Bitcoin price has been a bit volatile recently as investors focus on the ongoing Grayscale Bitcoin Trust (GBTC) and ProShares Bitcoin Trust (BITO) outflows. The two funds have seen some outflows in the past few weeks as investors move to other cheaper ETFs.

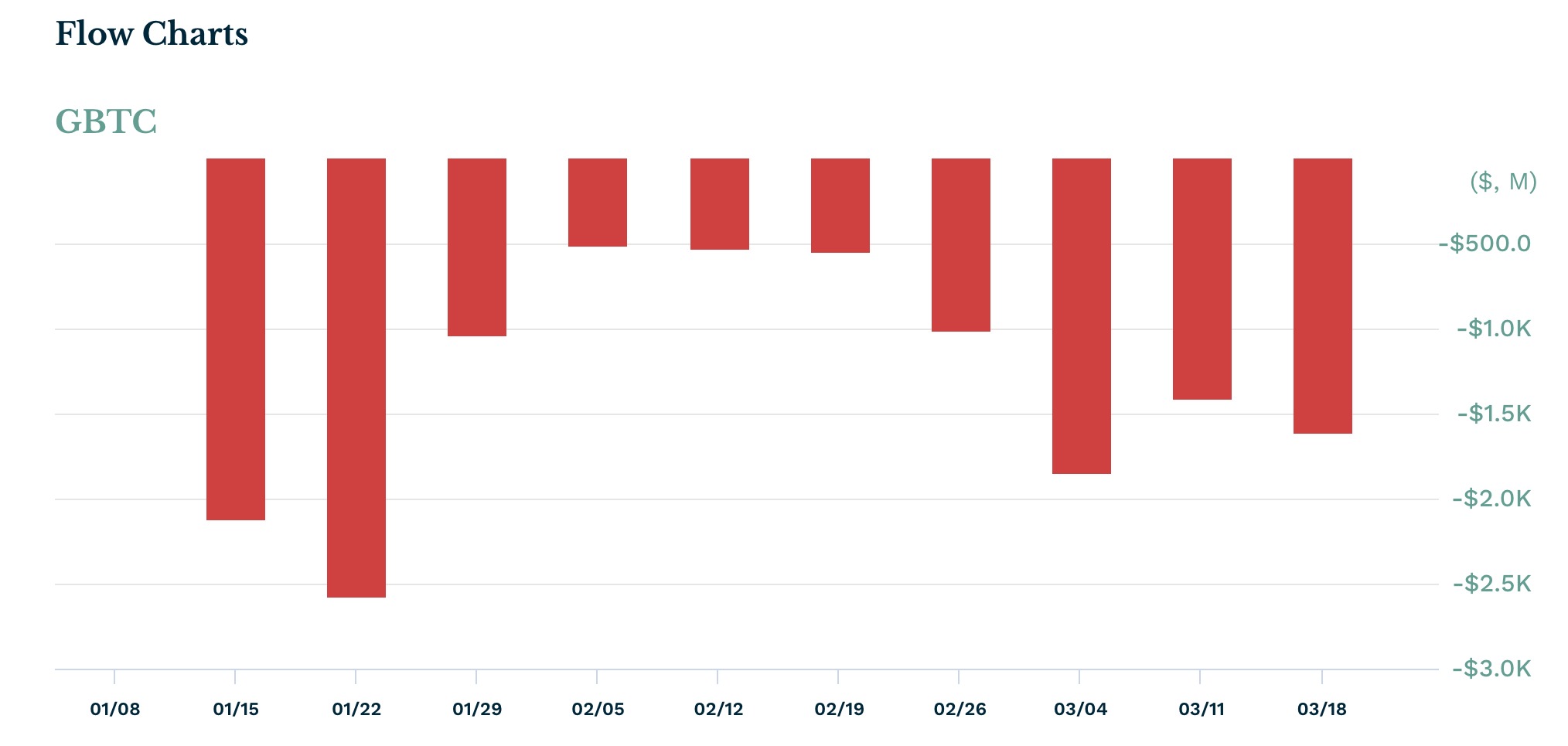

Data compiled by ETF.com shows that the GBTC ETF has had outflows in all weeks since the conversion into an ETF. It has shed assets worth over $13.1 billion and the trend is getting worse. It lost over $1.3 billion in assets last week.

GBTC started its life as a spot Bitcoin ETF with over 600k Bitcoins. Today, the number has crashed to over 300k and analysts believe that this meltdown will accelerate in the coming months.

GBTC is not the only ETF that is seeing some weakness. While the ProShares Bitcoin Strategy ETF (BITO) has added over $300 million in assets this year, it has shed some assets in the past two straight weeks.

The main reason why GBTC and BITO are losing assets is mostly because of their substantial fees. GBTC has an expense ratio of 1.50% while BITO has a ratio of 0.95%. These are huge ratios, which are costing investors millions.

For a long time, it was understandable why these funds had these fees. At the time, there was no alternatives to physical Bitcoin that was friendly to institutional investors.

This has changed recently now that the Securities and Exchange Commission (SEC) has approved a few spot Bitcoin ETFs. It approved eleven funds from companies like Bitwise, Blackrock, Fidelity, and Ark Invest.

These funds have seen more inflows in the past two months, which is a sign that they are capturing some of the assets from GBTC and BITO. The iShares Bitcoin Trust has grown to have over $15.4 billion in assets.

Similarly, the Fidelity Wise Origin Bitcoin ETF (FBTC) has grown its assets to more than $6.4 billion while Ark 21Shares Bitcoin ETF has over $2.65 billion in net assets.

These funds have a lower expense ratio than BITO and GBTC. ARKW has a ratio of 0.21% while FBTC and IBIT have 0.25%. For example, a $100k invested in GBTC would cost $1,500 per year and $15,000 annually, all factors constant.

In the same period, it would cost just $250 to invest in IBIT and FBTC, which is a huge difference for basically the same asset.

Therefore, BITO and GBTC will likely continue shedding assets in the coming months because of their significant fees. Grayscale is not considering slashing its fees but is instead focusing on launching a cheaper alternative to GBTC.