The iShares Bitcoin Trust (IBIT) ETF has remained in a consolidation phase in the past few weeks as investors wait for the next catalyst for Bitcoin. After soaring to a record high of $41.95 in March, the fund has retreated by almost 17% to the current $35, Other spot Bitcoin ETFs like FBTC, ARKB, BRRR, BTCO, and HODL have had a similar price action.

US inflation and retail sales data ahead

Bitcoin ETFs have stalled recently as the cryptocurrency industry has gone through a small crypto winter. BTC has remained in a tight range between the support and resistance levels at $60,000 and $70,000.

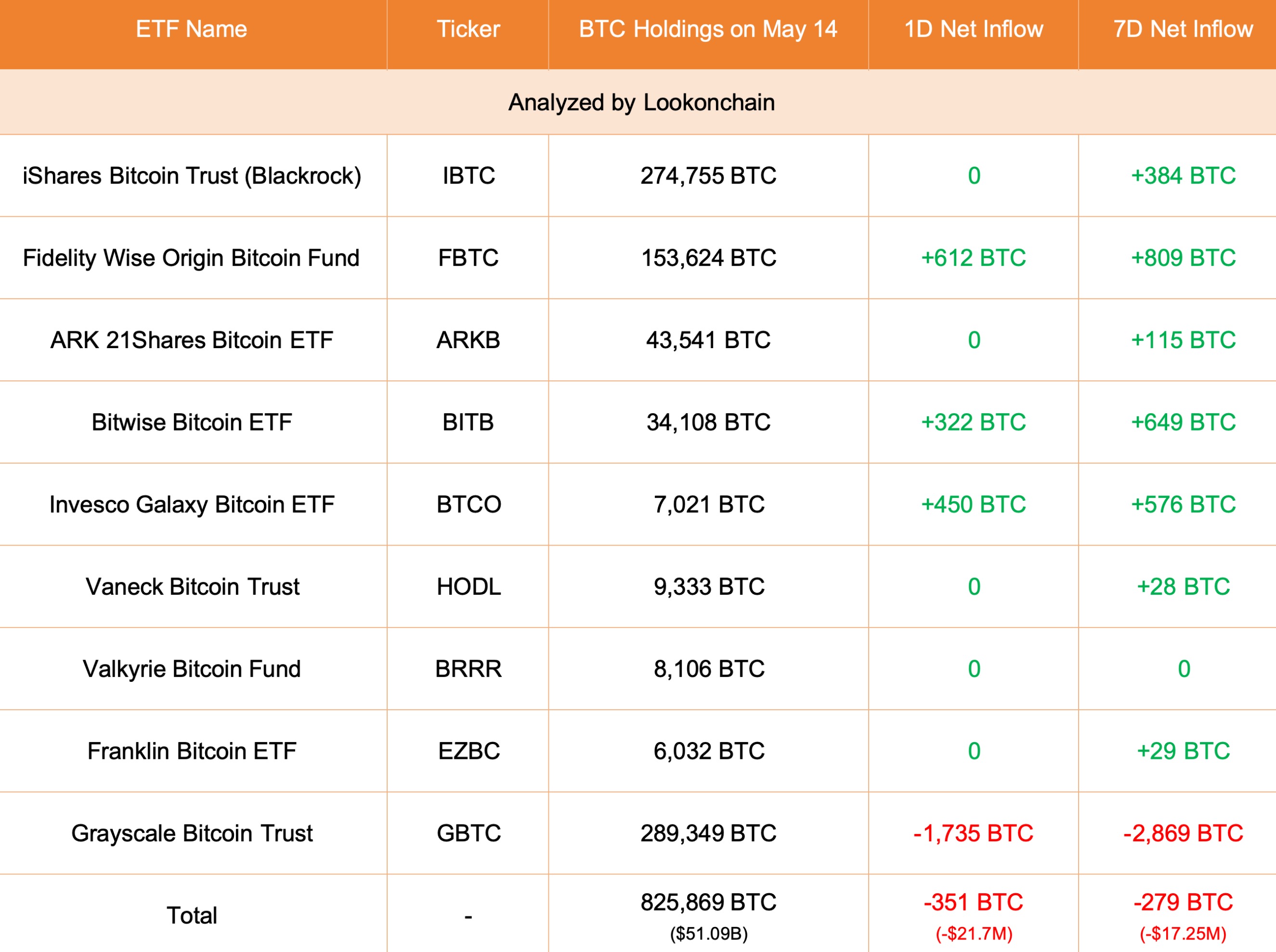

As a result, inflows in these ETFs have slowed drastically, Data shows that the IBIT ETF added 384 Bitcoins in the past 7 days while Fidelity’s FBTC added 809 coins. Cathie Wood’s ARKB added 115 coins while Bitwise’s BITB added 649 coins. Altogether, the 11 spot Bitcoin ETFs launched in January have 825,869 coins valued at over $51 billion.

The next potential catalyst for these ETFs will be the upcoming data dump from the US. The Bureau of Labor Statistics (BLS) will publish April’s inflation report, which will set the tone for the next Federal Reserve actions.

Economists believe that inflation held tight in April as the prices of energy, housing, and insurance continued rising. The median estimate is that the headline Consumer Price Index (CPI) slowed to 3.4% in April while the core CPI fell to 3.6%.

If these numbers are correct, it will confirm that the US is in a stagflation phase, characterized by slow economic growth and high inflation. These inflation pressures will continue now that Biden has launched new tariffs on key Chinese products like EVs and solar panels.

Higher inflation figures will be bearish for Bitcoin and other risky assets like stocks since it will reduce the chances of several rate cuts this year. In a statement on Tuesday, Jerome Powell hinted that the Fed will be patient before slashing rates.

A lower-than-expected inflation figure will point to more upside as it will raise the possibility of interest rate cuts.

The other potential bullish catalyst for these ETFs is the ongoing meme stock rally that has pushed companies like AMC, GameStop, Virgin Galactic, and MicroCloud Hologram higher. As we saw in 2021, the meme stock frenzy could also move to the crypto market.

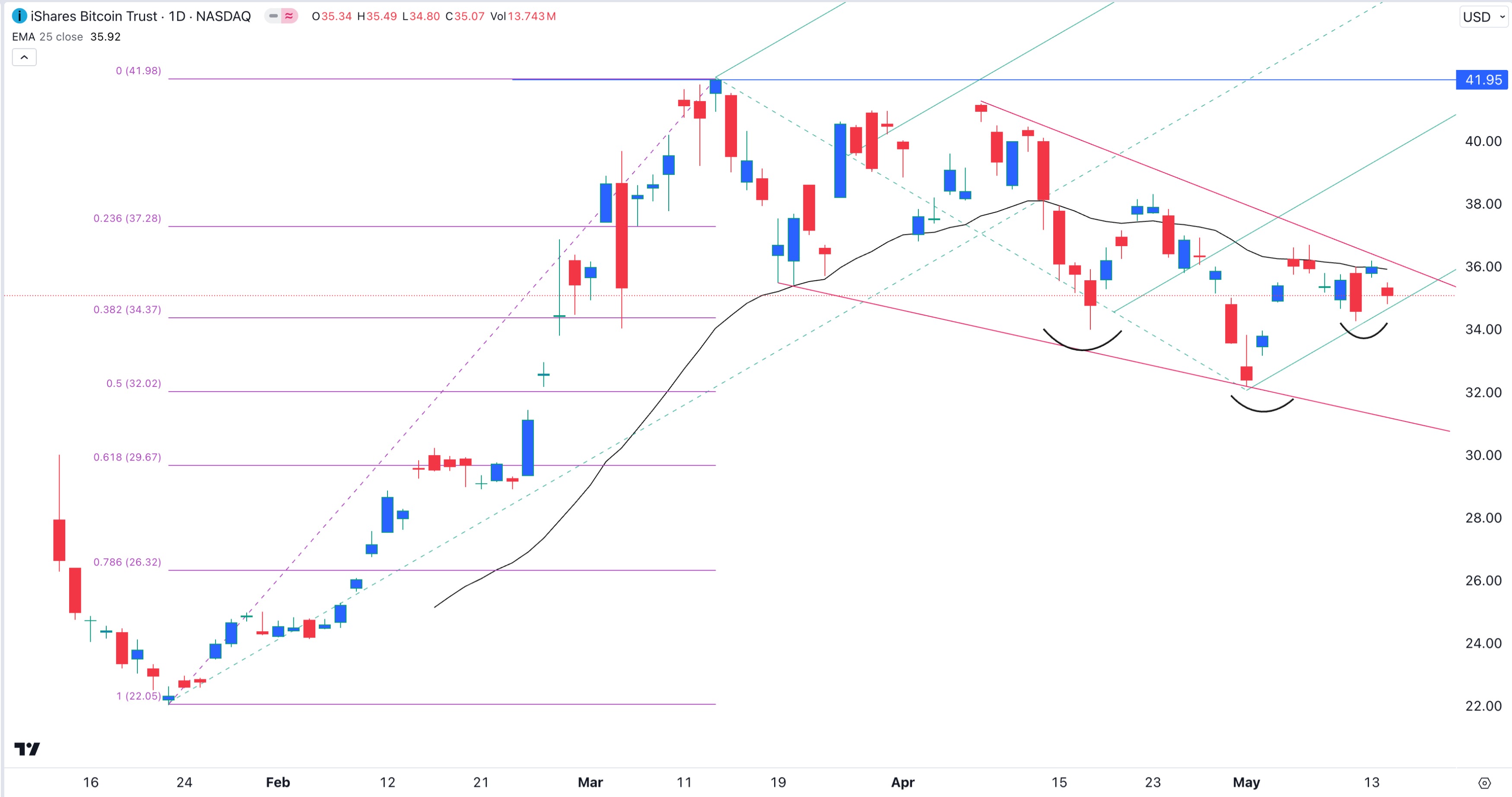

IBIT ETF price forecast

Spot Bitcoin ETFs like IBIT, BTCO, FBTC, and ARKB are always highly correlated because they track Bitcoin. Therefore, this IBIT forecast will also apply to the other funds.

On the daily chart, we see that the IBIT ETF has pulled back from the year-to-date high of $41.95 in March to the current $35. It has formed a descending channel shown in red and moved below the 25-day moving average.

The ETF has dropped below the 23.6% Fibonacci Retracement level and is sitting at the lower side of the Andrews pitchfork tool. It has also formed an inverse head and shoulders pattern, raising the possibility that it will have a strong comeback in the coming days. If this happens, the IBIT ETF will rise to the 23.6% retracement point at $37.28.