Hedera Hashgraph’s price has done well in the past few months, with technicals and fundamentals suggesting HBAR may soar from $0.32 to $2.50.

The current chart shows a bullish flag pattern, which means it is likely to get approval for a spot ETF. Also, there is a strong developer activity.

HBAR Price Technicals Suggest a Surge Is Coming

The first main reason the HBAR price may soon jump to $2.5 is that the coin has formed a highly bullish pattern. The daily chart shows that the coin has formed a bullish flag chart pattern.

The price target in a bullish flag pattern is determined by measuring the size of the flag and then extrapolating that distance from the upper side. Here, Hedera’s price soared by over 800% between November 5 and December 3.

Therefore, measuring that distance from the upper side of the flag means that the coin will jump to $2.5 in the longer term.

Hedera Hashgraph Developer Activity Is Rising

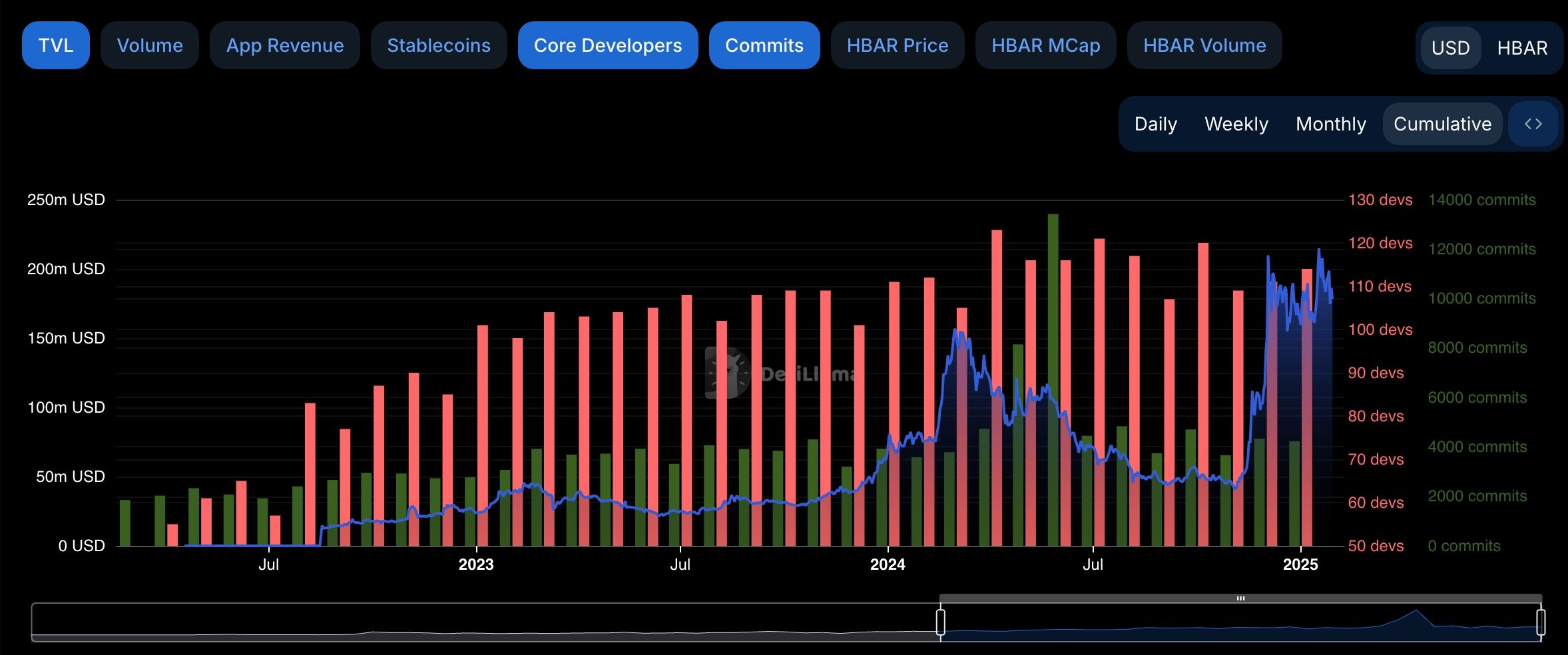

The other potential catalyst for the HBAR price is that the network is seeing more interest from developers. As shown below, it has had over 100 monthly developers in the past few months, an enormous increase from less than 50 in 2023.

These developers are also making more commits, indicating that the ecosystem will continue doing well. The total value locked (TVL) in the Hedera ecosystem has jumped to almost $180 million, higher from below $25 million in 2023.

Read more: Hedera Hashgraph Price Deja Vu? Pro See HBAR Soaring to $5

HBAR ETF Odds Are High

Further, the strong Hedera Hashgraph surge may happen as the odds that the Securities and Exchange Commission (SEC) will approve a spot HBAR ETF rise. Canary filed for a spot ETF in October last year.

Analysts believe the SEC, under Paul Atkins, will be more willing to approve crypto ETFs than Gary Gensler. If this happens, and because the SEC has not called Hedera a security, odds are that it will be approved.

For example, spot ETH ETFs have had a lukewarm reception, attracting $2.5 billion in inflows.

However, it is unclear whether the fund will generate substantial institutional demand. But, the approval of HBAR ETF should be bullish because of the hype surrounding the event.

READ MORE: Trump Media Launches Fintech Services; Plans to Invest in Cryptocurrency