Bitcoin price made another bullish breakout on Friday, soaring to its highest point since July 29. It has moved into a technical bull run after surging by almost 40% from its August lows. It is also a few points below its all-time high of $73,800.

Bitcoin dominance rises

Bitcoin’s surge has coincided with the rebound of its dominance in the crypto industry. According to CoinGlass, the dominance jumped to 57.60%, its highest level since April 2021. It is also a significant increase from the 2022 low of 38%. It bottomed at 50% earlier this year.

Bitcoin dominance is an important number that is calculated by comparing Bitcoin’s market cap with that of all other altcoins. In this case, Bitcoin has a market cap of $1.38 trillion compared to the total crypto market cap of over $2.34 trillion.

Its continued rise is notable because the number of altcoins has been in a strong uptrend in the past few months. Data compiled by CoinGecko shows that there are now over 14,885 coins, while CoinMarketCap estimates that there are 2.4 million tokens.

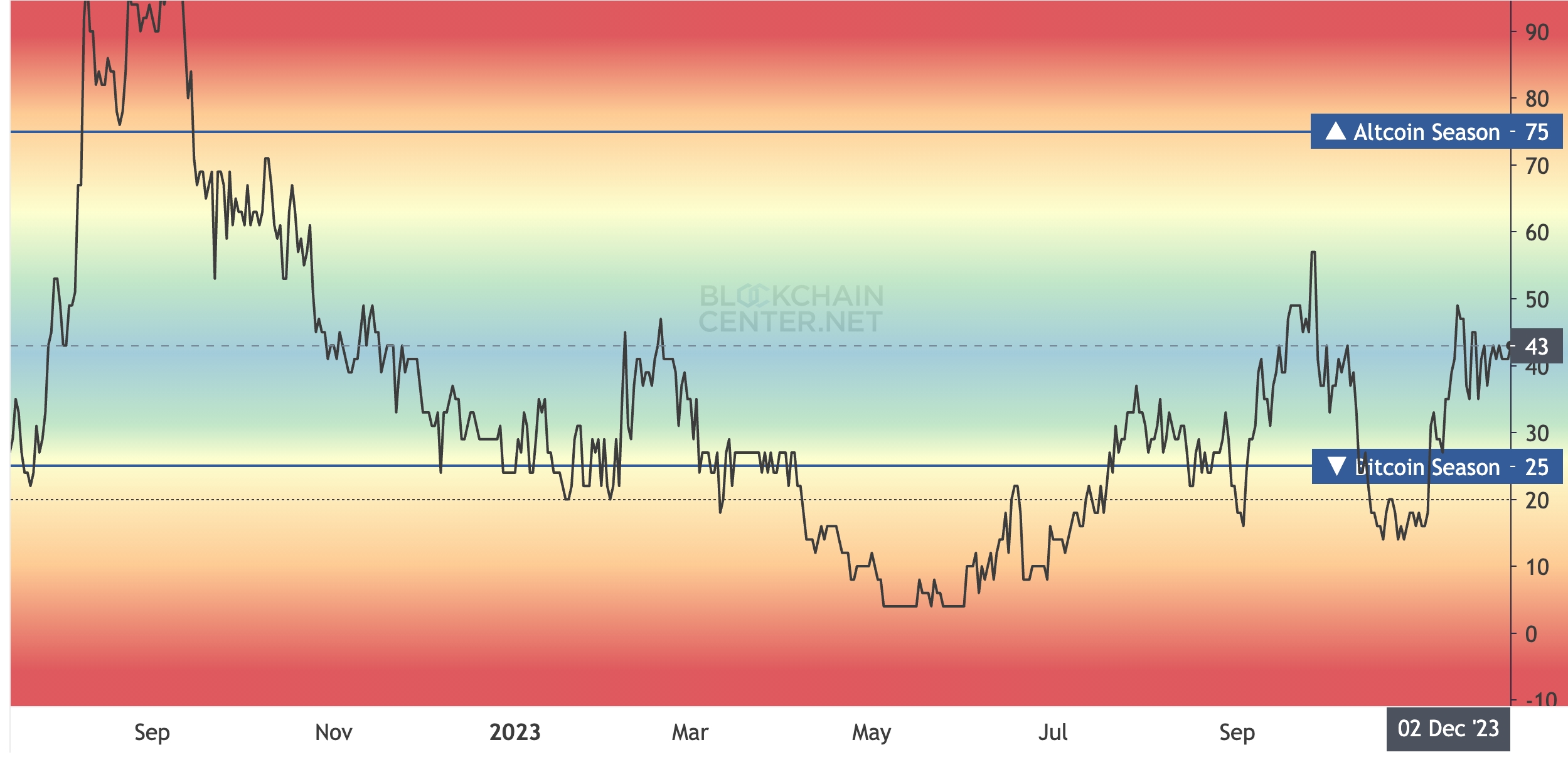

Meanwhile, another data set shows that the altcoin season metric is at 20%, meaning that many altcoins are underperforming Bitcoin. A good example of this is Ethereum, which we wrote on Thursday. The altcoin season happens when the metric moves to 75.

Altcoin season chart by BlockchainCenter

Analysts are upbeat on Bitcoin

Many crypto analysts are bullish on Bitcoin. In an X post, Matt Hougan, the Chief Investment Officer (CIO) at Bitwise, identified several potential catalysts for Bitcoin in the coming months.

Some of his potential catalysts are ETF inflows resuming, the next general election, soaring deficits in the United States, China’s stimulus, and whales accumulating. He expects Bitcoin to cross the $100,000 mark soon.

On the debt issue, the US has now accumulated over $35.5 trillion public debt, a figure that will continue rising regardless of who is in the White House. A study estimated that the deficit will grow to $3.5 trillion under Kamala Harris and $7.5 trillion under Donald Trump.

Global central banks like the Federal Reserve, European Central Bank, and Bank of England have all started cutting rates. Also, total Bitcoin ETF inflows have soared to over $20.66 billion, with the iShares Bitcoin Trust (IBIT) adding over $25 billion in assets.

Bitcoin chart by TradingView

Technically, Bitcoin has risen above the upper side of the falling broadening wedge pattern, pointing to more gains in the near term. If this happens, the next point to watch will be at $73,800, its all-time high.