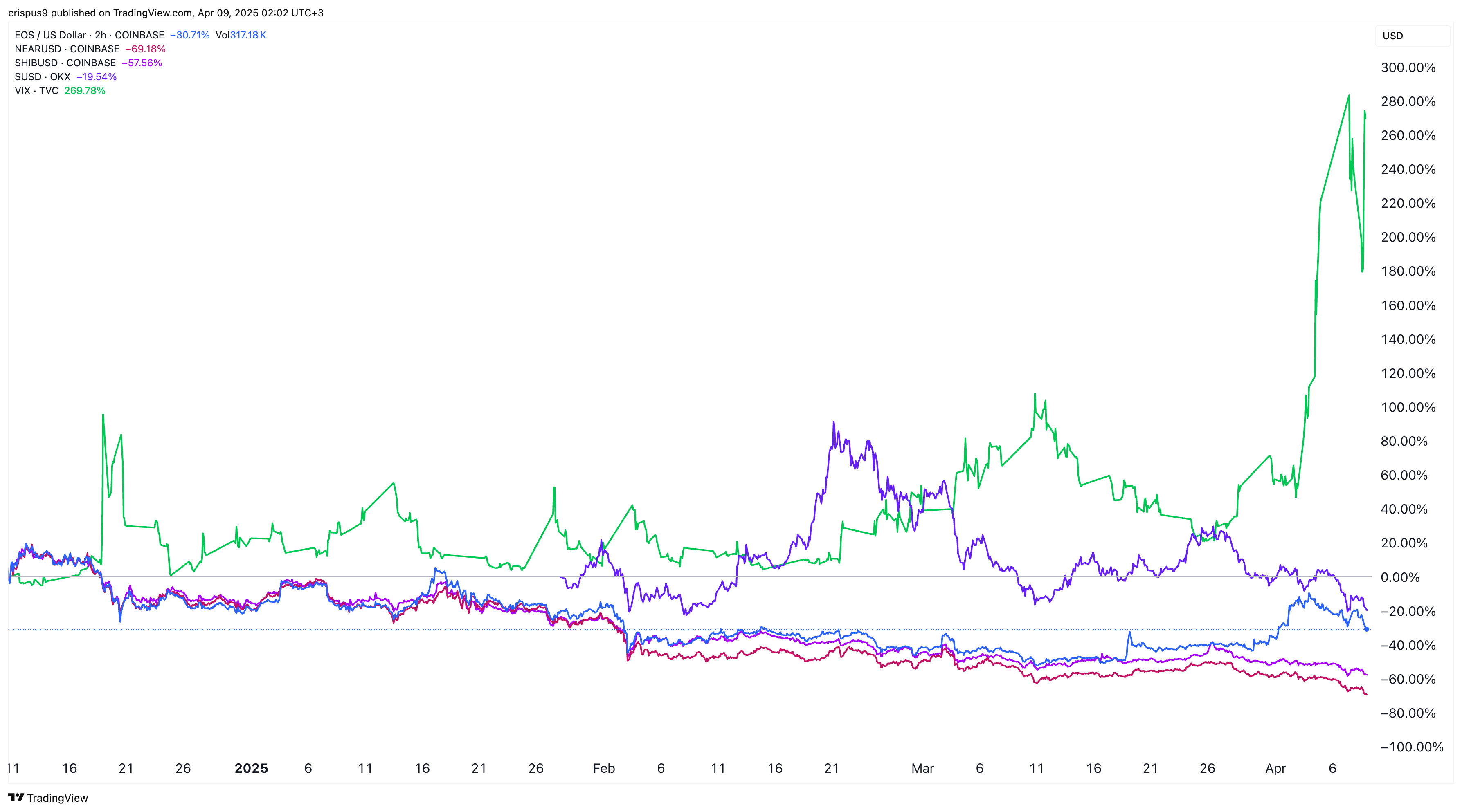

The crypto market suffered a significant meltdown on Wednesday morning, erasing some of the gains made on Tuesday when calm returned. The EOS price plunged by 12%, while Near Protocol, Sonic, and Shiba Inu plunged by over 10%.

Altcoins like EOS, NEAR, Sonic, and SHIB Have Plunged

Bitcoin, the biggest coin in the crypto market, also dropped sharply and pulled back to $76,000 from this week’s high of $79,000. Other tokens like Ethereum, XRP, Pepe, and Uniswap also dived, bringing the total market cap of all cryptocurrencies to over $2.42 trillion. This means that these tokens have shed over $1.6 trillion in value in the past few months.

The crypto crash coincided with the meltdown in Wall Street, where the Dow Jones, S&P 500, and Nasdaq 100 indices erased earlier gains and dropped by 0.85%, 1.57%, and 2.15%, respectively. Most notably, the VIX index, which measures fear in the financial industry, jumped by 11% to $52.

This price action was triggered by Donald Trump, who said that the US would impose a 104% tariff on Chinese goods starting on Wednesday. He did this after China retaliated against the 34% tariff he announced on Liberation Day last week.

READ MORE: Polkadot Price Nears Surge: Staking Inflows and Yields Soar

In a statement last week, he warned that he would hike his tariffs on China to 50% if Beijing went on with its retaliation. Judging by the recent statements, Trump expected Beijing to call and seek trade talks like other countries. In a note, one analyst told Bloomberg:

“The path forward has only become more murky. We are all beholden to one person’s decision-making.”

Another analyst said:

“It’s a game of chicken right now between the market and government.”

China and US Trade War Caused The Crypto Crash

The news on China tariffs was an anticlimax, as the Trump administration had signaled that it was willing to negotiate with other countries. Trump has said that South Korean, Japanese, and Vietnamese officials were going to the US to negotiate. Seventy other countries had called to negotiate, which is a good sign.

Cryptocurrencies like EOS, Near Protocol, and Shiba Inu crashed, as they are considered high-risk assets. Historically, these assets tend to tumble at the onset of a recession, a scenario analysts believe might occur. In a note, analysts at JPMorgan warned there was a 79% chance that the US would have a recession.

On the positive side, the initial panic is usually followed by a boom as the Federal Reserve and the government intervene. The Fed intervened during the COVID-19 pandemic by slashing interest rates and implementing quantitative easing. The government boosted liquidity through its stimulus packages.

READ MORE: Buckle Up! Shiba Inu Price May Explode Higher This Week