Toncoin price has gone nowhere in the past few months as its ecosystem woes continue. TON peaked at $8.2740 in June this year and has now dropped by 30% to the current $5.7565. So, will the Toncoin price bounce back now that the futures open interest has dropped?

Interest in Toncoin is fading

There are signs that investors are no longer as enthusiastic about Toncoin as they were earlier this year when the tap-to-earn craze was happening in its network. The lack of interest accelerated after French authorities arrested Pavel Durov, its founder.

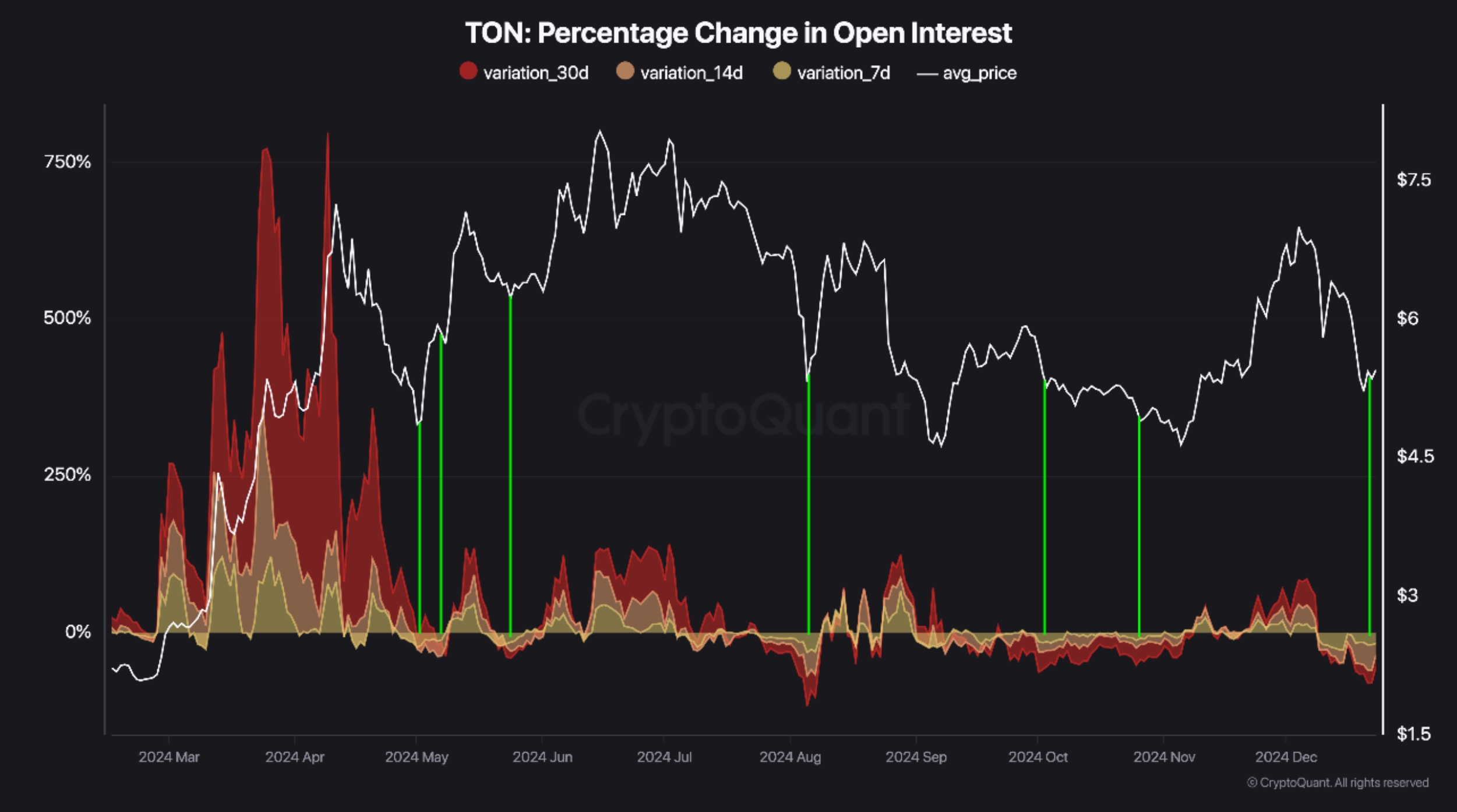

One sign that Toncoin is seeing weak demand is the futures open interest that has continued dropping and currently stands at $183 million. This figure is much lower than the year-to-date high of $362 million. It has also moved close to the lowest level in nine months.

Other data shows that the percentage change in open interest (OI) has turned negative. This is an important number because it is a popular gauge of sentiment and trading behavior in the market.

The move to the negative sign is a sign that investors are either selling their holdings or reducing their bullish holdings. While this is a bad sign, it can also be a sign that the coin has entered a period of slow accumulation, which will lead to more gains.

Another important fact is that whales are now the biggest holders of the coin. Whales hold about 66.42% of the TON holdings, up from 49.5% in September last year. Investors and retail traders have reduced their positioning as the coin has dropped.

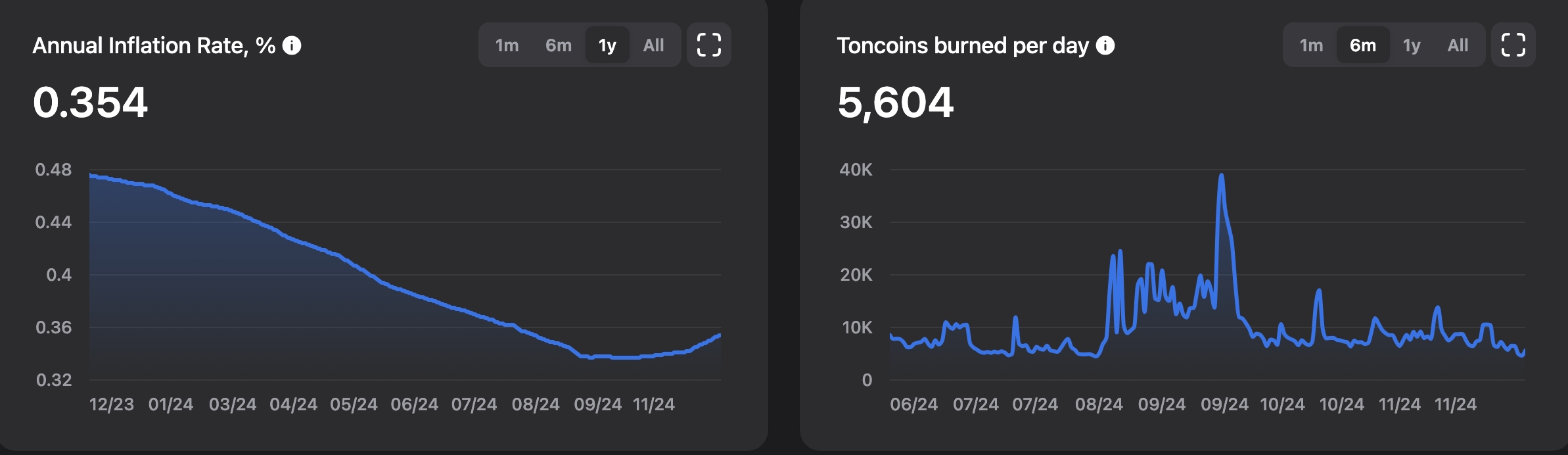

Still, on the negative side, TON has an annual inflation rate of 0.354%, its highest level since August this year. Ideally, a high inflation figure is not all that bad if accompanied by more burning. The challenge is that TON’s burn rate has dropped to 5,604 tokens a day, down from nearly 40,000 a few months ago.

Toncoin price analysis

The daily chart shows that the TON price has been in a downward trend after peaking at $8.2827 in June. It has formed a descending channel and moved below the short and longer-term moving averages. This decline happened as most tokens in its ecosystem, like DOGS and Hamster Kombat, fell.

Therefore, there is a chance that the ongoing rebound of the Toncoin price is merely a dead cat bounce caused by the Santa Claus rally. If this is correct, the TON price will likely drop and retest the lower side of the channel at $4.50.

Read more: Whales Amass 40M XRP Tokens in 24 Hours—Will XRP Price Surge 50%?