- The EU spends nearly 6-times as much as the US on fossil fuel imports from Russia: $296m vs $50m daily.

- As a percentage of total trade, the EU’s trade with Russia is 5-times larger than that of the US: 3.6% vs 0.7%.

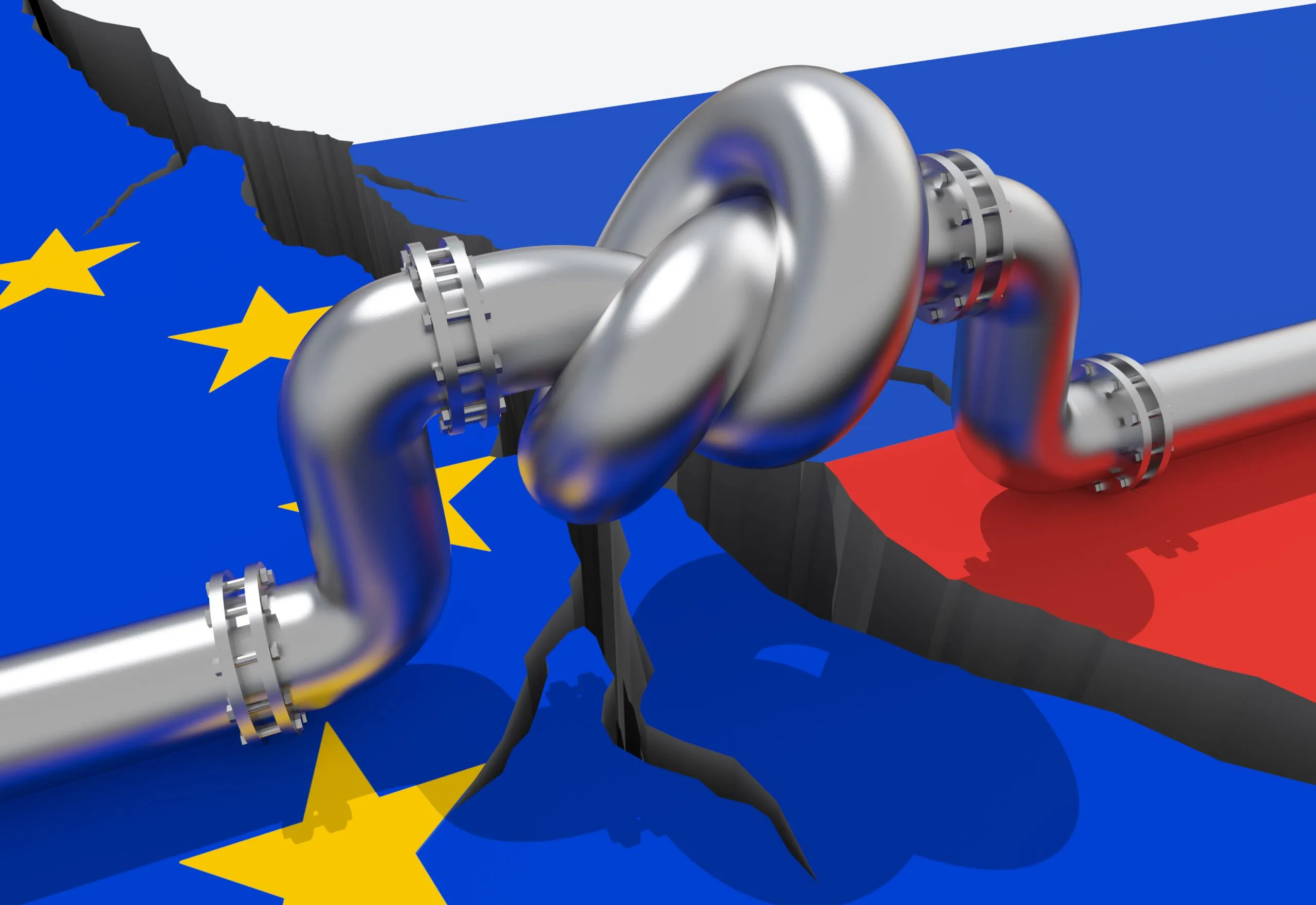

EU countries continue to import Russian energy despite the US ban— highlighting Europe’s reliance on Russian imports.

With the EU being one of Russia’s most significant trading partners, import data shows stark differences with the US in regards to Russian energy dependence.

A Breakdown of the Import Data

Data compiled from the European Commission, the UN Comtrade database, and the U.S. Census Bureau demonstrates that:

-

The EU spends nearly 6-times as much as the US on fossil fuel imports from Russia: $296m vs $50m daily.

-

As a percentage of total trade, the EU’s trade with Russia is 5-times larger than that of the US: 3.6% vs 0.7%.

-

In 2021, the EU spent $173 billion on imports from Russia representing 3.6% of total annual trade.

-

Mineral fuels such as coal, petroleum, and natural gas accounted for $108bn, equivalent to $296 million daily.

-

In comparison, the US imported $30.8bn worth of goods from Russia, amounting to 0.7% of total imports.

-

$18.1bn was spent on fossil fuels, equivalent to $50m per day.

European Commission President, Ursula von der Leyen’s efforts to deliver a collective response from European countries has been met with resistance from some EU members.

Talks with Hungarian Prime Minister Viktor Orbán on 9 May 2022, ended without a deal to address Budapest’s objections.

“We made progress, but further work is needed.” tweeted Ursula following the meeting.

Countries within the trade bloc have varying dependencies on Russian supplies due to their geographical location among other factors. Those with the greatest level of dependence seem to be countries showing the strongest resistance to the Russian oil ban so far.

Dependence on Russia by Countries Within the EU

The share of Russian products in total oil and petroleum imports varies by country in the EU. The countries located closer to Russia have a greater dependence on Russian imports due to existing supply chains and infrastructure.

The chart below ranks each EU country, as well as the UK, on the percentage share of oil imports that originate from Russia.

The EU is attempting to crank up the economic pressure on Vladimir Putin by targeting the oil industry. The proposed measures which involve banning EU countries from carrying Russian crude have the potential to rock EU economies significantly, leading to backlash from several nations.

Slovakia, which has the highest share of oil imports from Russia is one of several EU countries to have either resisted calls for a ban on Russian energy or asked for more time to find alternative sources.

Hungary and Germany which rank high on the list have also voiced concerns regarding the new trade embargo policies.

As per EU law, all member states are required to be on board before policies can be officially implemented. As a result, Brussels is being forced to revise its sanctions package to persuade the last remaining member countries.

The CEO of Bankless Times.These findings help to explain the reluctance by some EU countries to impose the ban on Russian oil. It may be months or even years before the European Union is able to permanently ween itself off Russian energy.