Italy’s largest bank, Intesa Sanpaolo, takes a bold step into digital assets with its first cryptocurrency investment. The move signals a shift in traditional banking’s stance toward digital currencies, potentially reshaping Italy’s finance sector. The development comes as global financial institutions increasingly explore blockchain technology and digital assets.

Intesa Sanpaolo Pioneers Italian Digital Asset Integration

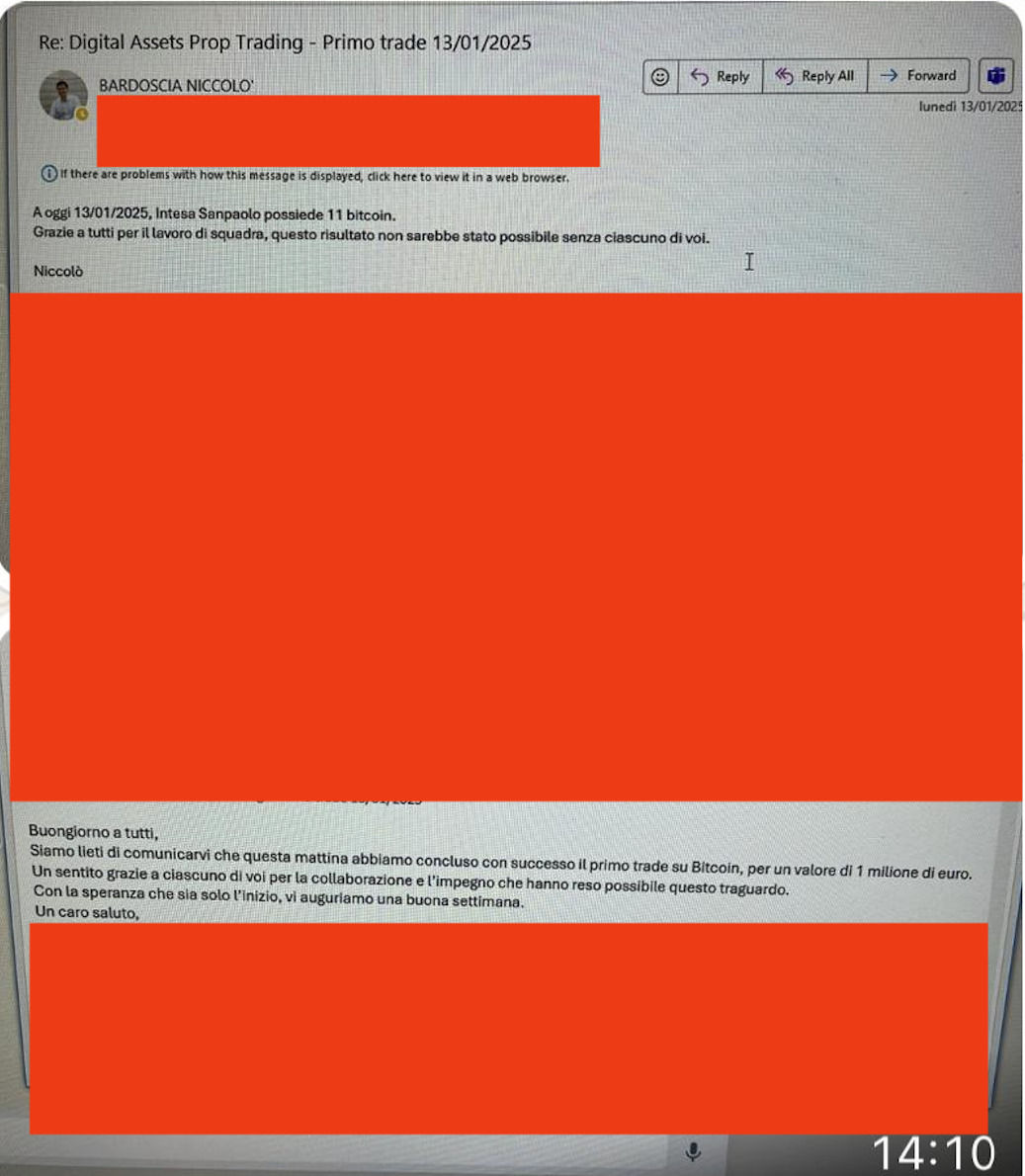

Intesa Sanpaolo reportedly acquired 11 Bitcoin, worth approximately €1 million, in a carefully planned transaction. Niccolò Bardoscia, head of digital assets trading and investments, confirmed the purchase through an internal memo leaked online. The bank’s decision follows months of preparation and marks the first time an Italian credit institution has directly invested in cryptocurrencies.

The timing aligns with broader developments in the bank’s digital asset strategy. Late last year, Intesa Sanpaolo expanded its trading desk to include spot trading capabilities. This built upon their existing operations in crypto derivatives and exchange-traded products. The move shows their growing commitment to embracing blockchain technology.

Market Impact and Future Plans

Since the leak, CEO Carlo Messina has described the purchase as primarily experimental. While modest compared to the bank’s €100 billion securities portfolio, the investment carries significant weight. Messina maintains that crypto investments should remain limited to institutional operators and sophisticated clients. This balanced approach shows how traditional banks can embrace innovation while astutely managing potential risks.

This purchase comes as cryptocurrency adoption continues to boom worldwide and in Italy. Recent data shows that 1.35 million Italians own digital assets, with total holdings reaching €2.2 billion. This increasing consumer interest could accelerate the mainstream acceptance of cryptocurrencies in traditional banking.

The bank’s blockchain journey started in 2014. Since then, it has expanded its expertise through various initiatives. In July 2024, it pioneered a €25 million digital bond issuance on the Polygon network. Its latest Bitcoin purchase aligns with Europe’s regulatory clarity under the Markets in Crypto Assets framework.

Intesa Sanpaolo’s position as Italy’s largest banking group could influence the broader financial sector. The move might encourage other Italian banks to explore digital assets. Their trading desk has received internal approvals and established technical systems for spot crypto purchases.

READ MORE: Eliza Labs Unveils Vision for Web3 AI Integration