Cryptocurrency prices are in a deep and ugly crash that has cost investors billions of dollars. After peaking at almost $3 trillion earlier this year, the market cap of all cryptocurrencies has tumbled to $1.89 trillion.

Ethereum, Avalanche, and Polkadot have sunk

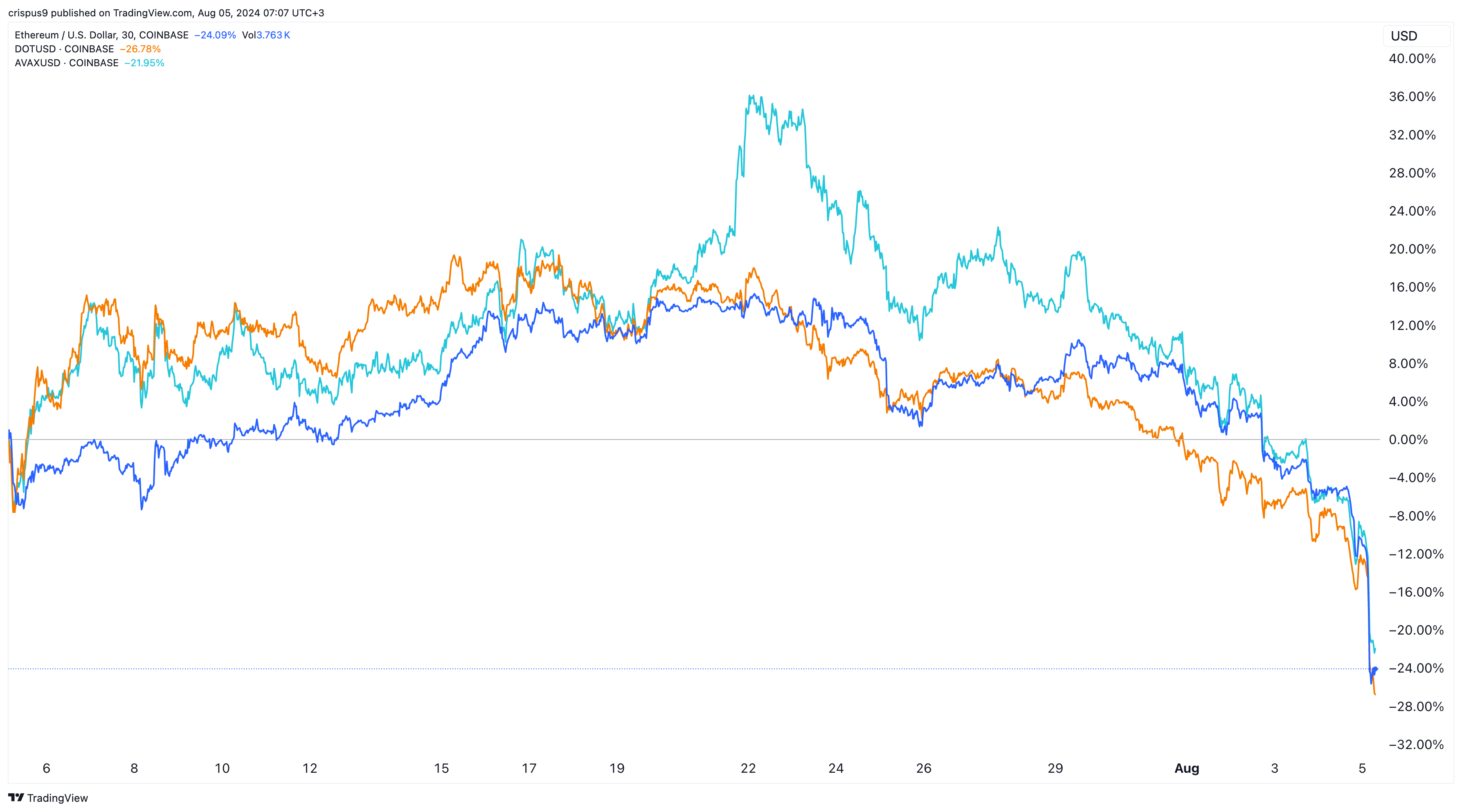

Most cryptocurrencies like Ethereum (ETH), Avalanche (AVAX), and Polkadot (DOT) have tumbled by double-digits in the past few weeks. Many of them have erased the gains made earlier this year.

The ongoing crypto crash is attributed to several factors. As I wrote earlier on, the main catalyst for the crash is the resurgence of the Japanese yen, which has led to the unwinding of a long-standing carry trade among investors.

Cryptocurrencies have also tumbled because of the rising recession odds, with Goldman Sachs rising its probability. The closely watched Sahm Rule indicator has moved to 0.53. The Sahm rule, which has been accurate for decades looks at the unemployment rate and is triggered when it rises by 50 basis points in 12 months.

Warren Buffett sits on $277 billion in cash

The other reason, which has not been mentioned above is that Warren Buffett is shifting to cash. On Saturday, Buffett, who is widely seen as the best investor in modern times, revealed that he has been dumping Apple stock even as it jumped to a record high.

He sold Apple shares worth over $84.2 billion in the last quarter and this trend could continue. As a result, his company now holds over $277 billion in cash on its balance sheet, the highest figure on record.

Warren Buffett’s move to cash means that he is likely expecting for something bad to happen in the stock market. For example, there are chances that he is expecting the US to move into a recession, a move that will help him to buy the dip.

Buffett also believes that the US stock market is severely overvalued. His favourite gauge on valuation, which looks at the stock market cap compared to the US GDP, has moved to an all-time high.

Therefore, actions by Warren Buffett are affecting cryptocurrencies because of the close correlation that exists between stocks and cryptocurrencies. In most instances, cryptocurrency prices crash when stocks are moving in a downward trend.

Stocks continued their recent crash on Monday, with the Dow Jones, S&P 500, and Nasdaq 100 indices falling by over 0.80% in the futures market.