- Tether price has regained its peg after it deviated from it slightly last week.

- Tether and other stablecoins like USD Coin have faced significant outflows recently.

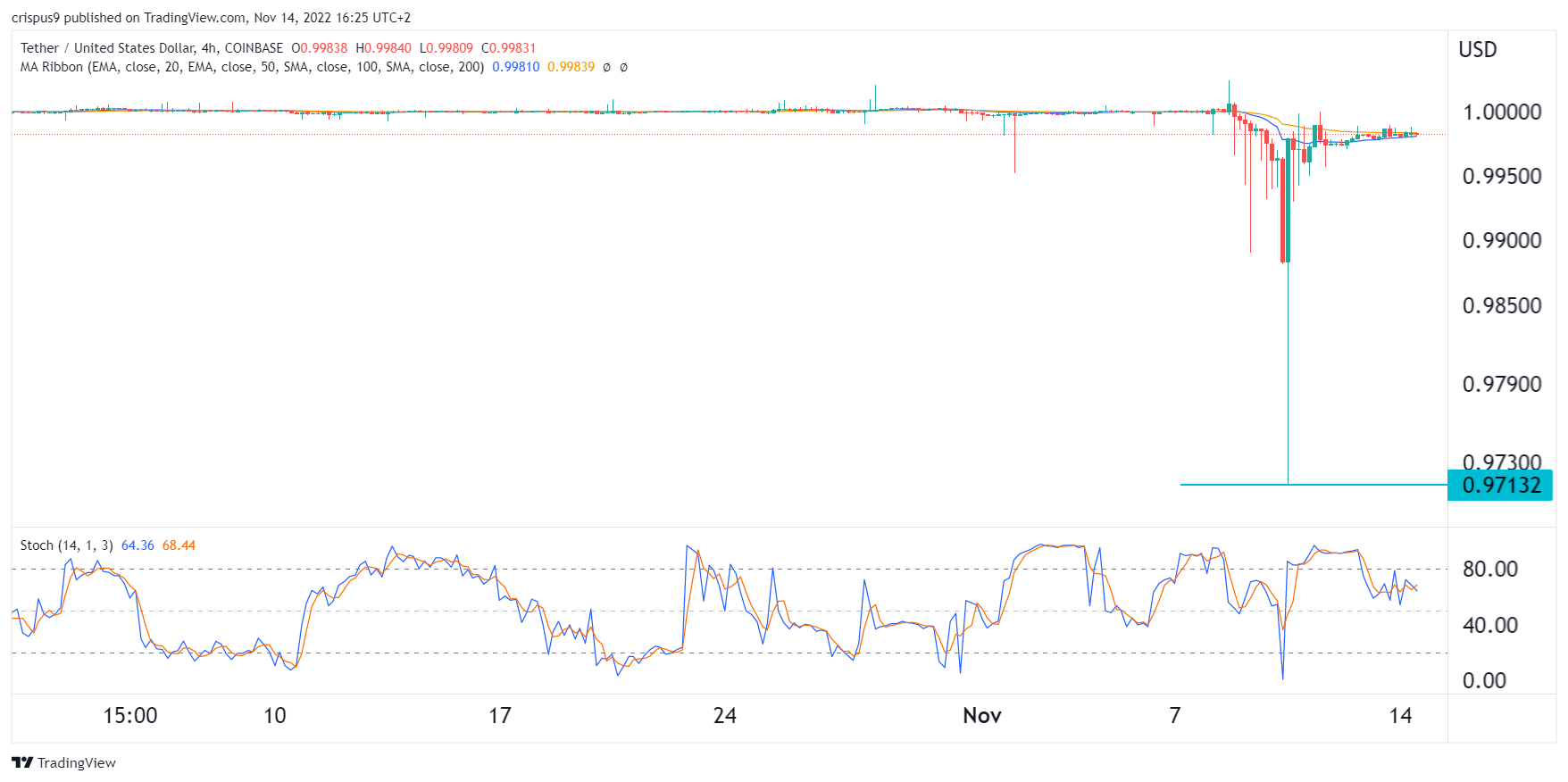

Tether price moved close to its parity level of $1 even as the amount of outflows continued. USDT was trading at $0.9983 on Monday as cryptocurrencies stabilised. Similarly, the USD Coin was trading at $1, giving it a market cap of over $44 billion.

Tether and USD Coin outflows

The cryptocurrency industry has been under intense pressure in the past few days as concerns about contagion risks continue. This happened after the collapse of FTX, the second-biggest cryptocurrency exchange in the world after Binance.

Investors are concerned that significant outflows in the crypto industry could lead to major challenges for exchanges. Besides, many crypto investors have started withdrawing their coins from exchanges.

Tether’s USDT and USD Coin play an important role in the cryptocurrency industry. These coins are mostly used in both centralised and decentralised exchanges (DEX) to facilitate transactions. Unlike Bitcoin and other cryptocurrencies, they are known for their stability.

Find out how to buy Tether.

Stablecoins have a crucial role in the market. For example, in May, Terra’s ecosystem collapsed after Terra USD lost its peg against the US dollar. In the aftermath, investors lost over $40 billion after the ecosystem collapsed.

Tether price has held relatively stable in the past few days. This is after it briefly lost its peg and collapsed to a low of $0.9713 last week. Historically, the coin has made similar dips and then re-pegged.

Data compiled by IntoTheBlock shows that total exchange inflows in the past seven days have been $11.7 billion. In the same period, outflows have been about $13 billion. This means that the net outflows have been around $1.7 billion. A separate report by CoinMarketCap shows that the coin has lost $3 billion in redemptions in the past few days.

Will Tether’s peg hold?

A concern that has existed in the market for many years has been the health of Tether’s assets. Unlike algorithmic stablecoins like USDD and Terra USD, Tether is fully backed on a 1:1 basis. This means that Tether’s parent company should hold $66.31 billion in cash to maintain the peg. The same is true for USD Coin.

According to Tether’s transparency page, the current balance of Teher on Tron is $37.1 billion while that on Ethereum is $32.2 billion. The other large players that hold Tether are Solana, Avalanche, and Algorand.

As at September, 82.45% of these holdings were in cash and equivalents while the rest were in liquid assets like corporate bonds, funds, and precious metals, secured loans, and other investments.

Therefore, while Tether has faced significant pressure, there is a high likelihood that it will be able to survive the peg. Besides, it has come under similar pressure in the past.