Dogecoin ($DOGE), the largest meme coin, is at a technical crossroads. With the Dogecoin price hovering around $0.15, the market is buzzing after bullish and bearish signals have emerged over the past 24 hours.

The token recently showed signs of breaking out of a critical ascending channel — and traders remain divided on its future trajectory.

Dogecoin Price Breaks Ascending Channel, Eyes $0.06 Support

According to popular analyst Ali (@ali_charts), the Dogecoin price has officially broken down from an ascending parallel channel in which it had been trading for several months.

This breakdown, as shown in his chart, may signal a momentum shift and suggest a deeper correction toward $0.060, a key historical Fibonacci support zone.

From a technical perspective, losing that ascending structure can often lead to a temporary loss of investor confidence. However, the market hasn’t panicked — at least not yet.

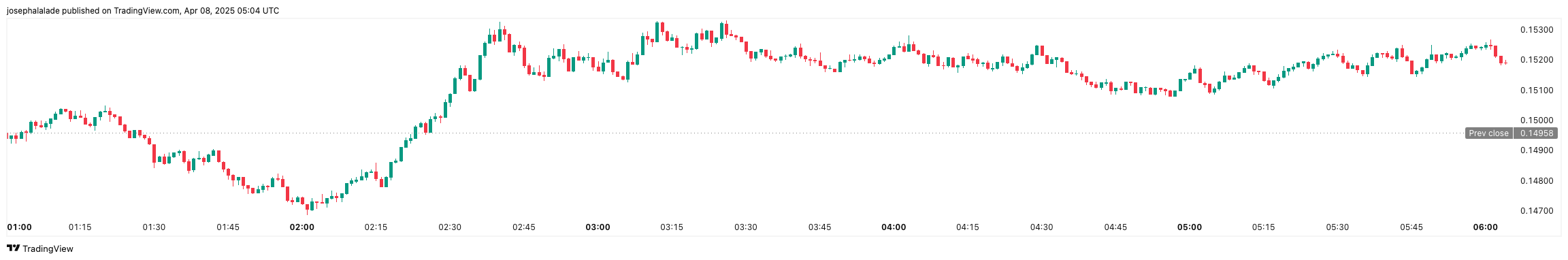

As of press time, DOGE is currently trading at $0.1517, up by 7% for the day. Its 24-hour volume spike was over 105%, reaching $3.3 billion.

Bullish Reversal Spotted After Hitting Oversold Levels

While Ali’s chart warns of a downside break, others are spotting an opportunity.

Crypto trader BitGuru noted that Dogecoin recently swept a key support level near $0.143. This move was followed by bullish signals suggesting a reversal from oversold conditions. BitGuru has targeted Dogecoin prices: short-term increases to $0.16 and $0.18, and a possibility of reaching around $0.205 in the longer term.

Supporting this idea is TraderSteve (@TraderSteve_), who highlighted Dogecoin’s MVRV (Market Value to Realized Value) metric — a popular on-chain valuation tool.

According to Steve, the MVRV is “screaming” undervaluation, which has marked the beginning of large rallies in past cycles. His chart suggests a potentially explosive move upward, potentially even aiming toward the $0.90 mark in the long term.

DOGE Technical Analysis

Despite these bullish views, TradingView’s technical indicators paint a more cautious picture. The 1-day technical summary for DOGE indicates an overall “Sell” bias.

Moving averages lean even more bearish, with 13 out of 15 indicators in the red zone — marking it a “strong sell.” Notably, key momentum indicators, like MACD and Awesome Oscillator, are in negative territory, while the RSI is around 37, showing that DOGE is close to being oversold but not quite there yet.

The Commodity Channel Index (CCI) is one of the few indicators suggesting a “Buy,” supporting a near-term relief bounce.

In the last few hours, DOGE has risen from its low of $0.143, and trading volume is increasing, indicating that buyers are returning. However, the price remains below several important exponential moving averages, making any short-term breakout uncertain unless DOGE can regain and maintain $0.16.

If it can push above this level, the bulls may take control. Should the price dip below $0.143 again, the bears might pull the Dogecoin price back to the $0.06 range.

READ MORE: PNUT Price Down 25% in a Week: Can the Meme Coin Reach $2B Market Cap Again?