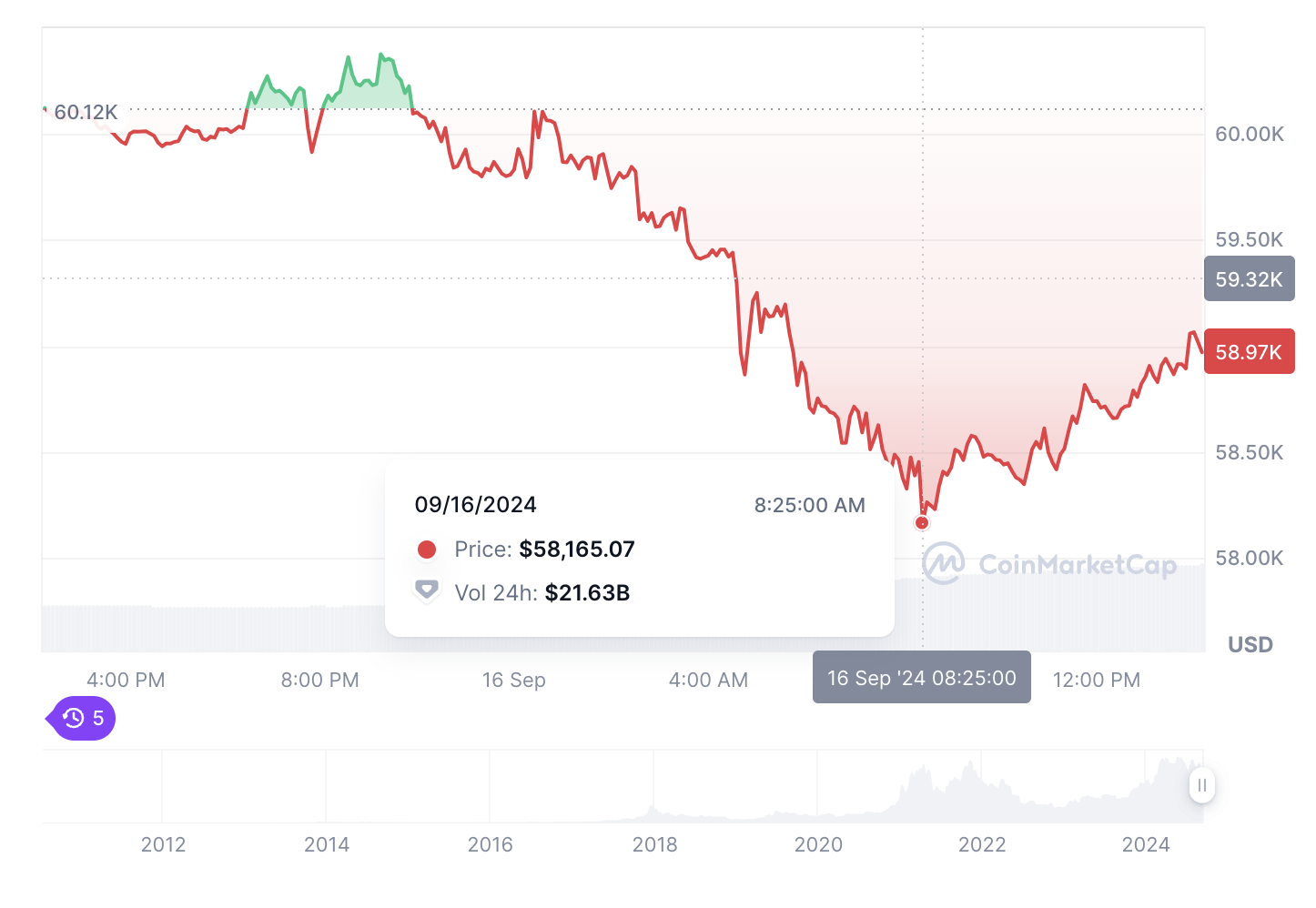

Bitcoin continued its upward momentum over the weekend, briefly crossing the $60k mark on Saturday, September 15. However, the leading cryptocurrency failed to sustain its position above the key resistance level of $59.3k and experienced a sharp decline in the early hours of trading on Monday, dropping to $58.1k.

Attempting a comeback, Bitcoin has been making higher highs over the last four hours, aiming to reclaim the $60k mark. On the intraday chart, BTC price has slumped by 1.89%, trading at $58,969 at the time of writing. At its current level, Bitcoin is up 6.85% week-on-week.

While Bitcoin’s price surged, gold reached a fresh all-time high, hitting $2,586 on Friday. However, by the end of the week, US stocks made only minor gains.

Interestingly, after two consecutive days of gains, Bitcoin has returned to levels from which it had previously dropped below $54k. The sharp rejection on Monday following the weekend rally shows how weak the support is at these levels.

Sustained Bull Run or Crash?

Bitcoin has shown remarkable resilience since briefly dropping below $53k on September 7. The upward trend in BTC’s price seems to be more of a short-term correction, as the cryptocurrency has yet to breach the strong resistance at $59k.

This week, the Federal Reserve has a meeting scheduled for Wednesday. The majority of analysts expect a 0.5% rate cut, though some believe that the cut, which would be the first in four years, will not exceed 0.25%.

Given this, the current momentum in Bitcoin’s price could face a setback and potentially drop below $55k this week. Currently, it is just managing to stay above the crucial support at $58.5k.

The recent spike in Bitcoin’s price could be attributed to last week’s inflation data. However, with inflation slowing to 2.5% in August, as reported by the US Bureau of Labor Statistics in its CPI data, the possibility of a 0.5% Fed rate cut may not be realistic.

With inflation down for the fifth consecutive month, a rate cut of 0.5% seems unlikely. While we will gain more clarity on Wednesday, the crypto market is expected to remain volatile until then. As we reported earlier, this bullish momentum could be a trap, and Bitcoin might face a sharp decline if the rate cuts do not meet expectations.

Following BTC’s move past the $60k mark, strong selling pressure triggered a sharp drop in its price. Any bullish momentum this week beyond $60k will likely lead to profit-taking and a sell-off from investors. The fall could be significant, and a stronger bullish momentum may not materialize until the US presidential election in November.