Polkadot price has stagnated at a crucial support level, and its fundamentals suggest potential for a strong recovery soon. DOT token was trading at $3.62, a key level it has failed to move below several times since early 2023. This article explores why the Polkadot price may soon surge by almost 200% from the current level.

Polkadot Price Could Rebound as Staking Inflows Jump

There are signs that investors are boosting their staking assets on Polkadot even as its price remains in a deep bear market.

Data from StakingRewards shows that DOT has a staking market cap of over $3 billion. Its staking ratio has moved to 54%, meaning that over half of all tokens in circulation have been staked. This is a notable catalyst because stakers tend to have a longer holding horizon.

Polkadot stakers have a good reason to hold the token since it has a reward rate of almost 12%, much higher than the ten-year US bond yield of 4%. This reward implies that a DOT holder with a $10,000 investment receives about $1,100 annually.

READ MORE: Is this a Golden Opportunity to buy Cardano, Hedera, Bonk, and Stellar?

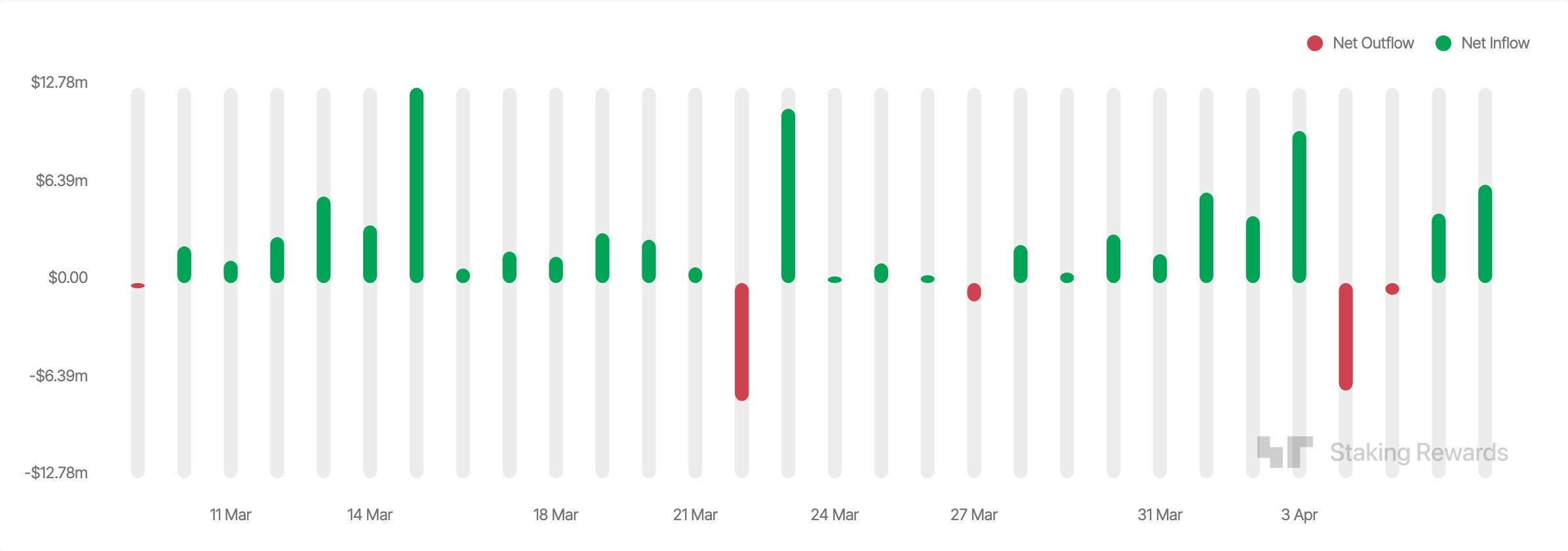

More data shows that money is increasingly flowing to the Polkadot staking network. DOT has experienced staking inflows on all but four days over the past 30 days. This is significant as other popular tokens, such as Ethereum and Solana, have experienced substantial outflows amid plunging prices.

Polkadot price has more catalysts ahead. The most notable catalyst is the developers’ progress on the final stage of Polkadot 2.0, known as elastic scaling, which will enhance its speed. It does this by enabling parachains to utilize multiple cores within a single Polkadot Chain block, enabling it to handle substantial workloads.

Polkadot Price Technical Analysis

The weekly chart shows that the DOT price has remained under pressure in the past few months. It has declined from a high of $11.40 in November to the current $3.62. This price level is notable as it has served as a strong support, having resisted declines several times since early 2023, a sign that it has formed a quadruple bottom pattern.

Additionally, the Polkadot price has formed a falling wedge pattern, which is a popular bullish reversal indicator. Therefore, it is likely to rebound as bulls target the key resistance at $12, up almost 200% from the current level.

READ MORE: Polkadot Price Prediction: 3 Reasons DOT Is About to Surge