- Merchants considering adoption of cryptos and stablecoins

- Accepting digital currency payments a point of differentiation

- Complexity of integration a leading challenge in enablement of digital currency payments

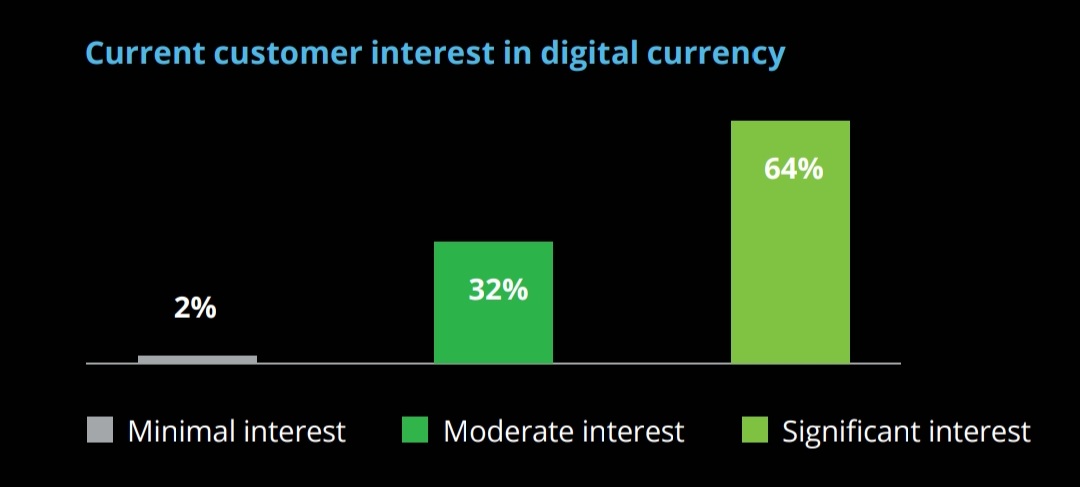

Overall interest in digital currency payments is significant among younger generations, leading to more than 85% of retailers giving high or very high priority to enabling cryptocurrency payments while roughly 83% are doing the same for stablecoins, research by Deloitte has revealed.

Nearly three-quarters of those surveyed reported plans to accept either cryptocurrency or stablecoin payments within the next 24 months, Deloitte said in a report titled “Merchants getting ready for crypto”, prepared in collaboration with PayPal.

The survey polled a sample of 2,000 senior executives at retail organizations across the United States between December 3 and December 16, 2021, with all respondents being from the consumer goods and services industry and a 10% contribution from each of the following subsectors: cosmetics, digital goods, electronics, fashion, food & beverages, home/garden, hospitality & leisure, personal & household goods, services, and transportation.

Sentiments around cryptos

Overall, merchants broadly agree that organizations accepting digital currencies have a competitive advantage in the market (87%).

The research points out that an overwhelming majority of those who currently accept cryptocurrency as a payment instrument (93%) have already seen a positive impact on their business’s customer metrics, such as customer base growth and brand perception, and they expect this to continue next year.

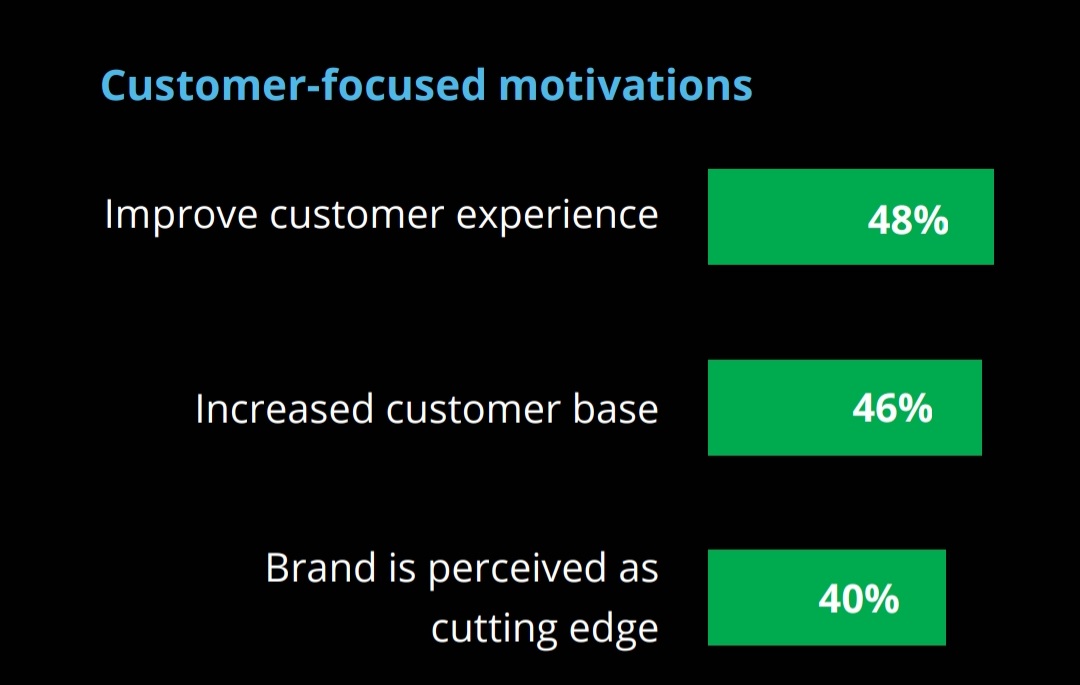

It adds that merchants are eager to adopt digital currency payments for a variety of reasons.

Respondents see that the market is rapidly changing and want to support customer preferences and expect to derive value from their digital currency adoption in three distinct ways: improved customer experience (48% of respondents), increased customer base (46%), and brand being perceived as cutting edge (40%).

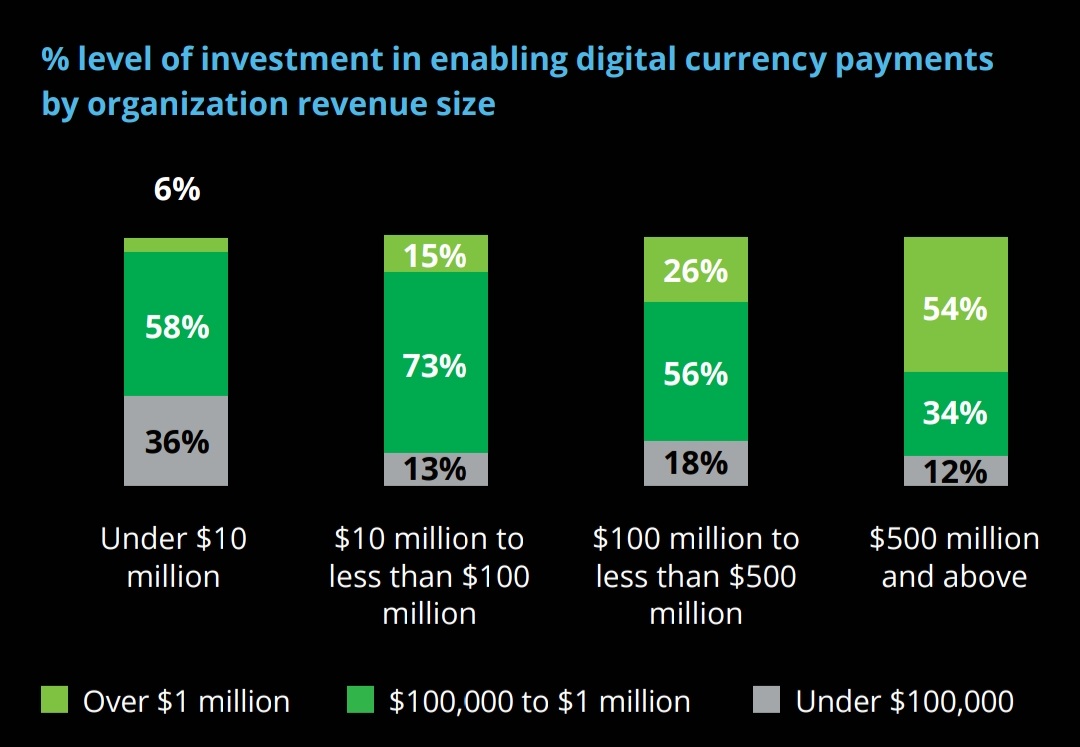

Investments in enabling digital currency payments by organization revenue size

Challenges

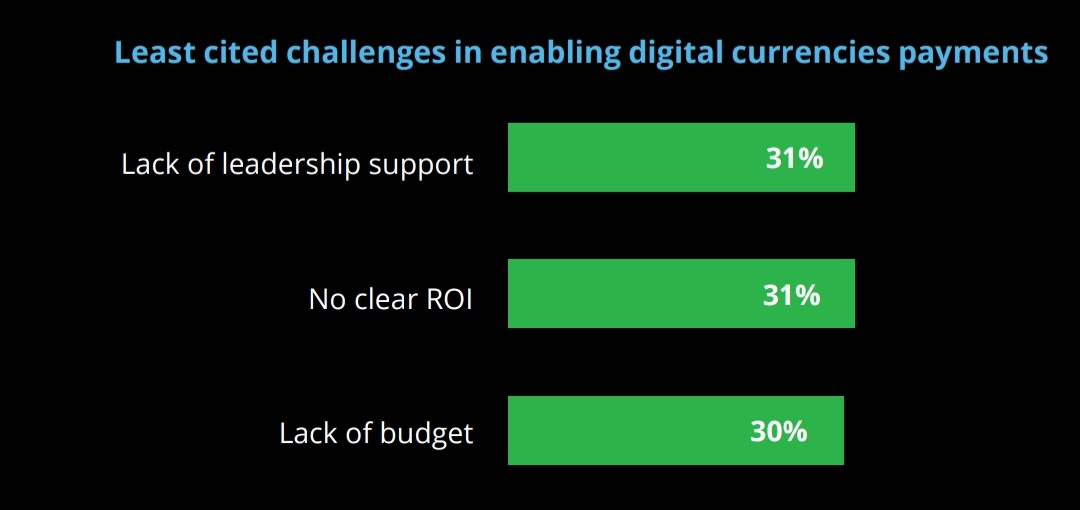

89% of respondents selected at least one of the two options alluding to integration complexity: integration with existing financial infrastructure and/or across various digital currencies. These challenges are seen consistently across companies, regardless of revenue size.

Similarly, survey respondents cited multiple barriers to adoption, with customer security of the payment platforms topping the list (43%), followed by the changing regulatory landscape (37%) and the instability of the digital currency market (36%). For large merchants and those who invested the most, the disconnected nature of the digital currency marketplace is their biggest barrier (43%).

“We expect continued education and broader learning to underpin further regulatory clarity to allow for wider mainstream adoption across a broader set of financial service offerings and products,” Deloitte said.