The Bitcoin price has done fairly well this year. It jumped by over 50% and reached its all-time high of over $73,000. This surge continued the recovery that started in January 2023, a few weeks after the FTX crash.

Bitcoin is beating popular ETFs

Bitcoin’s meteoric rise can be attributed to two key factors. First, the approval of spot Bitcoin ETFs in January sparked a surge in demand, particularly among institutional investors. Second, the recent halving event significantly curtailed its supply, further driving its value.

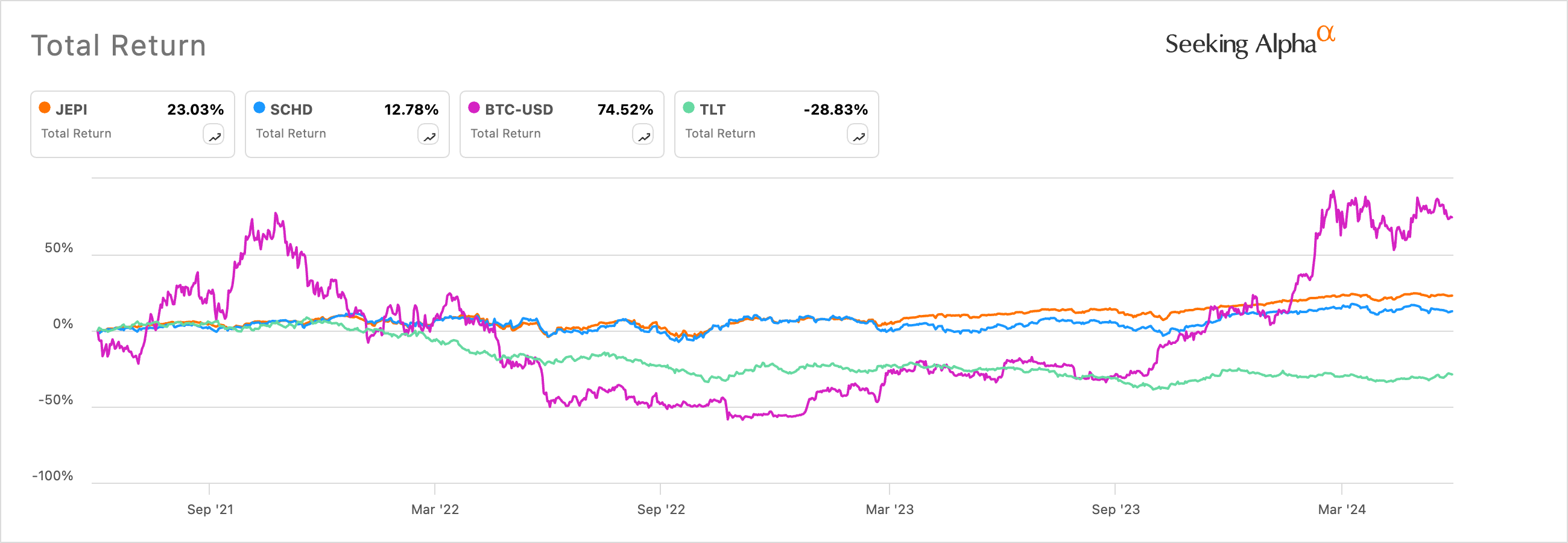

Notably, Bitcoin has continued to perform better than some of the industry’s most popular exchange-traded funds (ETFs).

On the other hand, the iShares 20+ Year Treasury Bond ETF (TLT) has experienced a significant downturn, plummeting by more than 5%. This can be attributed to a combination of factors, including the market’s focus on the escalating US debt, the yield curve inversion, and the Federal Reserve’s policies.

US debt has soared to over $34.6 trillion in the past few months, and this trend is accelerating. Analysts expect the debt to cross the $40 trillion level by 2026. Worse, Trump and Biden have not proposed acceptable measures to slash spending.

Trump has proposed more tax cuts and excluding tipping from taxes, which will increase the deficit by over $200 billion in the next decade. On the other hand, Biden has proposed higher taxes, a policy that cannot be passed in the Senate.

Therefore, bond investors have moved to short-term bonds, which offer better returns. A five-month bill has a yield of over 5%, while a 20-year Treasury yields about 4.2%.

JEPI and SCHD ETF performance

Bitcoin is also beating the Schwab US Dividend Equity ETF (SCHD), one of Wall Street’s most popular dividend funds with over $50 billion in assets. The SCHD yields about 3.45% and has had less than 5% returns this year.

SCHD, which was earlier mentioned here, invests in some of the top blue-chip companies in the US. Its most significant holdings include Texas Instruments, Amgen, Lockheed Martin, Coca-Cola, and Pfizer.

Further, it has done better than the JPMorgan Equity Premium Income ETF (JEPI), one of the biggest actively managed funds in the industry with over $3.3 billion in assets. JEPI’s total return has been 5.45% this year.

JEPI is an ETF using a unique options model called a covered call. It invests in S&P 500 companies and then sells call options on the index. By doing that, the fund takes a premium payment, which it distributes to holders monthly. Concurrently, it benefits from the upside of the S&P 500 index.

Bitcoin has also outperformed SCHD and JEPI in the longer term. It has jumped by over 74% in the past three years, while SCHD and JEPI have risen by 23% and 12.7%, respectively. The same has happened with the popular ETFs that track the Nasdaq 100 and S&P 500 indices.

This explains why it makes sense for income—and growth-focused investors to allocate some cash to Bitcoin (BTC). Besides, Bitcoin and stocks have demonstrated some volatility in the past few years.