- Robinhood stock price has plunged after the collapse of stocks and cryptocurrencies.

- The stock has multiple catalysts that could push it higher in 2023.

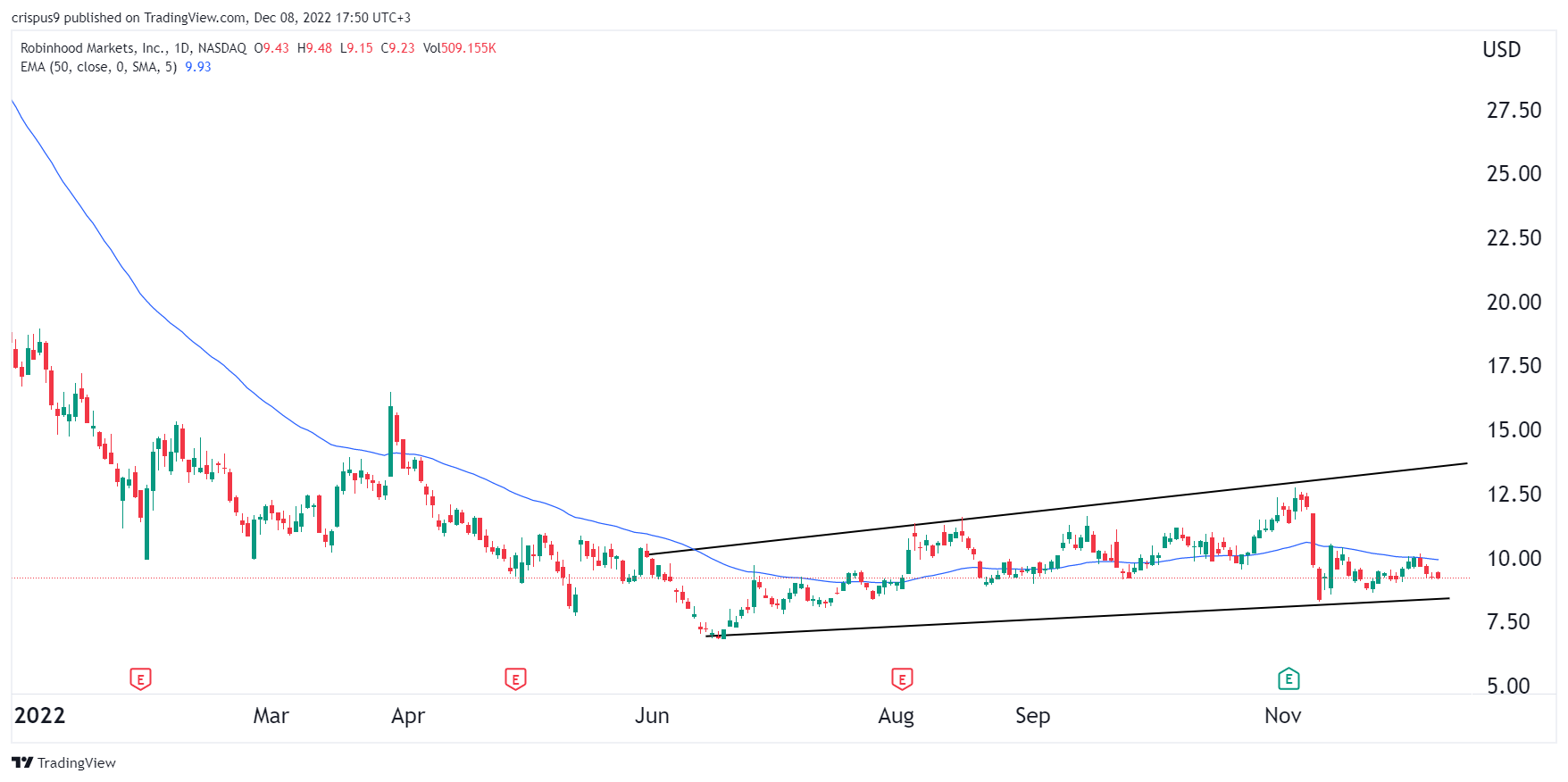

Robinhood stock price has been in a strong sell-off in 2022 as the stock and cryptocurrency market recoils. The shares were trading at $9.19 on Thursday, about 28% below the highest point in November. Like Coinbase, HOOD share price has plunged by 89% from its all-time high, giving it a market cap of $8.1 billion.

Crypto and stocks collapse

Robinhood share price has been in a strong sell-off as concerns about the company’s growth remains. The main concern is that American stocks have been in freefall this year. The main blue-chip indices like the Dow Jones and Nasdaq 100 have plunged by more than 10% this year.

Some of the most popular stocks have also plunged. For example, Carvana’s stock price has dropped by more than 80% this year amid rising bankruptcy risks. Similarly, companies like WeWork, Meta Platforms, and Coinbase have seen their stocks tumble. As a result, the number of people actively trading on Robinhood has dropped.

HOOD stock price has also crashed because of its exposure to cryptocurrencies. The company made it possible for people to buy crypto in 2021 as prices surged. It is now in beta-testing its crypto wallet that uses Polygon’s technology.

The company has seen its engagement drop sharply this year. While the number of active accounts rose to 23 million in October, monthly active users dropped by 33% YoY to 12.3 million. Assets under the custody of $70.2 billion was also unchanged in November.

HOOD 2023 prediction

Looking forward, Robinhood stock price will likely bounce back in 2023 if inflation eases and the Federal Reserve ends its tightening phase. In anticipation of these factors, we have seen the main indices move from the bear market by rising by over 20% from their lowest points this year.

Another likely catalyst for HOOD will be the upcoming launch of retirement solutions that will be launched in January. This is notable because young people are becoming more interested in investing for retirement. The firm’s CEO said:

"While there might be less interest in investing than there was in 2020 and 2021, interest among retirement, particularly among Gen-Z and younger people, is really high, and you have each successive generation of consumers interested in retirement at an earlier stage.”

Robinhood stock price forecast

The daily chart shows that the HOOD stock price has been under pressure in the past few months. It has moved below all moving averages. A closer look shows that the stock has formed a widening wedge pattern, which is usually a bullish sign. Therefore, I suspect that the stock will have a bullish breakout in 2023 as buyers target the key resistance at $20.