CleanSpark recently announced reaching a milestone by joining a small but unique circle of mining firms holding over 10,000 BTC. This development shows a change in how mining companies manage their treasury operations.

CleanSpark Mining Operations & Growth

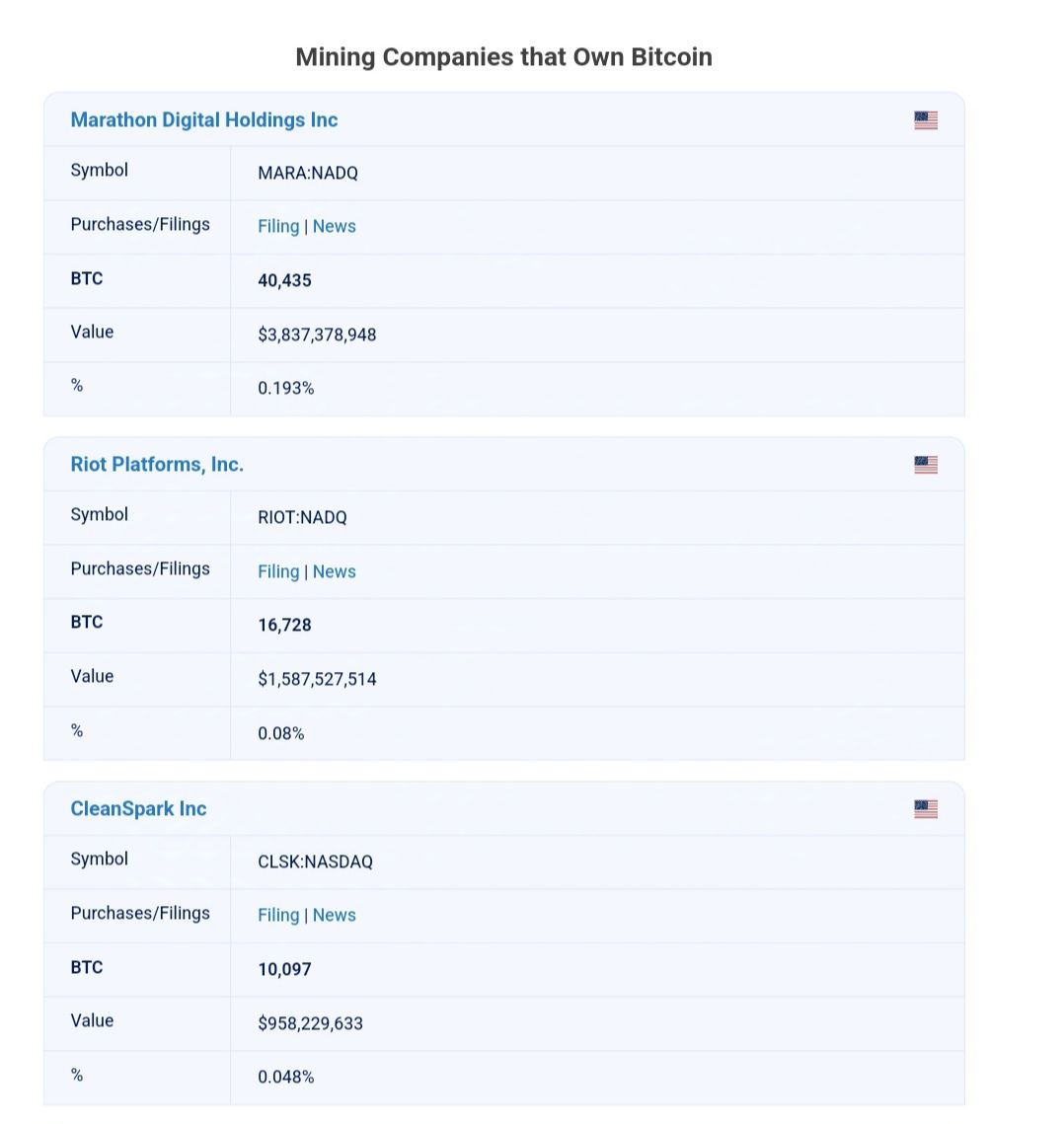

Going into 2025, CleanSpark grew its treasury to hold 10,097 BTC, now sitting third in global mining rankings. The company started mining operations in December 2021, making this achievement even more impressive.

The company’s performance is impressive across various metrics. Its Bitcoin holdings increased by 236% compared to last year. The hash rate efficiency improved by 33% year-over-year, reaching 39.1 exahashes per second, resulting in a 290% increase in the company’s hash rate compared to the previous year.

In addition, CleanSpark dropped its energy consumption per unit of work to 17.59 joules per terahash, allowing it to maximize production while minimizing energy consumption. December 2024 proved productive for mining operations across the United States. CleanSpark mined 668 BTC during the month, while Marathon Digital produced Mara 890 BTC. Riot Platforms came in third place by slightly exceeding the 500 BTC mark. These numbers reflect the growing capacity of US-based mining operations.

Top 3 Bitcoin Mining Firms. Bitbo.io.

Evolution of Treasury Management

The mining landscape is seeing strategic shifts in operational approaches. Companies are expanding their infrastructure through new facilities and acquisitions. CleanSpark added seven mining campuses in Tennessee and established operations in Mississippi and Wyoming.

Rather than immediately selling mined Bitcoin, firms increasingly hold on to their assets. CleanSpark demonstrated this trend by selling only 12.65 BTC in December despite mining 668 BTC during the same period.

READ MORE: Fidelity’s Bitcoin and Ethereum ETFs See Record Outflows