Cardano price staged a Santa Claus rally this week, moving to $0.937, up by over 23% from its lowest level last week. Still, despite this comeback, there are signs that the ADA network is not doing well.

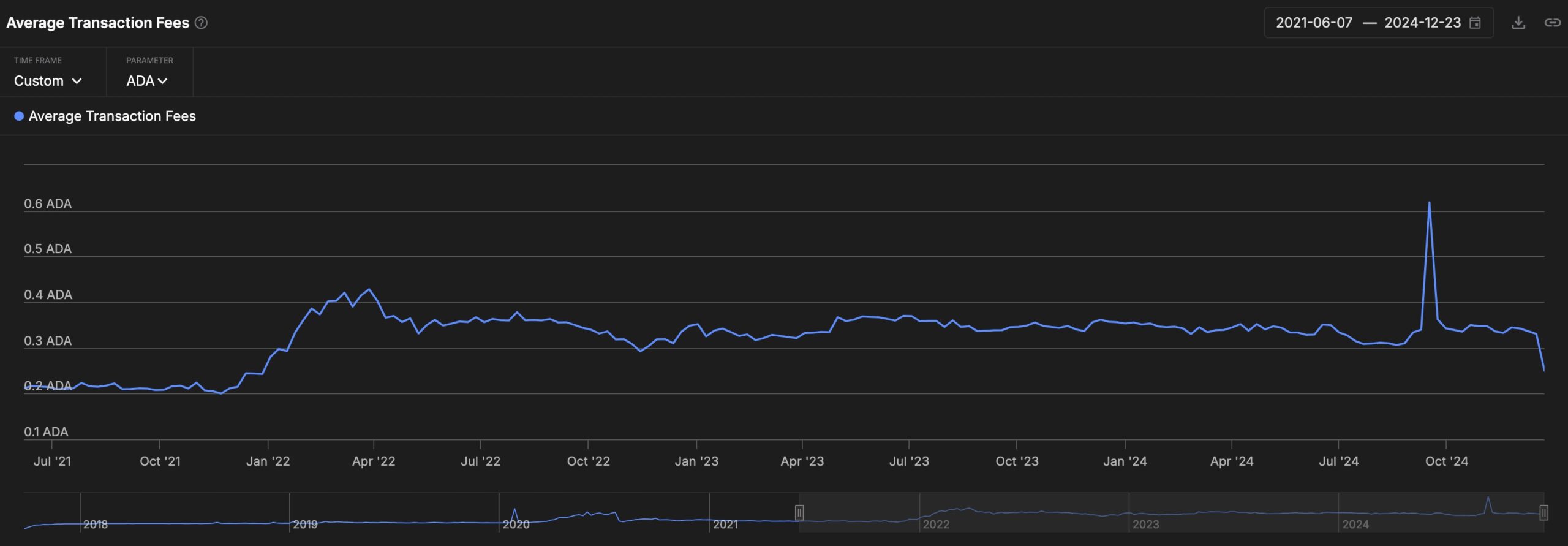

Cardano transaction fees have plunged

Data compiled by IntoTheBlock shows that Cardano’s transaction fees have crashed to a three-year low this week. This fee plunged to 0.25 ADA on Wednesday morning, much lower than the year-to-date high of 0.615 ADA. It was the lowest level it has been since December 2021.

As a result, the fees collected by the network dropped to 171k ADA from this month’s high of 291k ADA. The network’s activity often determines a blockchain’s fees. In most cases, fees rise when there is congestion in the network, a sign that Cardano activity is not doing well.

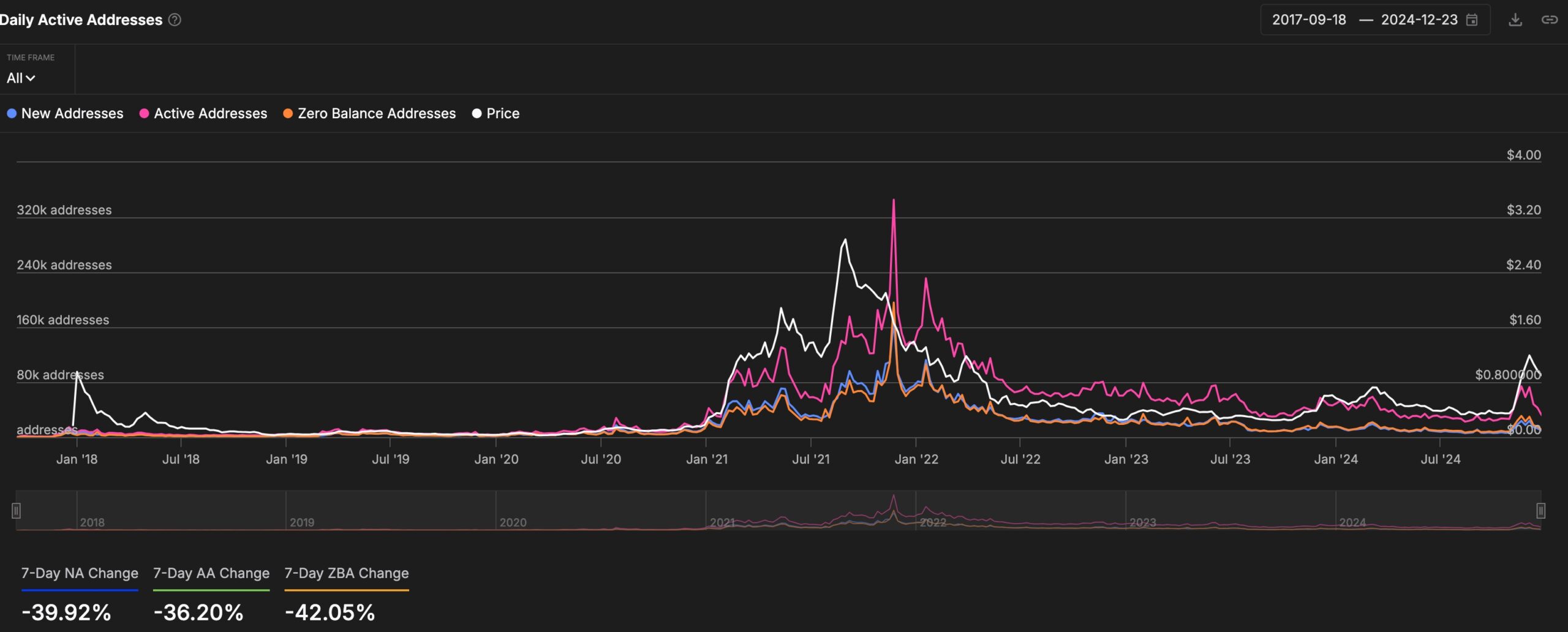

More on-chain data shows that the number of daily active addresses on Cardano has plunged in the past few days. New addresses fell by almost 40%, while active addresses and zero balance addresses fell by 36% and 42%, respectively.

This decline happened as many speculators and inexperienced traders sold their coins after the Cardano price crashed. In theory, this is usually a good thing for the price since whales and long-term holders maintain their positions.

More data shows that the Cardano ecosystem is not doing well, and the total value locked (TVL) in its DeFi ecosystem has been on a downward trend since November 6. It peaked at 610 million ADA tokens and has fallen to 536 million, a sign that some participants removed liquidity in key platforms like Liqwid and Lenfi.

Read more: Best 3 Altcoins to Buy the Dip as the Crypto Crash Continues

Will the ADA price rally hold?

The daily chart shows that the ADA price crashed and bottomed at $0.763 as cryptocurrencies dived. This was a notable drop because it retested the important support at $0.81, the upper side of the cup and handle pattern.

Cardano has formed a hammer pattern, a popular bullish reversal sign. This hammer formed on December 20th, and the coin has risen above the 50-day moving average. That is a sign that Cardano will continue rising in the next few days.

However, Cardano price has also formed a head and shoulders and a bearish flag pattern. These are some of the top bearish patterns. Therefore, there are odds that the ongoing rebound is part of a dead cat bounce, meaning the coin has more downside. If this happens, a sustained sell-off will be confirmed if Cardano drops below the support at $0.810.