US President Donald Trump’s most recent threat of additional tariffs has led to a global market plunge, with Bitcoin and the whole crypto space crashing by two digits since his Monday statements.

Starting Tuesday, the US will slap a 25% tariff on Mexican and Canadian imports to “level the playing field” and respond to trade imbalances. Tariffs on Chinese imports will also increase from 10% to 20% because China has failed to prevent fentanyl shipments to America.

Meanwhile, Canada and Mexico have hinted at retaliatory measures in response to the US tariffs. Canadian Foreign Minister Mélanie Joly indicated that Canada is prepared to respond. Mexican President Claudia Sheinbaum reiterated that Mexico’s earlier countermeasures would be triggered once the US tariffs are implemented.

Bitcoin Wins As Trump’s Tariffs Could Weaken the Dollar

According to crypto analyst Michaël van de Poppe, tariffs will likely trigger short-term market volatility, leading to negative reactions in traditional finance and crypto. During periods of uncertainty, investors take a step back, which would cause a temporary price decline for Bitcoin and other risk assets.

Van de Poppe predicts that China could make up for the tariffs by focusing on the domestic economy and undertaking massive quantitative easing (QE).

QE is when central banks inject money into an economy by purchasing assets, which weakens a nation’s currency but drives economic growth. If China follows this path, it could inject liquidity into domestic markets and thereby indirectly affect world liquidity flows, creating a ripple effect in assets like Bitcoin (BTC).

One of the main points of Van de Poppe’s analysis is that if China triggers QE, the US might be forced to follow similar policies to ensure economic stability. This would depreciate the US dollar since more money is in circulation.

Historically, a declining dollar has benefited Bitcoin (BTC), as it can be used to hedge against currency devaluation and inflation. Investors who want to protect against the reduction in wealth can purchase BTC, thus increasing its price.

Declining bond yields also help the Bitcoin price to increase. When the bond yields fall, investors shift their investment to assets that will provide greater returns. Thus, they will invest in equities and cryptocurrencies.

If the United States starts QE and interest rates decline, the price of Bitcoin can experience higher demand. Investors will seek assets that can outperform inflation and provide better returns.

The Bigger Picture

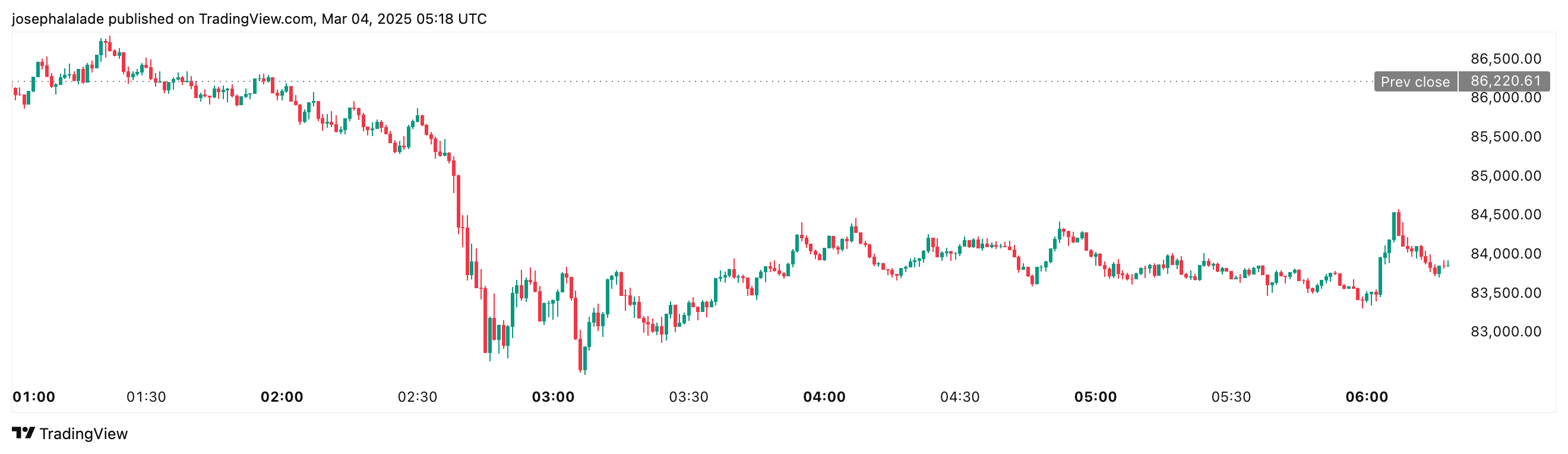

At the time of writing, Bitcoin’s price was $83,728, dropping 10.04% in the last 24 hours. Since Donald Trump made tariff announcements, the coin has fallen from over $93,600 to $82,400.

“Don’t blindfold yourself onto some intraday price movements. It’s about the bigger picture,” Michaël van de Poppe stated.

His argument is simply to avoid being bothered by the markets’ short-term actions. Even though Bitcoin prices temporarily fall amid the tariff uncertainty, the bigger macroeconomic context can make its price appreciate in the near term.

READ MORE: Here’s Why Pi Network Coin Price May Surge 85% Soon