SPX6900, a relatively new meme coin, is firing on all cylinders as investors bet on Uptober, and as most similar tokens rebound. The SPX token jumped to a record high of $0.2406, giving it a market cap of over $221 million.

Meme coins are bouncing back

SPX6900 is a new meme coin with a unique angle. Unlike other coins that are based on animals like cats, dogs, and hippos, it is based on the stock market.

Its goal is to become the biggest meme coin by replicating the success of the S&P 500 index, which has a long track record of gains.

The token surged this week for three main reasons. First, it rallied after BitMart became the first crypto exchange to list it. Before that, most of its trading was happening in popular decentralized exchanges like Uniswap, Raydium, and Balancer.

Therefore, with its market cap rising, there is a likelihood that popular tier 1 exchanges like HTX, Bybit, and Binance will list it.

Second, the SPX6900 meme coin rose because of the ongoing recovery of most cryptocurrencies, including meme coins. Bitcoin jumped to $62,500 on Friday while the total market cap of all coins rose to $2.12 trillion.

Most meme coins were in the green, with their total market cap rising to over $50 billion. Some of the most notable gainers were Baby BNB, Keyboard Cat, Doland Tremp, and Gigachad, which rose by over 50%.

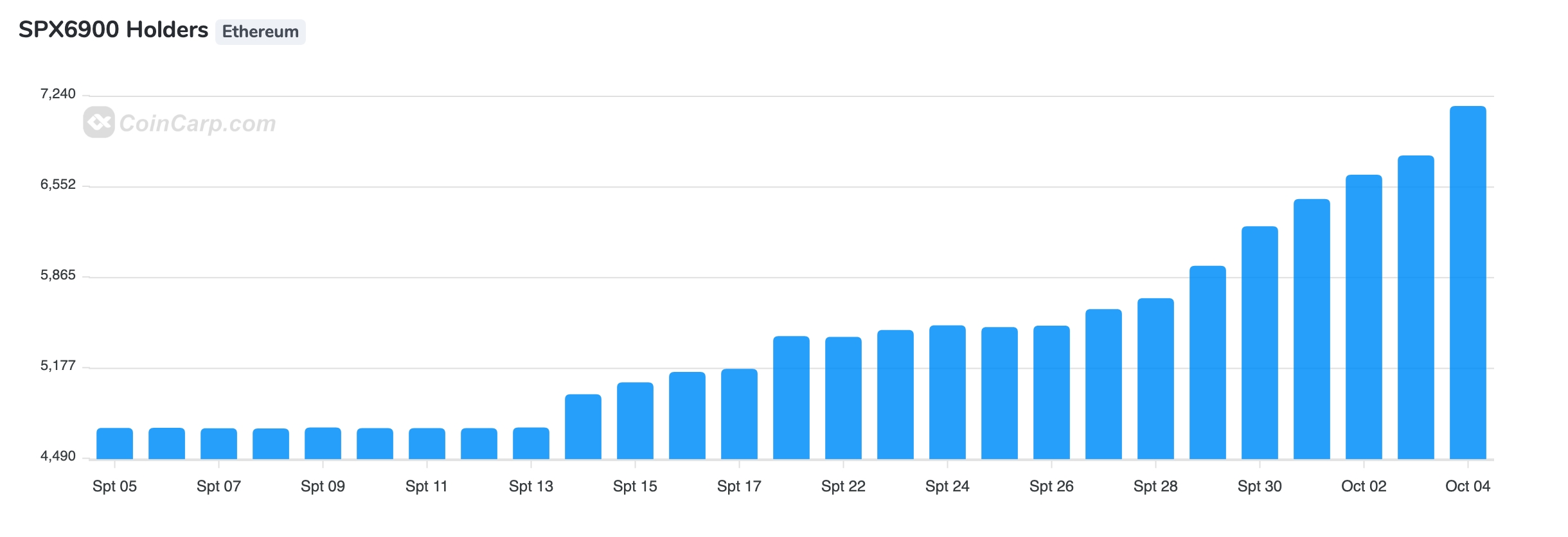

Third, on-chain data shows that the number of SPX6900 token holders continued rising, hitting a record high of 7,530 on Friday. This is a big increase since the token had less than 5,000 holders a few weeks ago.

SPX6900 risks remain

Still, there is a risk that the SPX token’s rally will be short-lived. In most cases, meme coins that attract a lot of Fear of Missing Out (FOMO) rally tend to suffer a harsh reversal when the momentum fades.

The other risk is that inflation could remain stubbornly high, pushing the Federal Reserve to maintain higher interest rates for longer. Besides, the US published strong jobs numbers, with the nonfarm payrolls (NFP) rising by over 240k. Also, crude oil prices are jumping amid rising geopolitical risks.

Additionally, the fear and greed index remains in the green, meaning that investors are a bit afraid of investing in cryptocurrencies. After rising to the green zone of 61, the index retreated to the fear zone of 35.