- Bitcoin mining profitability hits its lowest this month.

- BTC hashrate almost halved just a month after China's crackdown on miners mid last year.

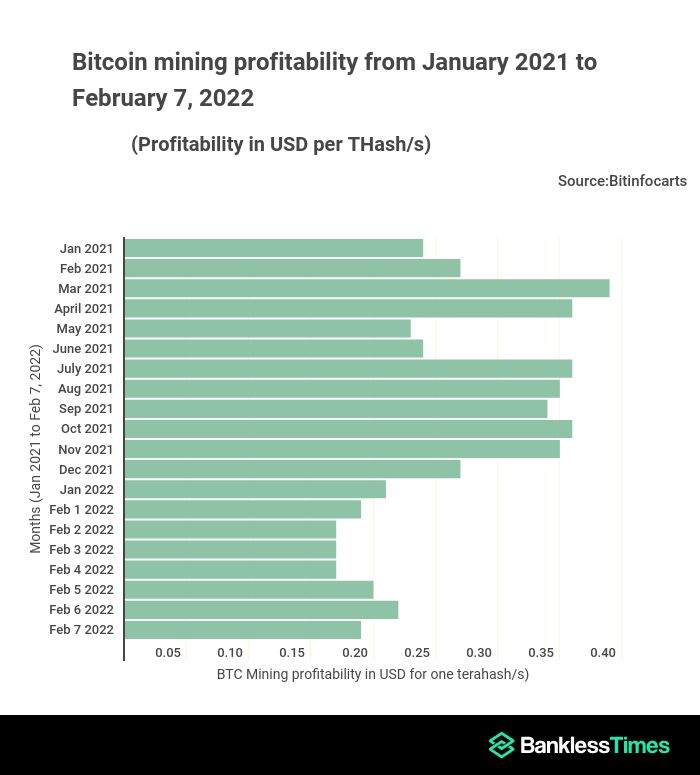

Bitcoin(BTC) miners are facing dwindling fortunes due to their ventures’ declining profitability. That’s according to recent data that shows BTC mining profitability touching its lowest on February 4, 2022.

The report places BTC mining profitability at $0.167 per one terahash per second (1THash/s). In contrast, the coin’s mining profitability was $0.282 per THash/s at the same time last year.

Causes and effects of declining BTC mining profitability

A drop in the BTC mining profitability casts a dark shadow on the crypto’s entire ecosystem. First, it has resulted in shrinking miners’ margins. A sustained shrinkage of those earnings could result in the exit of some of them.

Should that happen, BTC enthusiasts could be staring at slower transaction times. That’s because an exit of a section of the miners would present a gap in the digital asset’s mining power.

Analysts have pinned this drop to two factors. First is the rise in the crypto’s mining difficulty or hash rate.

This difficulty reached an all-time high (ATH) of over 26 trillion mid-June this year. As such, verifying blocks for rewards has been difficult.

Secondly, the price of the king crypto has dropped from last year’s ATH. Besides, the high electricity costs necessitated by higher hashing rates eat into the miners’ margins.

How did we get here?

The data is keeping with the general trend in the sector. Between May and the end of June 2021, the BTC mining profitability levels have been declining. From highs of $0.42 per THash/s on 2 May, the figure dropped to around $0.22 in mid-June before plummeting to $0.17 on 27th June.

28th June saw an upswing in the metric. Improved fortunes saw it attain the $0.306 mark. It then peaked at $0.377 on July the third. And after dropping to $0.228 on 20th July, it began rising again.

China’s hand

Market observers adduce the growth in profitability around this time to China’s crypto crackdown.

The shutdown of China’s crypto Ventures led to the halving of hashrate. And this, coupled with BTC’s surging value, shored up miners’ fortunes.

The metric maintained an upward trajectory, hitting $0.464 on 23rd August. Another downturn brought it to the $0.274 level on 28th September 2021. Two further peaks on 17th October and 9th November subsequently gave way to the downward trend

That drop is due to the re-entry of Chinese BTC miners into the crypto’s mining scene.

These had hibernated following China’s crypto purge in mid-2021. The miners have relocated to safe havens where they’re re-building their mining operations.