Donald Trump’s Truth Social is on a death spiral as traffic to its website falls and its cash burn intensifies. The DJT stock has dropped by over 55% from its highest level in 2024, bringing its market cap to over $7.72 billion.

DJT Stock Is Overvalued as Its Website Traffic Falls

Trump Media & Technology is one of the most overvalued companies in the United States. Besides, this $7.7 billion company generates almost no revenue and incinerates millions of dollars a quarter.

The most recent financial results showed that the company had just $1 million in revenue in the third quarter. Its net loss stood at over $19.2 million in that quarter, bringing the trailing two-month loss to over $32 million.

DJT will continue to lose money as it builds its products and offerings. Historically, social media companies have made losses for many years before breaking even.

Fortunately, Trump Media & Technology has over $650 million in cash and no debt. The challenge, however, is that this cash balance will likely continue dwindling, leading to potential cash raises that will dilute its existing shareholders.

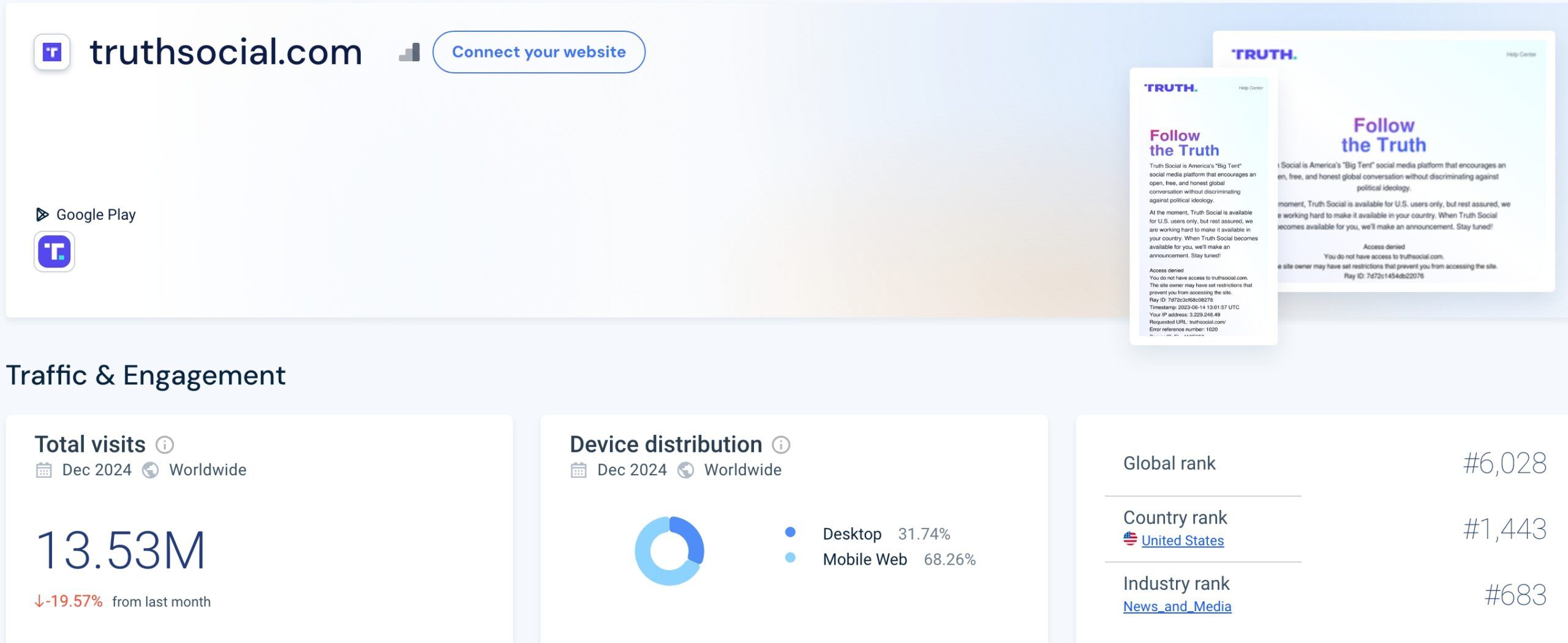

The company also faces the challenge of its advertising business now that its website traffic is falling. Its traffic fell by 20% to 13.3 million in December, a tiny number for a $7 billion company.

Analysts expect the company will see higher advertising by companies and organizations seeking Trump’s intervention on key issues. However, this spending will likely not be enough to save the company for the long term.

Most importantly, Trump will be president for just four years, and his influence will likely wane after the next midterm elections. It is unclear whether Truth Social will thrive without Donald Trump.

Trump Media Can Embrace the Microstrategy Strategy

One potential strategy for the company to thrive is to copy MicroStrategy and buy Bitcoin. Four years ago, MicroStrategy was a fledgling technology company worth about $1 billion. It has become a $95 billion juggernaut by just investing in Bitcoin.

MicroStrategy holds 461,000 coins worth almost $50 billion. In this strategy, DJT would use the cash in its balance sheet and buy as many Bitcoins as possible. It would also use convertible bonds to accumulate as many coins as possible.

Besides, Bitcoin has some of the best fundamentals. It is seeing strong retail and institutional demand at a time when the supply is running out, and Bitcoin mining difficulty is rising.

READ MORE: Polygon Price Prediction: What Happened to the Pol Token?