- Ethereum’s put/call ratio has dropped to the lowest level since March.

- However, technicals suggests that a bearish breakout is likely.

Ethereum price is still under intense pressure as the cryptocurrency winter continues. Ether is trading at $1,978, which is higher than the lowest point this month. Its price action is significantly similar to that of Bitcoin, which is currently stuck at about $30,000.

Ethereum put/call ratio

One of the most effective tools to gauge sentiment among investors in the market is to look at activities in the options market. This activity will give you a clear picture about the state of the market since many traders use the options industry to hedge against risk.

For starters, there are two primary types of options in the market. A put is an options contract that gives a person the right but not the obligation to sell an asset at the expiry time. Call, on the other hand, is an option that gives them an obligation to buy an asset at the expiry time.

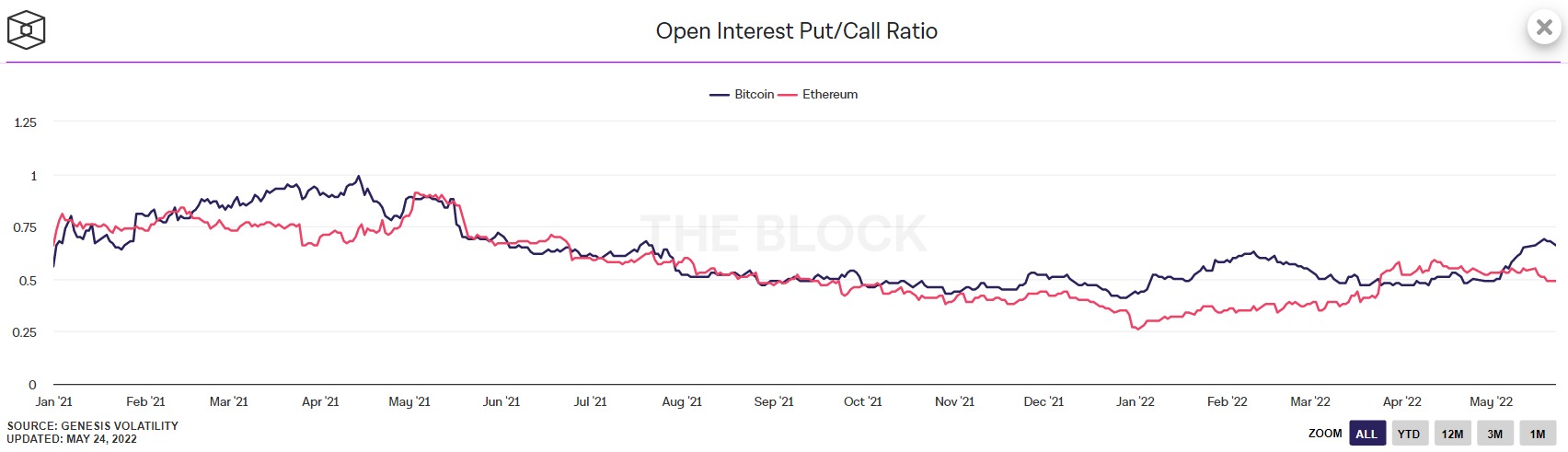

As such, investors tend to compare the ratio of put and call and then determine whether to buy or sell a financial asset. In most cases, a ratio that is bigger than 0.7 is usually seen as being bearish since investors are buying more puts than calls.

Learn more about how to buy ETH with a credit card.

Now, turning to Ethereum, data compiled by IntoTheBlock shows that it has a put-to-call ratio of 0.49, signaling that investors have more calls than puts. On the other hand, Bitcoin’s put/call ratio has been in an upward trend and currently stands at 0.66.

Therefore, this means that Ethereum price will likely do better than Bitcoin in the coming months if the options market is to go by.

Some of the possible catalysts for Ethereum will be a shift to its applications now that Terra has imploded and the fact that the merge is set to happen soon. However, it is worth noting that Bitcoin and Ethereum have a close correlation with each other.

Ethereum price prediction

Turning to the daily chart, we see that ETH price has been in a strong bearish trend in the past few days. The coin formed an inverted cup and handle pattern that is shown in blue. It also moved below the 25-day and 50-day moving averages. Another bearish signal is that it has formed a bearish pennant pattern.

Therefore, Ethereum price will likely have a bearish breakout in the coming days. If this happens, the key support level to watch will be this month’s low of $1,711.