After showing some resilience on Monday, gaining over 5% on the intraday chart, Bitcoin is down once again following the first presidential debate, which concluded in Philadelphia on Tuesday.

The former president Trump, on various occasions, has reiterated his promise to make America the crypto capital of the world, emphasizing the need to support new technologies. On the other hand, Vice President Kamala Harris has yet to publicly disclose her stance on cryptocurrencies.

In what is being seen as a reaction to the first presidential debate before the election in November, the top coins, including Bitcoin, Ethereum, and Solana, slumped.

Currently exchanging hands at $56,533, Bitcoin is down a little over 1% in the last 24 hours. Ethereum’s Ether tokens have slipped nearly 1.5% day-on-day, to $2,315. Solana, the leading altcoin after Ethereum, is also down 2.75% on the day, to $131.

This week, we have seen a minor reversal, considering Bitcoin dropped below $54k over the weekend. While it is still trading under $57k, where the leading crypto has some support, predictions of Bitcoin slipping to $50k levels this week have not come true—yet.

Another important observation this week has been the Bitcoin ETF inflows. According to data from Coinglass, after a record two weeks of continuous outflows, Bitcoin ETFs saw an inflow of more than $26 million on the first day of the week. This could indicate that institutional interest in Bitcoin is once again starting to build up.

Why the Presidential Debate and the November Election Matter

The upcoming U.S. presidential election in November could be a game changer for the global crypto industry. Here are a few reasons why this election and presidential debate matter more to the crypto industry than ever before.

- Crypto has never been a topic of debate for presidential candidates. Prior to the debate in Philadelphia on Tuesday, no presidential candidate had ever mentioned crypto. Trump is the first to do so.

- The Republican candidate, Donald Trump, has actively pledged to bring crypto regulations. He is also on record saying that he wants the SEC chair removed and replaced by someone who is more “pro-crypto.” This is significant, as it is unprecedented in the 13-year history of crypto for a US presidential candidate to call out a financial regulator in favor of the crypto industry.

- There is also a stark contrast between Trump and his rival Kamala Harris. The debate was important for the crypto community because one candidate remains unresponsive when it comes to stating their stance on cryptocurrencies. Many crypto enthusiasts were hoping Kamala Harris would clarify her position on cryptocurrencies—or at least respond to Donald Trump’s call for making the U.S. the crypto capital of the world.

- The result of this election will be the most significant one for the crypto industry globally. If a pro-crypto president is elected in the U.S., it could mean more favorable regulations, providing a boost to crypto and blockchain-driven companies worldwide.

- Remember, the U.S. is the largest economy, and if the government starts promoting crypto businesses through favorable regulations, many other governments will follow.

Additionally, analysts are bullish on Bitcoin if Trump wins the November election. While Bitcoin bulls like Michael Saylor may sound wildly optimistic in predicting Bitcoin will reach $13 million in the next 20 years, more moderate analysts have predicted Bitcoin could hit $90,000 in 2024—if Trump becomes the next U.S. president.

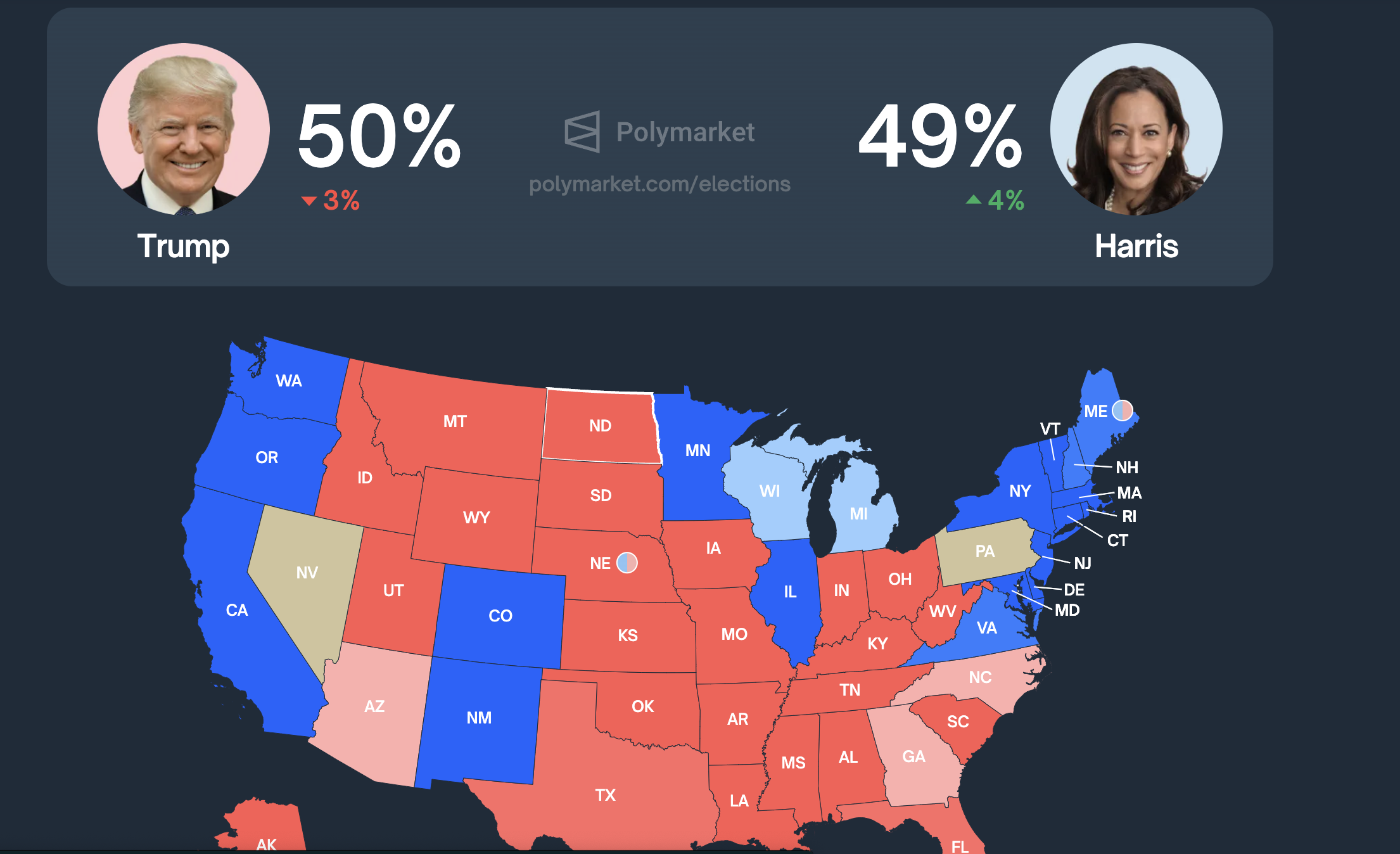

Update: Following the presidential debate, the odds of Trump winning the election on Polymarket has dropped by 3 points.

As Donald is being seen as a pro-crypto candidate, the drop in his “winning probability” has also contributed to crypto market’s downward momentum.

Despite a 3 point drop, Trump still has a one point lead. There have been mixed reactions to the debate, with neither being a clear winner.