- Over 1 billion in crypto lost to scams since 2021: FTC

- Instagram, Facebook, WhatsApp and Telegram top platforms for scams

- Top cryptos used to pay scammers were Bitcoin, Tether and Ether

Social media and cryptocurrencies are a combustible combination for fraud, with nearly half the people who reported losing crypto to a scam since 2021 saying it started with an advertisement, post, or message on a social media platform, according to a report by the US Federal Trade Commission (FTC).

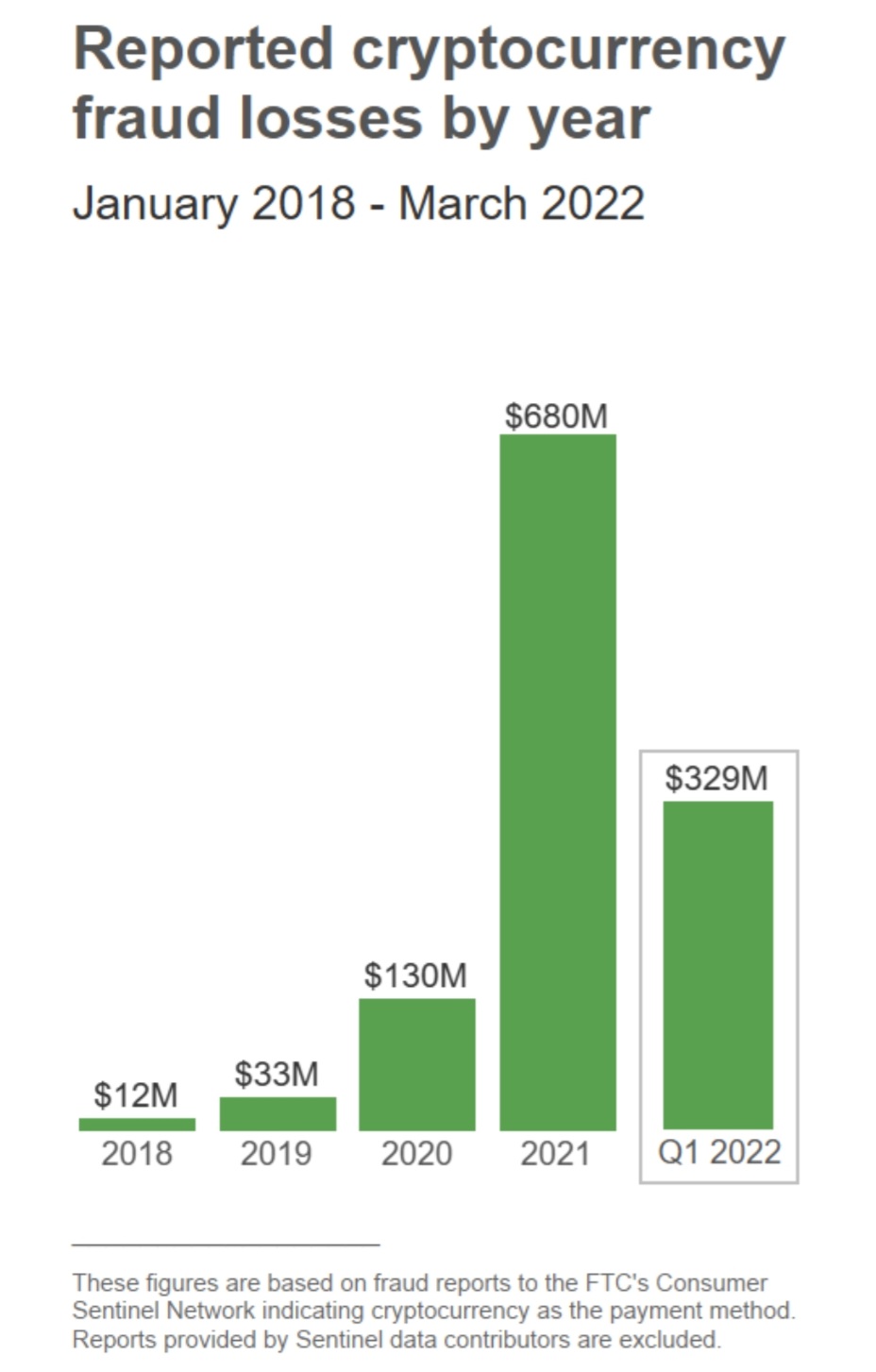

The FTC in its report states that since the start of 2021, more than 46,000 people have reported losing over $1 billion in crypto to scams – about one out of every four dollars reported lost.

The reported losses in 2021 were nearly sixty times what they were in 2018.

The top cryptocurrencies people said they used to pay scammers were Bitcoin (70%), Tether (10%), and Ether (9%).

According to the FTC, since the start of 2021, nearly four out of every ten dollars reported lost to a fraud originating on social media was lost in crypto, far more than any other payment method.

The top platforms identified in these reports were Instagram (32%), Facebook (26%), WhatsApp (9%), and Telegram (7%).

Investment scams

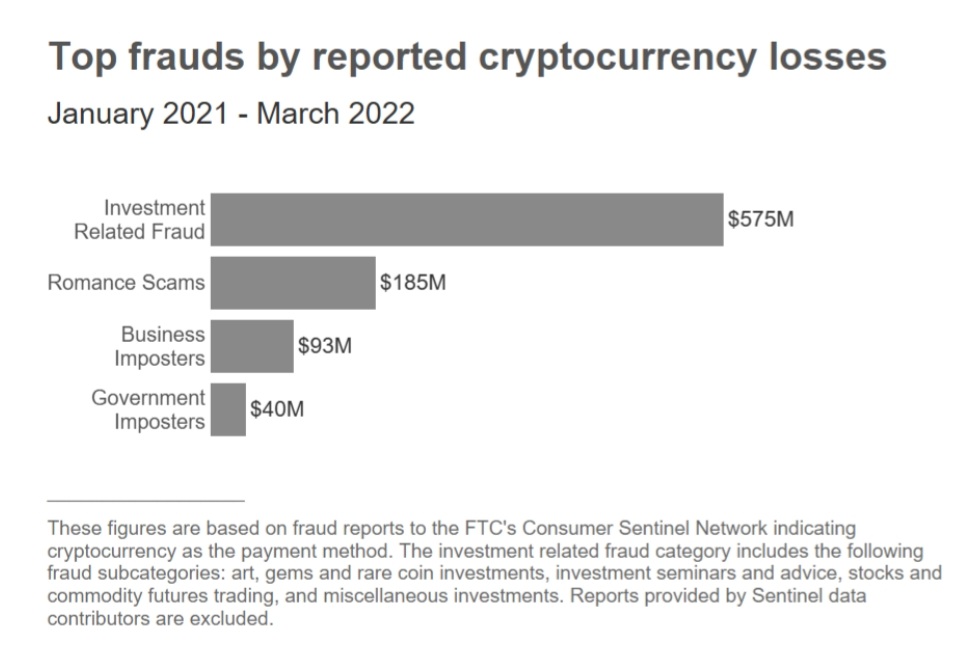

Of the reported crypto fraud losses that began on social media, most are investment scams.

Since 2021, $575 million of all crypto fraud losses reported to the FTC were about bogus investment opportunities, far more than any other fraud type.

Romance scams

Romance scams are a distant second to investment scams, with $185m in reported cryptocurrency losses since 2021 – nearly one in every three dollars reported lost to a romance scam during this period.

Business scams

Business and Government Impersonation Scams came in third at a total of $133m, in which scammers target consumers, claiming that their money is at risk due to fraud or a government investigation.

Border patrol scams

According to the FTC, in some cases, scammers impersonate border patrol agents and have told people their accounts will be frozen as part of a drug trafficking investigation. These scammers tell people the only way to protect their money is to put it in crypto: people report that these “agents” direct them to take out cash and feed it into a crypto ATM.

People in their 30s hardest hit

People ages 20 to 49 were more than three times as likely as older age groups to have reported losing cryptocurrency to a scammer. Reports point to people in their 30s as the hardest hit – 35% of their reported fraud losses since 2021 were in cryptocurrency.

However, the median individual reported losses have tended to increase with age, topping out at $11,708 for people in their 70s.

FTC details a number of ways to steer clear of crypto scams

Only scammers will guarantee profits or big returns. No cryptocurrency investment is ever guaranteed to make money, let alone big money.

Nobody legit will require you to buy cryptocurrency. Not to sort out a problem, not to protect your money. That’s a scam.

Never mix online dating and investment advice. If a new love interest wants to show you how to invest in crypto or asks you to send them crypto, that’s a scam.