- Bitcoin price has pulled back in the past few weeks.

- The VIX index has declined below $20.

- Bitcoin fear and greed index has retreated to 48.

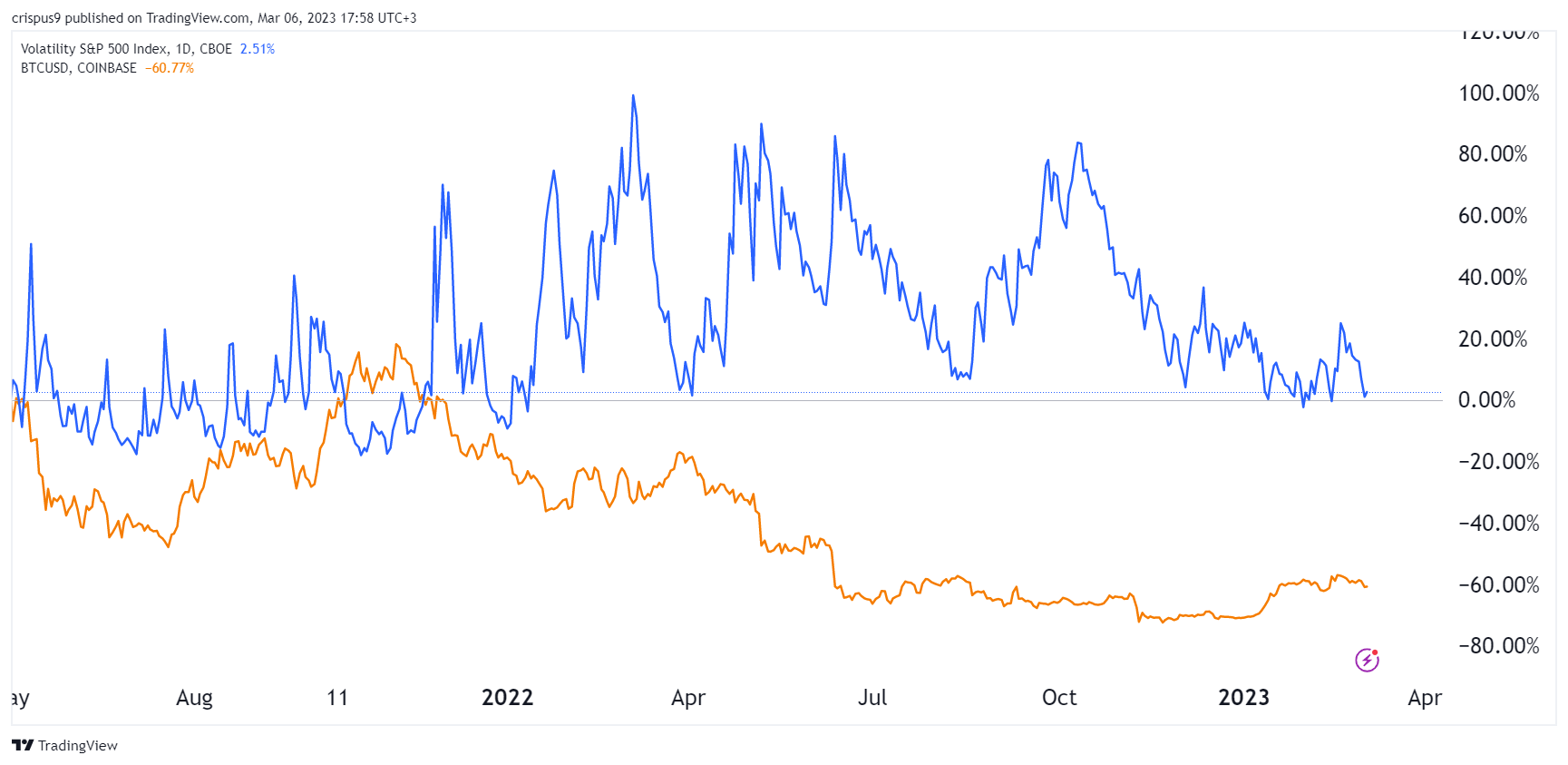

The VIX index crashed below $20 once again even as risks in the financial market remained at an elevated level. The index, which is popularly known as the fear gauge, pulled back to about $18.45, which was a few points below last week’s high of $23.60. It has plunged by more than 50% from its highest level in 2022.

VIX and Bitcoin prices

The VIX index was designed using S&P 500 options data. It is widely used to measure the amount of volatility in the financial market, including in the crypto industry. In most periods, the VIX index tends to rise when volatility is rising, which in turn, drags stocks and cryptocurrencies lower.

Therefore, the recent performance of the index is a bit shocking considering that most assets are not doing well. The closely-watched S&P 500 and Nasdaq 100 indices have pulled back from their highest levels this year.

The same trend is happening in the crypto market, where Bitcoin price has pulled back from its highest point this year. As I wrote earlier, Binance Coin has formed a triple-top pattern, signaling that more sell-off may be on the way.

Read more: How to buy Bitcoin with bank transfer.

Bitcoin and other cryptocurrencies are facing more risks. First, there is the ongoing risk surrounding Silvergate Capital, the crypto-focused bank. The company stopped offering its key services as it experienced a major bank run.

Second, there are numerous regulatory risks in the industry as investors works to avoid further collapses. For example, the Securities and Exchange Commission (SEC) is investigating Binance and other exchanges for offering securities.

Further, there are monetary policy risks, as well as the Federal Reserve, continues tightening its policy. The Fed is expected to continue tightening its interest rates in the coming months. This view is backed by the relatively strong economic numbers coming from the US. The unemployment rate has retreated while inflation is still at the highest point in months.

Falling VIX is a catalyst

Still, despite the rising challenges, analysts believe that the falling VIX index is a positive thing for Bitcoin price. Historically, risky assets like Bitcoin tend to do well when the VIX is pulling back.

A good example of this is what happened in November last year after the collapse of FTX. At the time, Bitcoin plunged as the VIX jumped to a high of $34.65. BTC declined from $67k to about $16,000 in 2022 as the VIX topped at $38.

The other important factor is that the VIX tends to move in the same direction as the US dollar index (DXY). The DXY index has retreated slightly to about $104.4 from last month’s high of $105.50.

So, what does this mean for Bitcoin prices? Bitcoin and other cryptocurrencies will react to a statement by Jerome Powell scheduled for Tuesday. After this, it will react to the upcoming US non-farm payrolls (NFP) data and consumer price index (CPI) data.