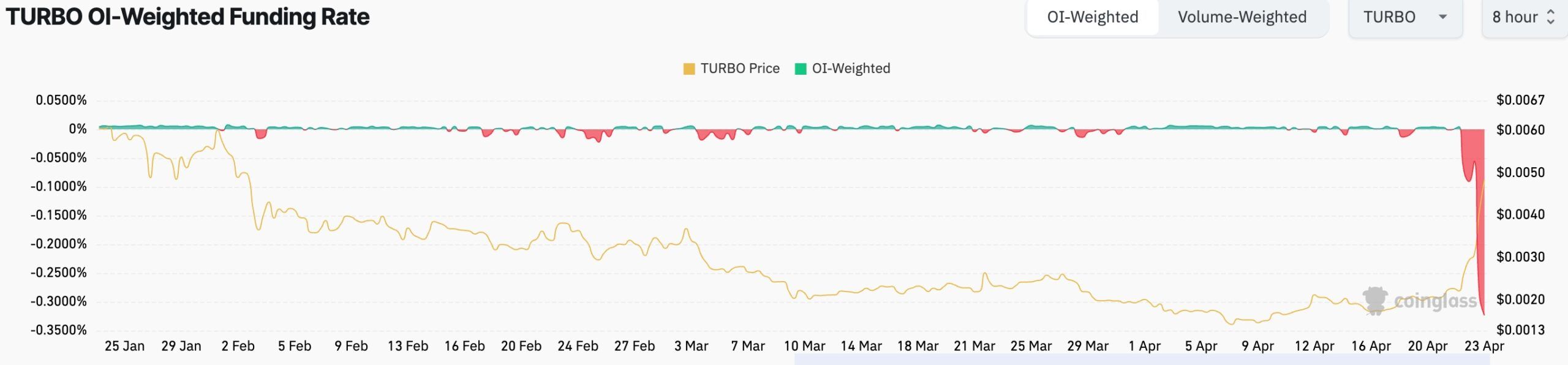

The risk, however, is that the coin’s funding rate fell to minus 0.3235%, its lowest level on record. A negative rate indicates a higher demand for shorting the asset, reflecting traders’ expectations of a price decline. The falling negative funding rate is a sign that the surge may end soon.

READ MORE: Shiba Inu Price: Coiled Spring Ready to Pounce as Whales Buy

Turbo Crypto Price Technical Analysis

The daily chart indicates that the Turbo token reached its bottom at $0.0001366 this month. It then bounced back and has reached a high of $0.005560 on Wednesday.

It has surpassed the key resistance level at $0.003045, which was its lowest swing in June and August of last year.

The coin has moved above the 50-day moving average, indicating that bulls are currently in control. Oscillators such as the Relative Strength Index (RSI) and the Moving Average Convergence/Divergence (MACD) have been trending upwards.

Therefore, the coin will likely drop to retest the support at $0.0030, aligning with the robust pivot and reversal indicated by the Murrey Math Lines tool. More gains will be confirmed if the price rises above the key resistance point at $0.005560. Such a move would push it to the resistance at $0.007735.

READ MORE: Dogecoin Price May Surge as Chart Patterns and Open Interest Align