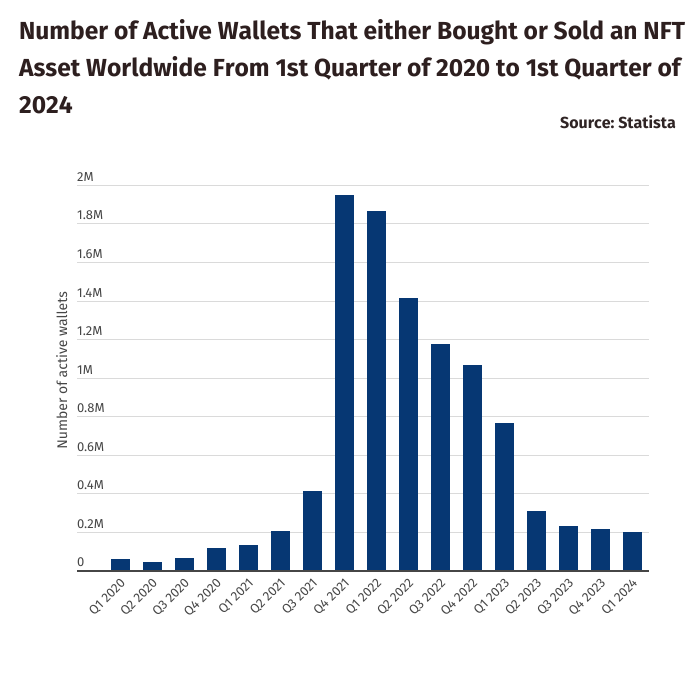

- The NFT market has seen a dramatic drop, with the number of wallets buying or selling NFTs plummeting.

- NFTs peaked in late 2021 and early 2022 with 1.9 million active wallets, but interest has waned significantly since then.

In this post:

- The NFT market has dropped dramatically, with the number of wallets buying or selling NFTs plummeting.

- NFTs peaked in late 2021 and early 2022 with 1.9 million active wallets, but interest has waned significantly since then.

The once-bustling NFT market has experienced a staggering reduction in active wallets. According to BanklessTimes.com, the number of wallets buying or selling NFTs has dropped by 75% in the last year.

Speaking on the development, Edith Reads, a financial analyst from BanklessTimes, said:

“ Several projects and digital assets are saturated in the NFT space. This flood of new entries, many of which lacked unique value propositions, may have contributed to investor fatigue and diminished interest.”

Market Challenges are Not New to Digital Assets

NFTs emerged in 2020 but gained widespread popularity in 2021. The digital asset peaked during the last quarter of 2021 and the first quarter of 2022, with an average of 1.9 million active wallets.

This period was marked by a surge in interest from artists, investors, and collectors, who engaged in high-value transactions involving millions of dollars. The booming demand sparked immense interest and turned NFTs into a major topic of conversation.

However, since then, NFT active wallets have consistently declined. Between the first quarter of 2022 and the first quarter of 2023, the number of active wallets dropped by 59%, and they have dropped by around 90% in the last two years.

The drop is significant and points to a cooling market. This substantial drop suggests that the initial hype around NFTs has faded, and people are reassessing their economic value.

Why the Decline?

The decline in active NFT wallets might be due to various reasons. Among them is market saturation due to the initial surge in NFT prices. Most investors came up with new projects anticipating quick and profitable sales due to market speculations by then. Yet, as the market began to stabilize, people lost interest, leading to reduced trading.

The world has recently experienced economic shakedown, with rising inflation and high interest rates taking centre stage. The situation has lowered purchasing habits, with investors taking caution in their funds. Some investors have gone back to traditional assets, claiming stability.

Although the current trends are disheartening, several analysts expect the NFT market to rebound. New trends and technologies are anticipated to emerge, reshaping the landscape and offering fresh opportunities for innovation and growth.