- The crypto fear and greed index has remained in a neutral phase recently.

- CNN Money’s fear and greed index has moved to the extreme greed area.

- This consolidation could be the calm before the storm.

The crypto fear and greed index remained in a consolidation phase as demand for Bitcoin, Ethereum, and other cryptocurrencies waned. The index is stuck at the neutral point of 52, where it has been in the past few weeks.

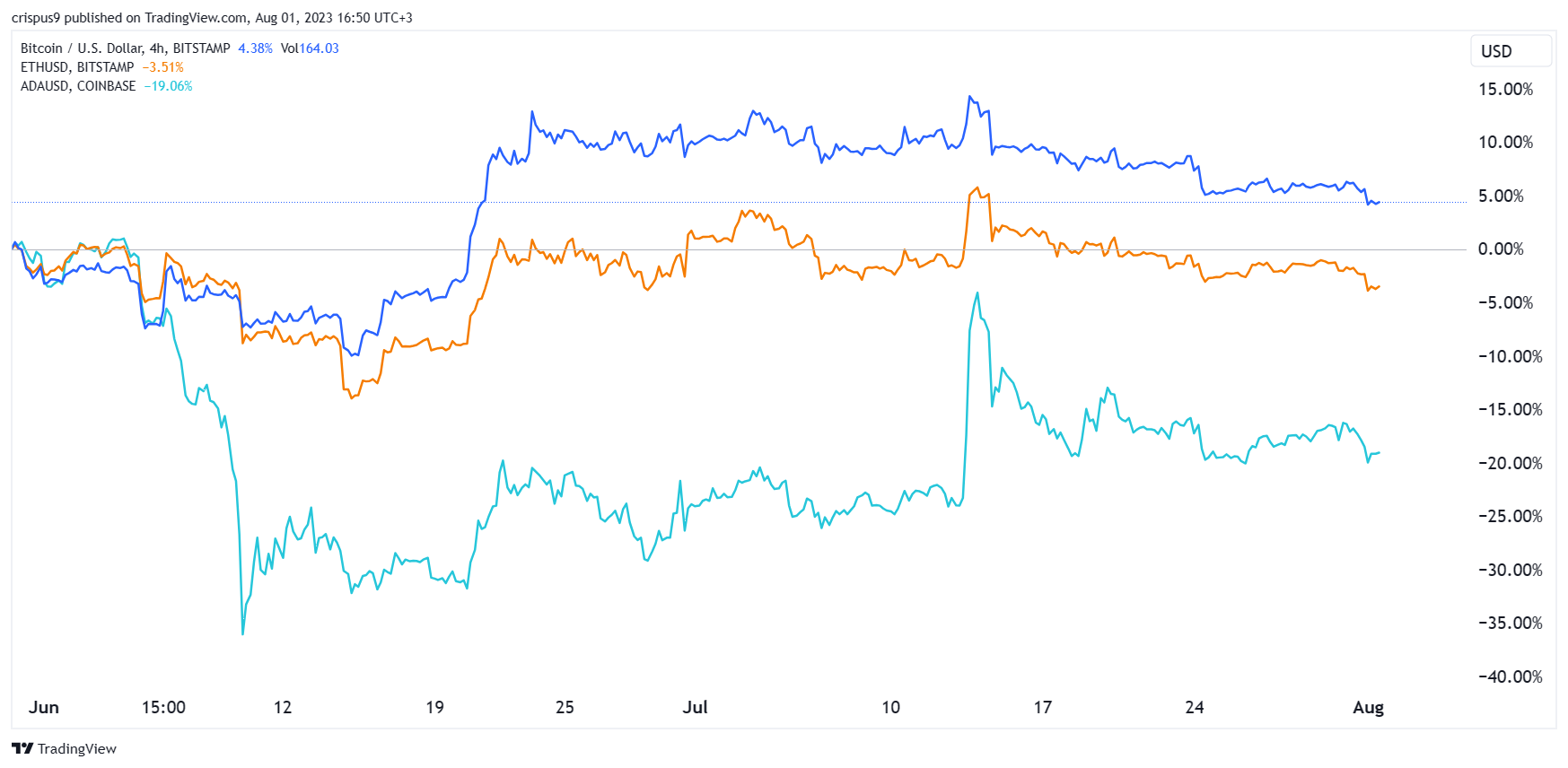

This index consolidation has coincided with a period when most cryptocurrencies have remained in a tight range for a while. Bitcoin price has remained a5 $29,000 in the past two weeks. Further, Ethereum’s price has moved at $1,800 while the total market cap of all cryptocurrencies is at $1.1 trillion.

Historically, the crypto fear and greed index tends to react to the movements of key coins, especially Bitcoin. It rises when BTC is soaring and vice versa. A look at some of its key sub-indices has moved downwards recently.

For example, volatility, as measured by the Average True Range (ATR) has dropped. Social media mentions and market momentum have declined since the first week of July.

The crypto fear and greed index has diverged with the one tracked by CNN Money. The latter has moved to the extreme greed zone of 77 as American stocks have roared back.

Most of its sub-indices like market momentum, stock price strength, stock price breadth, put and call options have moved to extreme greed. At the same time, the safe haven demand and junk bond demand have moved to the greed zone.

Therefore, there is a likelihood that many crypto investors have moved to American equities, which have surged this year. The Nasdaq 100 index has jumped by more than 40% this year while the Dow Jones and the S&P 500 indices have risen by double-digits.

This explains why cryptocurrencies ignored important news in July. For example, they ignored the sweet partial victory by Ripple in a US court. Also, they reacted mildly to the encouraging US consumer price index (CPI) dropped to 3.0% while the core CPI dropped to 4.8%. As a result, there is a likelihood that the Fed has stopped hiking rates.

With the crypto fear and greed index stuck at neutral, it could be a calm before the storm for cryptocurrencies. This means that coins like Bitcoin and Ethereum will likely have a major breakout or breakdown in August. This view will be confirmed if the Bitcoin price moves above the year-to-date high-volume environment. A breakdown will be confirmed it drops below $28,500.