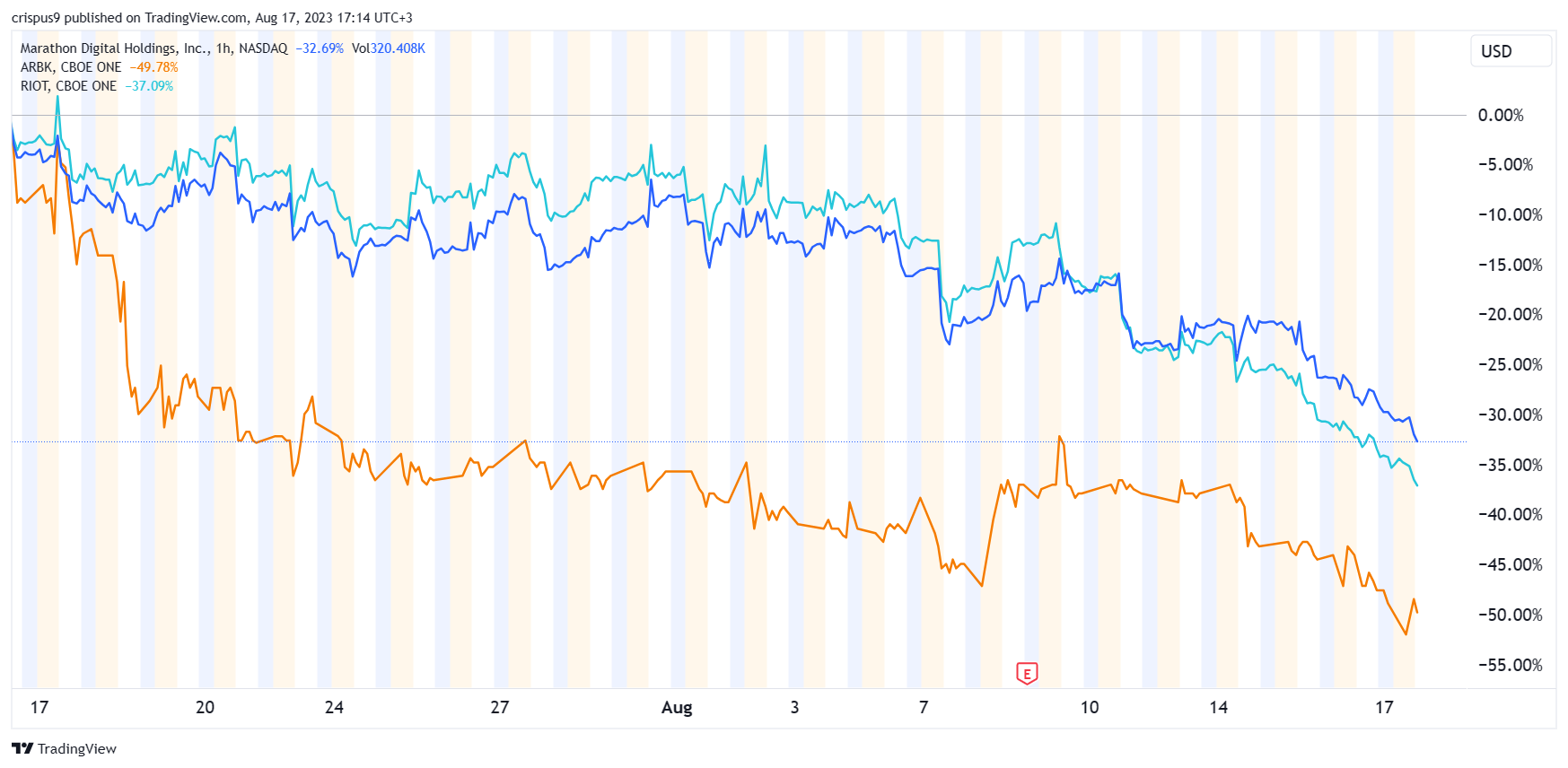

- Bitcoin mining stocks have crashed hard in the past few days.

- Bitcoin moved from its consolidation and retested the support at $28,000.

- There are concerns about China and the Federal Reserve.

Bitcoin mining stocks continued their sell-off as the coin’s sell-off gained steam. Argo Blockchain share price plunged to $1 in New York, ~56% below the year-to-date high. Similarly, Marathon Digital stock price retreated to $13, the lowest level since June. Other top laggards are companies like Hut 8 Mining and Cipher Mining.

Bitcoin price plunges

The main reason why Argo Blockchain and other mining stocks plunged was the performance of Bitcoin and the broader market. Bitcoin price moved below the important support at $29,000, where it has been in the past few weeks. It plunged to a low of $28,000.

As I wrote in this article, the situation could get worse because Bitcoin formed a double-top pattern on the daily chart. In price action analysis., this pattern is one of the most bearish signs. The neckline of the pattern stands at $25,000. A drop below that neckline means that Bitcoin’s sell-off could advance to $20,000.

Bitcoin mining companies like Argo Blockchain, Riot Platforms, and Marathon Digital make money by selling their mined Bitcoins. As such, like other miners, they prefer a situation where Bitcoin price is rising. In addition to fiat currencies, these firms also have huge crypto holdings in their balance sheets.

Argo Blockchain’s sell-off has been more severe because it is one of the most vulnerable companies in the industry. It has a strained balance sheet and it recently diluted its shareholders by selling shares worth $7.5 million in London. Remember, the company narrowly avoided bankruptcy in December after it received a bailout from Galaxy Digital.

Federal Reserve and China concerns

Bitcoin mining and other American stocks are also plunging because of the Fed minutes that were published on Wednesday. The minutes showed that Fed officials were concerned about overtightening and undertightening. As a result, they left a narrow room for one more rate hike in September or October.

Meanwhile, there are serious concerns about China, the second-biggest economy in the world. Data published this week showed that the economic growth has stalled while the youth unemployment figure has jumped.

Beijing will stop publishing the youth unemployment data while officials have warned that analysts about being too negative about the economy. Further, several important companies, including Country Garden are hanging on a thread. All these factors have contributed to the ongoing crypto sell-off.

The outlook for Bitcoin mining stocks like Argo Blockchain, Riot Platforms, and MARA is bearish for now.