The Solana price has faced extreme pressure in the past few weeks, as on-chain data shows that Solana (SOL) investors are in a state of fear.

The Solana coin has become one of the most affected altcoins amid the bearish market performance. The Bitcoin price crashed from $99,244 to $86,776.45 in seven days. Bitcoin is trading at $88,754, showing a 2.72% decrease over the past 24 hours and 7.25% this week.

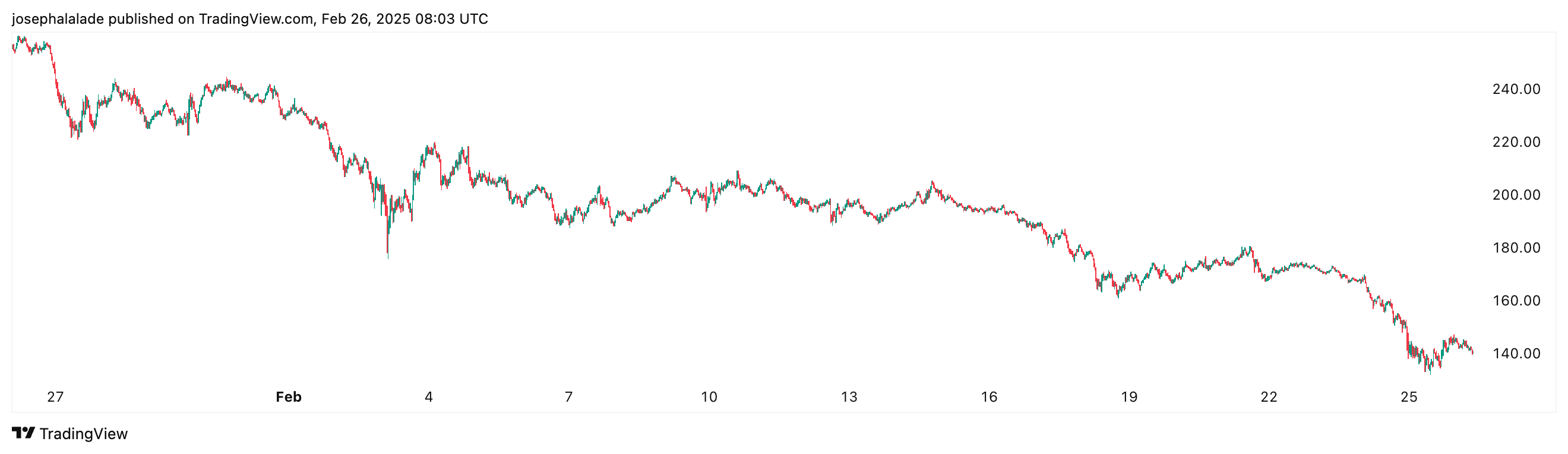

Solana fell 17.11% over seven days after losing 41.64% in the past month. This time last month, the popular altcoin was trading at roughly $240 but lost around $100 since then.

The coin now trades at $140.05, and the bearish performance does not show signs of slowing down.

Solana Investors Show Signs of Fear as Price Declines

According to crypto analyst Ali, one main reason the price of Solana keeps falling is that many investors are in a state of fear. This view comes from Glassnode’s Net Unrealized Profit/Loss (NUPL) data.

Investor sentiment shows SOL holders moving from optimism to fear, indicating growing market uncertainty. The declining black line representing Solana’s price aligns with lower investor confidence.

Historically, when market sentiment shifts into fear or capitulation, it can either indicate further downside or present a buying opportunity for long-term investors.

READ MORE: XRP Price Prediction: Ripple Risky Pattern Points to a 50% Crash

If SOL continues to decline, we may see a transition into capitulation as less confident investors sell before a potential recovery. However, if buyers step in at key support levels, the Solana price could stabilize and rebound, especially if broader market conditions improve.

Crypto Sentiment: Extreme Fear

The Santiment market intelligence platform also shared similar data with their 204,000 followers on X. They noted that investor sentiment for Solana (SOL), Bitcoin (BTC), Ethereum (ETH), and Ripple (XRP) had reached extreme levels of bearishness as Bitcoin dropped to $86K.

The chart reveals that negative sentiment is at rock bottom, indicating fear, uncertainty, and doubt (FUD) dominate the market. Historically, extreme negative crowd sentiment often signals that a market bottom may be near as traders panic-sell assets.

Intense bearish sentiment shows lost investor confidence in Solana (SOL), possibly leading to further downside or a period of consolidation before recovery. Bitcoin’s decline has also weighed heavily on the broader crypto market, influencing Ethereum, XRP, and SOL.

However, crypto sentiment often rebounds quickly, and past trends show that when extreme fear sets in, a rebound could follow as smart money re-enters the market.

What’s Next for the Solana Price?

Further analysis shows Solana nearing key support zones.

Crypto trader Coinvo shared a chart showing SOL’s price dropping sharply toward a “massive” historical support level between $120 and $140, where the price previously consolidated before making upward moves.

If buyers step in at this level, Solana could stabilize and reverse upward, but further downside is possible if support fails.

READ MORE: Top 3 Altcoins That Could Make You a Crypto Millionaire by 2030